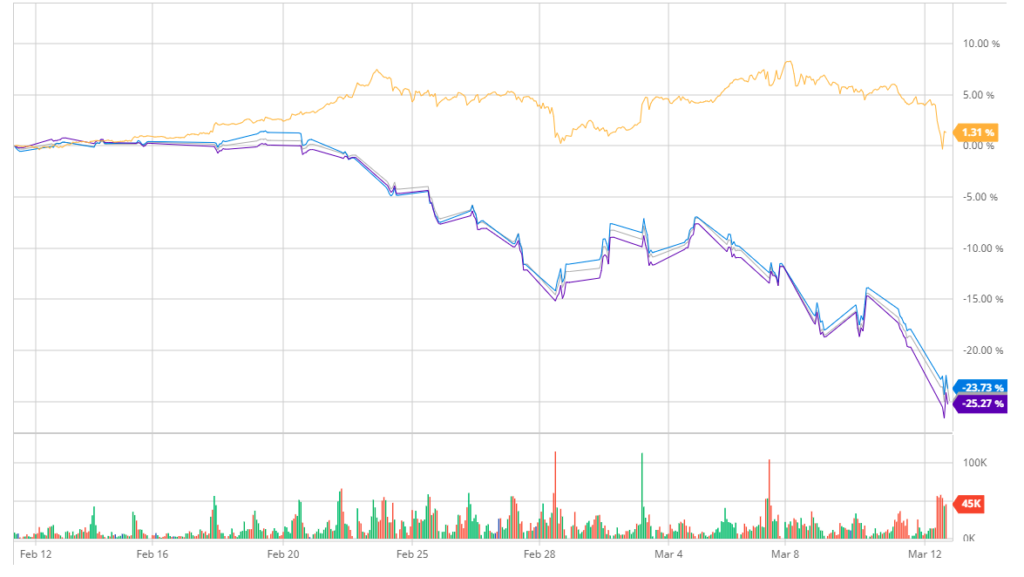

Since early 2009 US markets have been in a bull market. In less than a month that 11 year bull market has ended and we are now officially in a bear market. The big three US indices are all down more than 20%.

Interesting that the trigger to the selloff was something no one was expecting. But perhaps the fact that no one saw this specific catalyst coming shouldn’t come as a surprise.

As I mentioned before, making financial decisions out of fear or panic will rarely result in the best outcome. Cool heads will prevail.

At this point in time I have more questions than answers, but in the midst of this bear market there is great opportunity.

Is Now the Time to be “Greedy”?

“Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

It’s hard for me to respect Warren Buffett when the man does everything in his power to avoid paying taxes while at the same time publicly saying he should pay higher taxes. It is hypocritical.

Despite my misgivings about Mr. Buffett I can’t argue with the long term performance of Berkshire Hathaway.

It’s important to ignore what Warren Buffet says on his virtue signaling tours and look at what he is actually doing with his money.

Others are fearful right now so it could be a good time to be “greedy”. Of course buying things on sale isn’t actual greed but I digress.

Who Knows when the markets will bottom out?

I’ve been underweight US stocks and will be using this bear market as an opportunity to dollar cost average into US index funds and ETFs. I do not believe it is possible to time the bottom so I’m not going to try. What I am trying to do is to buy into the market at an interval of good prices.

Compared to the highs stocks are on sale at a 25% discount. They might go on sale for 40% off or even 50% off but in either case it is a significant discount from the mid-February highs.

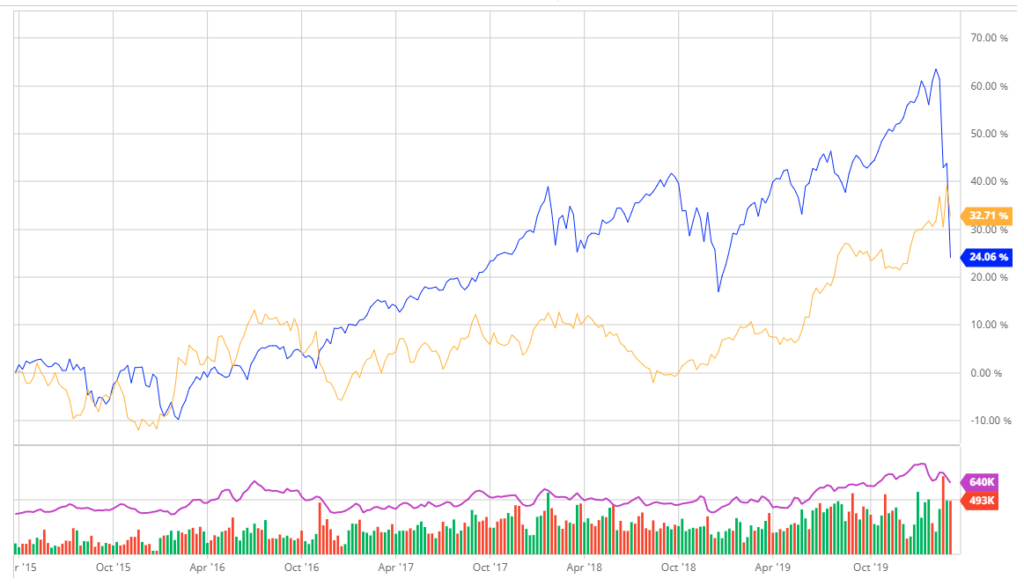

How is Gold Working Out?

Gold has been a decent hedge so far. However during a panic the yellow metal will probably fall as people sell everything. And indeed gold is down from the $1,700 high made earlier this month.

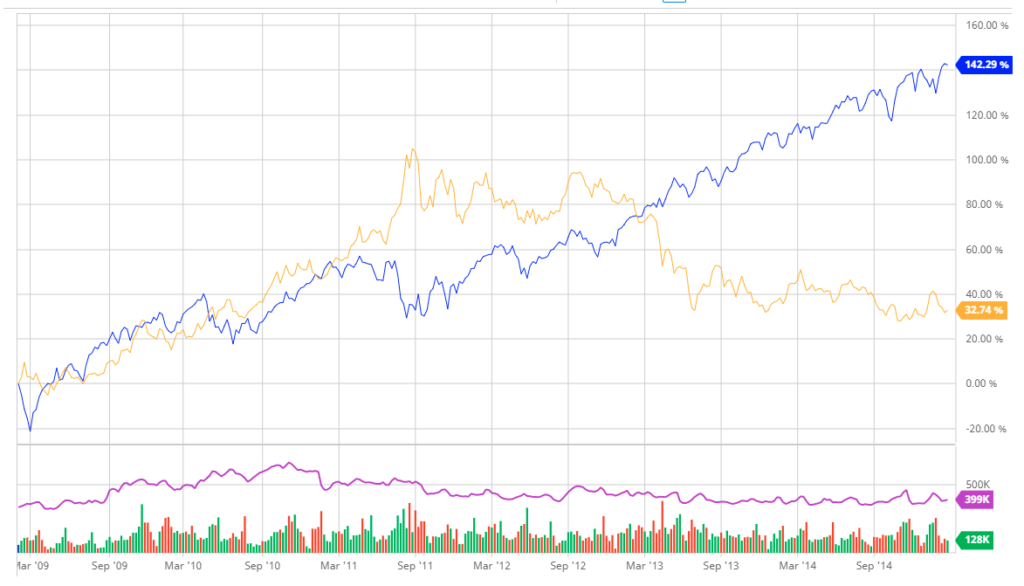

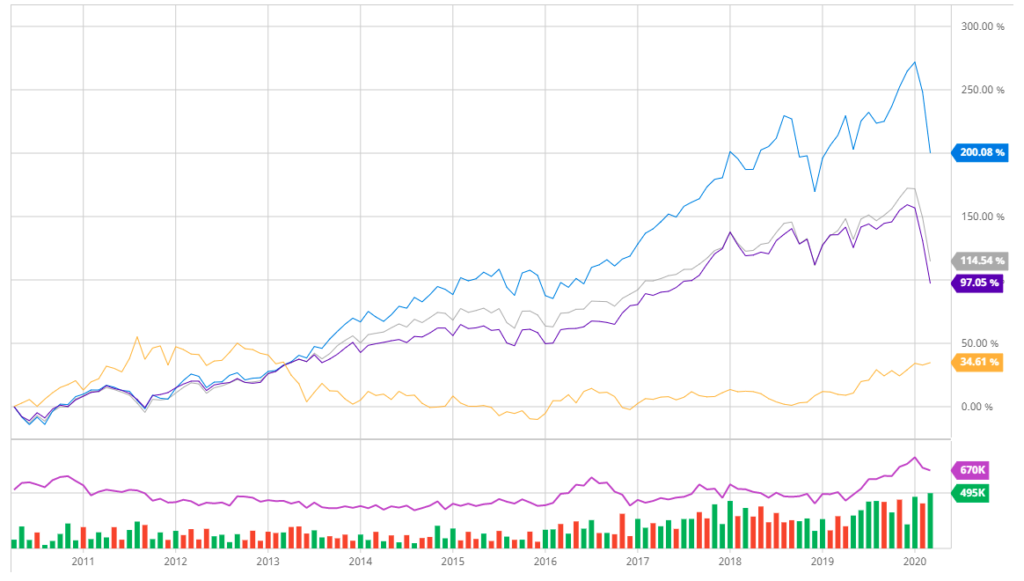

For the first five years after the last financial shock (2008-2009) US stocks were the place to be and gold, which had a tremendous run-up, went into a bear market. Of course past performance is no guarantee of future performance, but it can provide a guide for how markets could possibly perform.

Over the past five years, as a result the current crash, gold has outperformed the S&P 500. Gold is up 32.71% compared to the S&P 500 being up 24.06%.

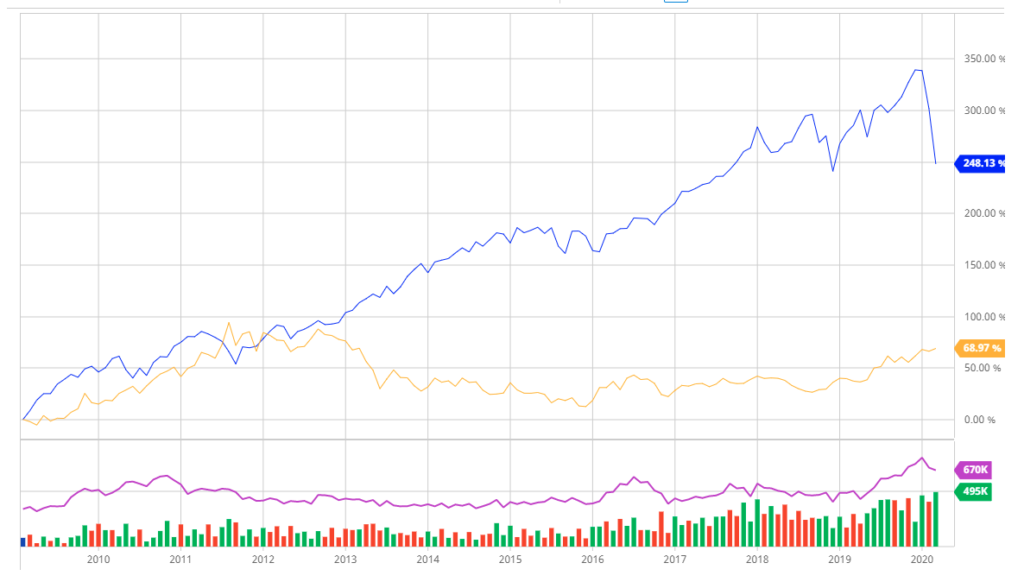

However, even after this large drop. Since the 2008-2009 financial crisis, stocks have been the place to be. The S&P 500 is still up 248% since February of 2009, while gold is up relatively modest 68.9%.

And despite this large drop, for the past 10 years, stocks have done very well.

The Fed Tries to “Help”

Not one to stand by and allow the free market to operate–the US Federal Reserve announced more quantitative easing (QE4) on Thursday. Of course if you count the not-QE QE, this would be QE5, for those keeping score at home. It is also anticipated that rates will be cut again.

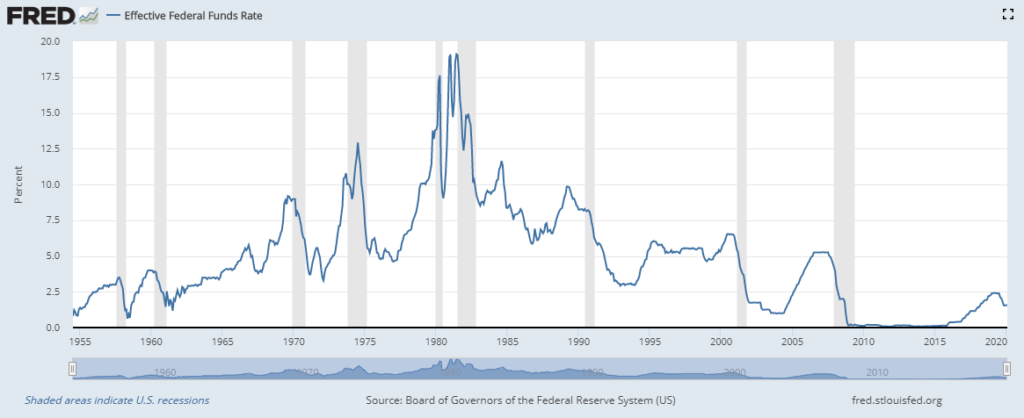

Rates are already at an absurdly low 1-1.5%.

Rates were over 6.5% prior to the 2000 dot com crash. They were hiked back up to about 5.25% prior to the 2008-2009 financial crisis. But after the 11 year bull run rates only made it as high as 2.4%.

In short the rates have never been this low going into what could be a recession.

The Fed is entering this bear market (and potential recession) with interest rates already so low they have little ammunition to “help”.

The Fed is already doing more Quantitative Easing.It seems inevitable that rates will go negative.