Stocks are one of the key ways I grow my wealth.

I like value investing and value stocks. It’s not some aesthetic or subjective reason. As an asset class US value stocks have a history of outperforming other US stock classes.

I like picking individual stocks but I appreciate that is not suitable for everyone. For some folks a passive index asset allocation strategy could be better.

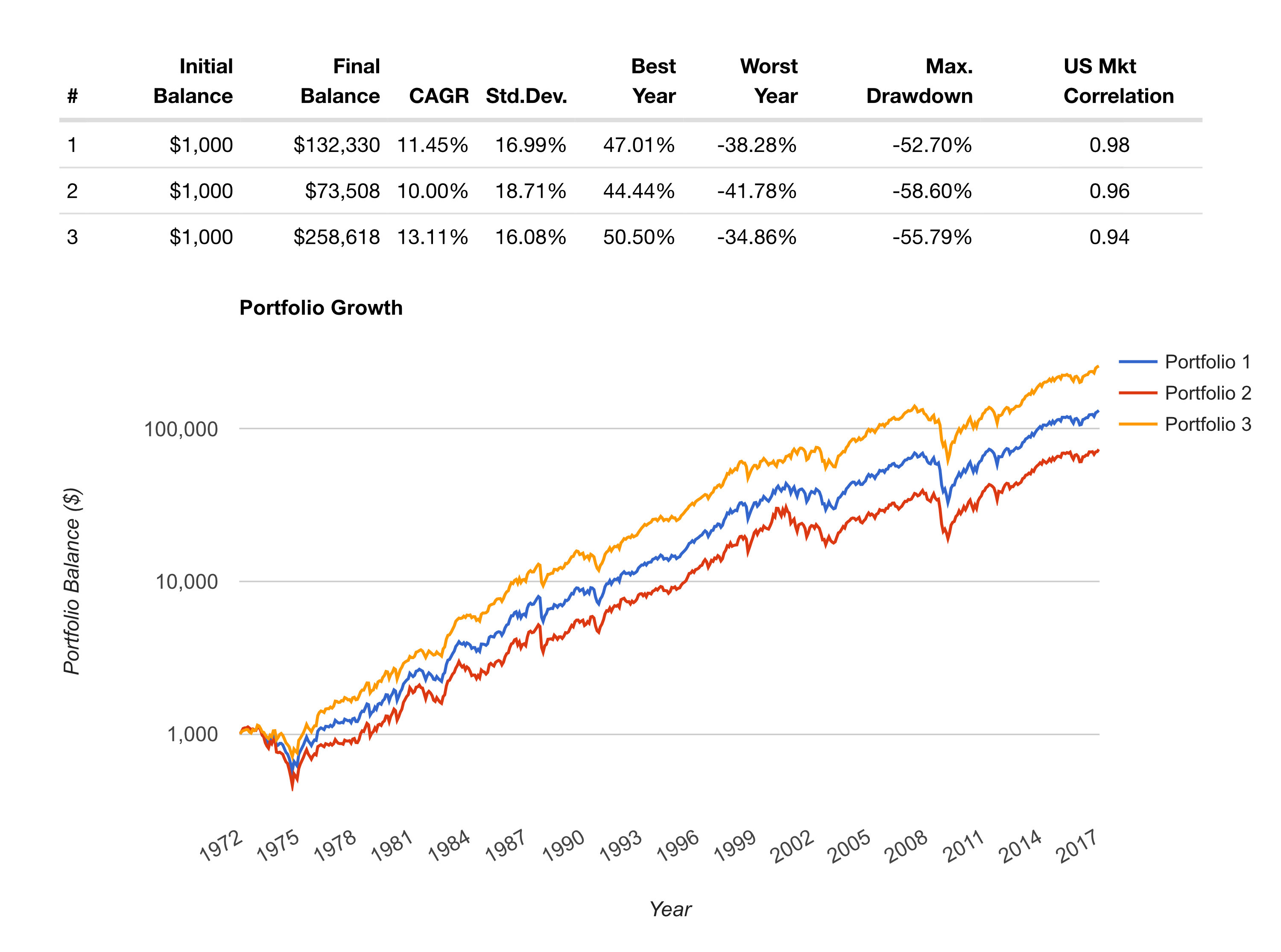

Equally Weighted Large, Mid, and Small Cap Portfolio Performance Since 1972

If one were to have invested $1,000 in the a portfolio consisting of roughly equal allocations of large market capitalization (“Large Cap”) stocks, mid-cap and small cap stocks in January of 1972, it would have grown to $132,330 by January of 2017. The compound annual growth rate (CAGR) of this portfolio was 11.45%. The maximum drawdown around the 2008 financial crisis was 52.70% (stressful).

During this same time, if one were to invest $1,000 in “US Stocks” the CAGR would have been 10.21%, balance on January 2017 would have been $80,008, and the maximum drawdown would have been 50.89%.

Source: portfoliovisualizer.com

What about Growth Stocks?

A portfolio with 1/3 large, 1/3 mid and 1/3 small cap growth stocks would have done even worse than the allocation above. The CAGR since 1972 has been 10%, the maximum drawdown was 58.6% (wow!), and $1,000 would have grown to $73,508.

So growth stocks performed worse.

Source: portfoliovisualizer.com

US Value Stocks have Outperformed

US value stocks have outperformed growth stocks. A portfolio mixed with 1/3 large cap value, 1/3 mid cap value and 1/3 small cap value would have a CAGR of 13.11%.

A $1,000 investment in 1972 would have grown to $258,618. The maximum drawdown would have been slightly higher than straight market cap stocks, at 55.79% (still stressful) but less than the growth stock portfolio.

Source: portfoliovisualizer.com

What it All Means

There are two main takeaways.

- Value stocks outperform other stocks classes

- A small increase in the CAGR has a large impact if the time horizon is long enough

- US value stocks had a lower maximum drawdown than growth stocks

- US value stocks have higher maximum drawdown than stocks in general

Source: portfoliovisualizer.com

For more details on this data see the portfoliovisualizer.com FAQ.