by John | Nov 20, 2017 | Cryptocurrency

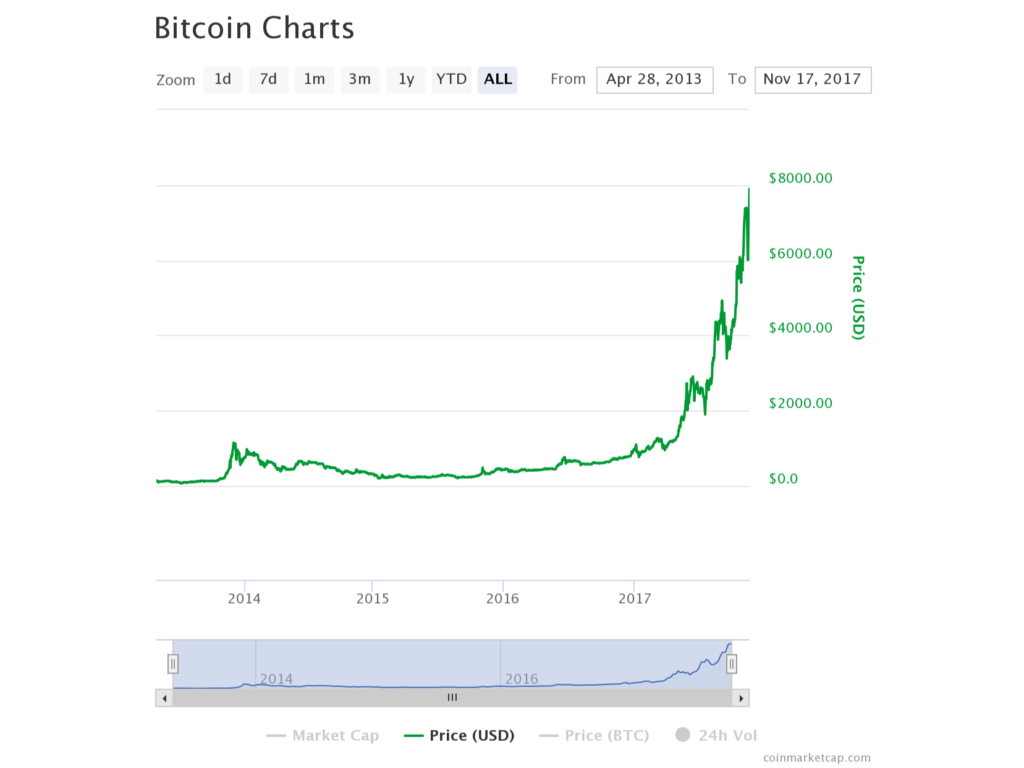

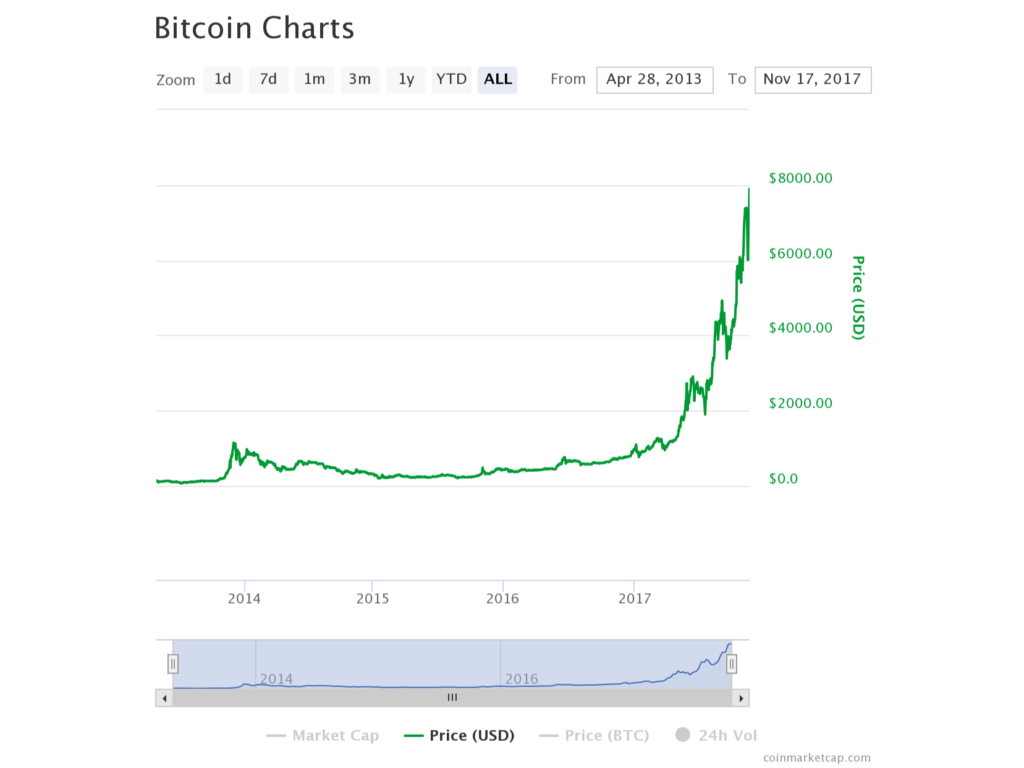

One Bitcoin is currently trading north $8,000 as of writing. The total market capitalization of all cryptocurrencies is over $240 billion.

Bitcoin (BTC) is up over $2,000 since last month alone.

Since 2013 BTC has gone up, up, up thousands of percentage points.

Cryptocurrencies like Bitcoin have made millionaires. An entire industry that didn’t exist ten years ago has a market capitalization of hundreds of billions.

Much of the focus of this website is in alternative investments. I think the stock market is overvalued and a lot of the financial products peddled by wall street are bad deals, at least for customer. The alternative investment du jour is without a doubt cryptocurrencies more specifically Bitcoin, which as of writing is trading northwards of $8,200.

Are you afraid of missing out on the cryptocurrency craze? There a couple ways to squelch this fear.

I’m not quite this excited about Bitcoin and Cryptocurrencies and I think it’s important to be informed

Option A: Don’t Own Any Cryptocurrencies

You don’t need to own any cryptocurrencies. You don’t need to own one Iota (that is a cryptocurrency) of Bitcoin, Litcoin or Lisk. If you don’t want to learn more about them, or speculate on them that is your choice. It’s a valid choice and it might even be a great choice.

But I’ve decided to make a different choice.

As I’ve said before I’m personally skeptical of cryptocurrencies as a long term store of value. I also think there are superior alternatives.

But the market has continued to grow and a lot of people think it is the next big thing. They compare it to the “dot com” boom that took place earlier in the century (there was also quite a bust if I remember correctly). I was skeptical of Bitcoin when it was $1,000 and $4,000 and I’m skeptical of it now that it’s over $8,000.

Option B: Take a Measured Approach

Bitcoin could continue to climb to the moon or it could go to zero. It could also do both.

Being on the sidelines and watching cryptocurrencies climb higher and higher is difficult. People like to buy things as they are going up. But buying out of fear of missing out is a horrible idea that will in all likelihood results in bad decisions and losses.

In my most reasonable mind, I believe that Bitcoin will not be the future of cryptocurrencies. I think it’s unlikely to go to zero but I think it will drop precipitously. I don’t think cryptocurrency technology is going away, but I think some other, better cryptocurrency technology will eventually supplant Bitcoin.

The nature of digital technology is that it becomes obsolete and is replaced by newer, better technology.

I don’t know the future. That is just my opinion and my best, most reasoned judgement of the technology and the facts as I understand them. I know I could be wrong.

So I own some cryptocurrency so that I’m not on the sidelines and I am benefiting from the rise in price. But I only own what I can afford to lose.

Is Bitcoin the Google or the Next HotBot.com?

Is Bitcoin the next Google or Apple? Or is Bitcoin the next hotbot.com or pets.com?

If you’ve never heard of hotbot.com that is exactly my point.

Is Bitcoin the next Facebook, or is it the next MySpace?

I don’t know.

I do think that from a technology perspective there are many other coins and cryptocurrencies that I think are superior to Bitcoin. I know that when I’ve tried to use Bitcoin as a medium of exchange it stinks. It’s expensive, especially when the network is busy, and it takes a minimum of 10 minutes, and usually 20-30 minutes.

There are other cryptocurrencies that are faster, more anonymous and more secure.

Bitcoin is lousy for payments and attempts to make it better have thus far not come to fruition.

Maybe it will be better for payments in the future. Or maybe, as some people argue, Bitcoin doesn’t need to be used to day to day payments, that it can just be a “store of value” like gold that doesn’t change hands very often.

I can’t foresee the future but I do see benefits in cryptocurrency technology. But at the same time this technology is, in my opinion, very difficult to value.

Is BTC expensive or cheap at $8,000? I don’t know. It seems expensive to me, but I’ve been wrong (or early) for years.

Will Bitcoin’s robust network, name recognition and first mover advantage allow it to maintain it’s dominance? I don’t know.

Fortunately I don’t need to know.

As I said before, no one needs to own cryptocurrencies. It’s a personal choice. But I don’t want to sit on the sidelines in case cryptocurrencies are the “next internet” or “next radio”.

So what are some details of this option?

How not to Fear Missing Out on the Cryptocurrency Craze: A Strategy

Part 1: Only buy what you can Afford to Lose

Cryptocurrencies are highly speculative and highly volatile. That is why I think it is very important to only purchase an amount of cryptocurrency you can afford to lose.

For example, I bought about .5 BTC on Coinbase at $7,000 before the Bitcoin segwit2x fork (which didn’t happen). I intended only to hold it through the segwit2x fork. I then watched as BTC fell to $6,000, representing a $500 loss. But because I had only bought what I could afford to lose I was able to hold through that dip, and when Bitcoin rallied back to mid $7,000 I was able to reduce my position at a profit.

If I had bought more than I could afford to lose, it would have been harder not to panic and sell to cut my losses.

Part 2: Diversify

If cryptocurrencies become mainstream and go up another gazillion percent, you won’t need to own that much of any one to make a handsome profit. There are over a thousand cryptocurrencies with a market capitalization over $244 billion. Of that $244 billion Bitcoin accounts for the lion’s share, at $140 billion and the top ten account for nearly $220 billion, or about 90%.

Some are going to go to zero and disappear, others might stagnate, and still others might continue to go up in value and over the next 20-30 years and represent a great speculation.

Some cryptocurrencies like “1337” (see https://en.wikipedia.org/wiki/Leet), MiloCoin, or the cryptocurrencies named after an English-language obscenities, are in my opinion not worth owning at all.

By owning a handful of the more promising cryptocurrencies, one increases the likelihood of owning one that really takes off.

Part 3: Goals and Discipline

If I had kept all the Bitcoins I bought several years ago, and sold them today, I would have made somewhere around $45,000. If I had kept holding them who knows how much they would be worth in the future. Instead, I’ve bought and sold Bitcoins and other cryptocurrencies over the years and probably made a few thousand instead (I’d have to check my tax returns to know for sure).

Throughout that time I’ve held some cryptocurrency and it has steadily gone up. One of my mains goals with cryptocurrency was not not lose money and I’ve succeeded thus far in that goal.

Is your goal with cryptocurrencies to try to pick the top? Is it to double your money and get out? Is it to buy and hold until Bitcoin goes to $100,000?

Because cryptocurrencies are so volatile right now I think it’s good to have a goal and then exercise the discipline to follow it. Decisions made based on emotion tend not to consistently work out.

If you decide speculative risk is right for you, you can buy Bitcoins on Coinbase.

by John | Jun 15, 2017 | Cryptocurrency, Learning from Mistakes, Wealth Protection

I think the vast majority of my readers get it. I think my readers are smart, critical thinkers. However, I’ve gotten a few comments from people who somehow think that because ETH is now trading upwards of $300 that somehow my article Ethereum Cloud Mining is Not Profitable is no longer valid.

I’ll make myself clear. It does not matter how high ETH goes, Ethereum cloud mining was not profitable for me.

Did I make more money as a result of Ethereum cloud mining compared to simply holding onto the $561? Yes. But the fact remains that the Ethereum cloud mining contract was a slow, expensive way to acquire ETH.

Owning ETH was profitable. I made money on the appreciation in dollar value of ETH. I would have made more money if I had bought ETH directly, versus Ethereum cloud mining.

I wrote this very clearly three months after I purchased the Ethereum Cloud Mining contract from Hashflare.io:

I would also be better off if I had just bought ETH.

If I bought $561 of ETH for $9 (where it was trading when I started mining). I would have 62 ETH…

Through Ethereum cloud mining I mined 41.27 ETH.

I would rather have 62 ETH immediately than wait a year to get 41.27 ETH. The cloud mining contract increased my cost basis.

Now, if I could buy hashing power at a low enough cost Ethereum cloud mining could have been profitable. If mining difficulty went down over time, Ethereum cloud mining would be more likely to be profitable. However, mining difficulty has consistently gone up and the cost of cloud mining contracts is too high.

Ethereum cloud mining was not a good investment for me. I would have been better off simply buying ETH directly. This is true regardless of how high the price of ETH goes.

by John | Apr 23, 2017 | Cryptocurrency, Learning from Mistakes, Passive Income

Today I wanted to cover how to calculate cloud mining profitability. I had a recent comment on my article: Ethereum Cloud Mining is not Profitable that I’m concerned perpetuates the kind of static analysis that will cause someone to lose money on cloud mining.

I’m going to do my analysis for Ethereum Cloud Mining. However, this analysis will work for any coin that has increasing mining difficulty.

Assumptions: I’m assuming the price of ETH is static. Why? Because if it goes up, that is simply a bonus. If mining isn’t profitable unless the currency goes up, then one is better off buying the currency outright.

Step One of How to Calculate Cloud Mining Profitability

First you need to know how much the cloud mining will cost per unit of hashing power. As of 23 April 2017 Hashflare.io is selling 100 KH/s for 2.20 USD. That is 1 MH/s for 22 USD.

Use a static calculator first. This will provide the baseline static analysis. For Ethereum I like this calculator.

As of writing there is a network hashrate of 22595.62995398704 GH/s, a blocktime of 13.31 and one ETH going for 48.63 USD.

So with 1 MH/s I would earn 0.043093 ETH per month, worth 2.10 USD per month. Multiply that by 12 and the total ETH mined (0.517116) would be worth $25.2.

So if the price of ETH stays the same (which for the purpose of the static analysis we will assume it will), and the network hashing power stays the same. Then the profit will be $3.2 after a year IF THE NETWORK HASHING POWER STAYS THE SAME. The problem with a static analysis is that network hashing power does NOT stay the same.

Network Mining Difficulty Goes Up

If you stop with this static analysis you’ll surely lose money though. Why? Because the network hashing power has historically gone up and gone up A LOT.

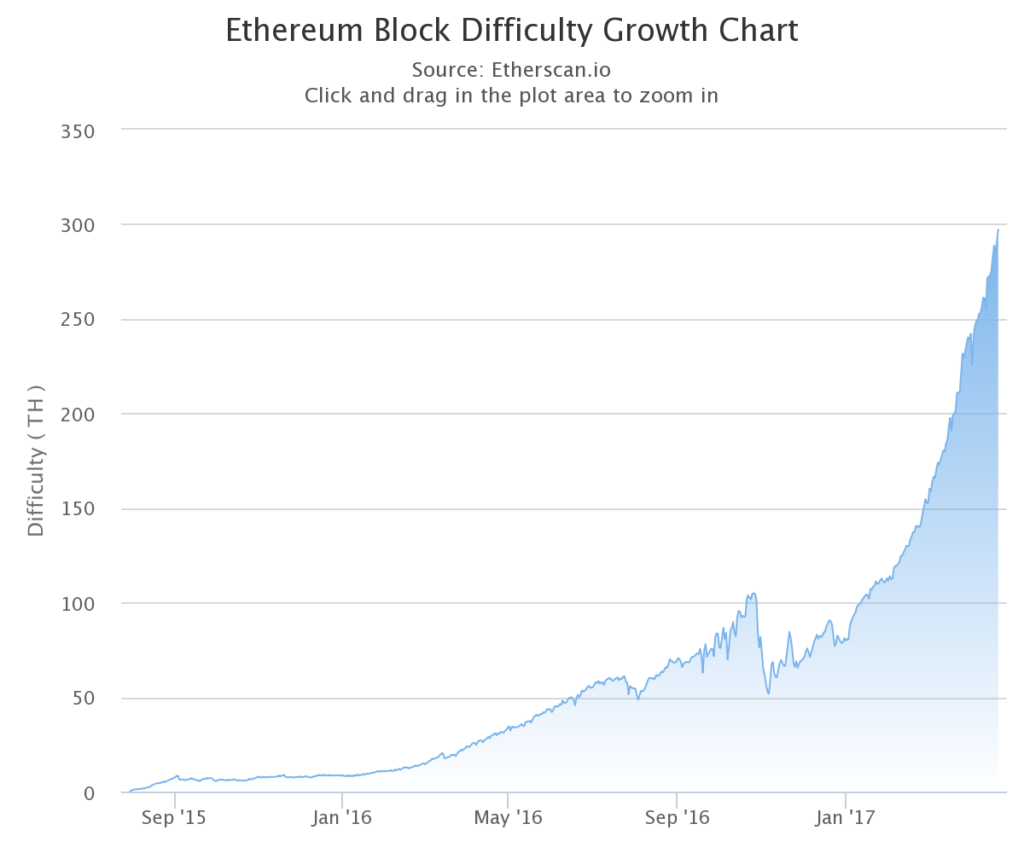

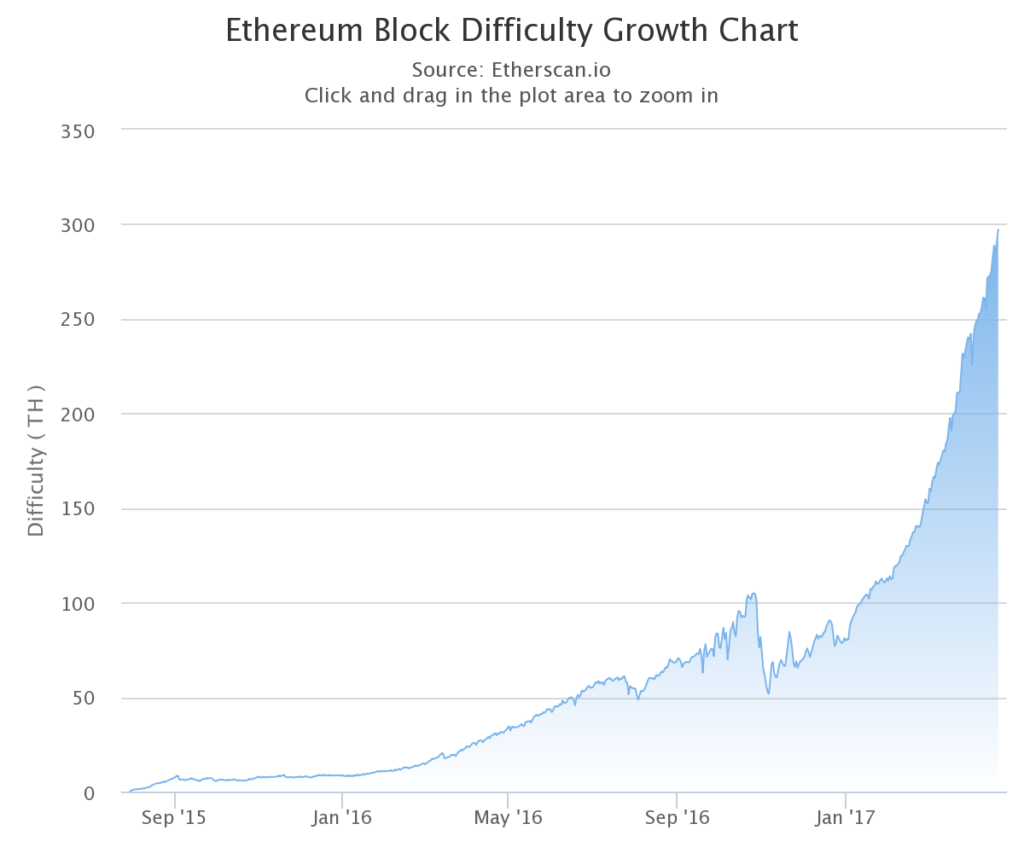

Ethereum Block Difficulty Growth Since 30 July 2015

In the first four months of 2017 alone, mining difficulty for Ethereum has gone up over 200% from under 100 TH/s up to nearly 300 TH/s. Which means the amount of ETH mined for anyone with fixed hashing power will have been reduced by over 66%.

Factoring in the growth rate of block difficulty is the most important factor when determining cloud mining profitability.

Step Two of How to Calculate Cloud Mining Profitability

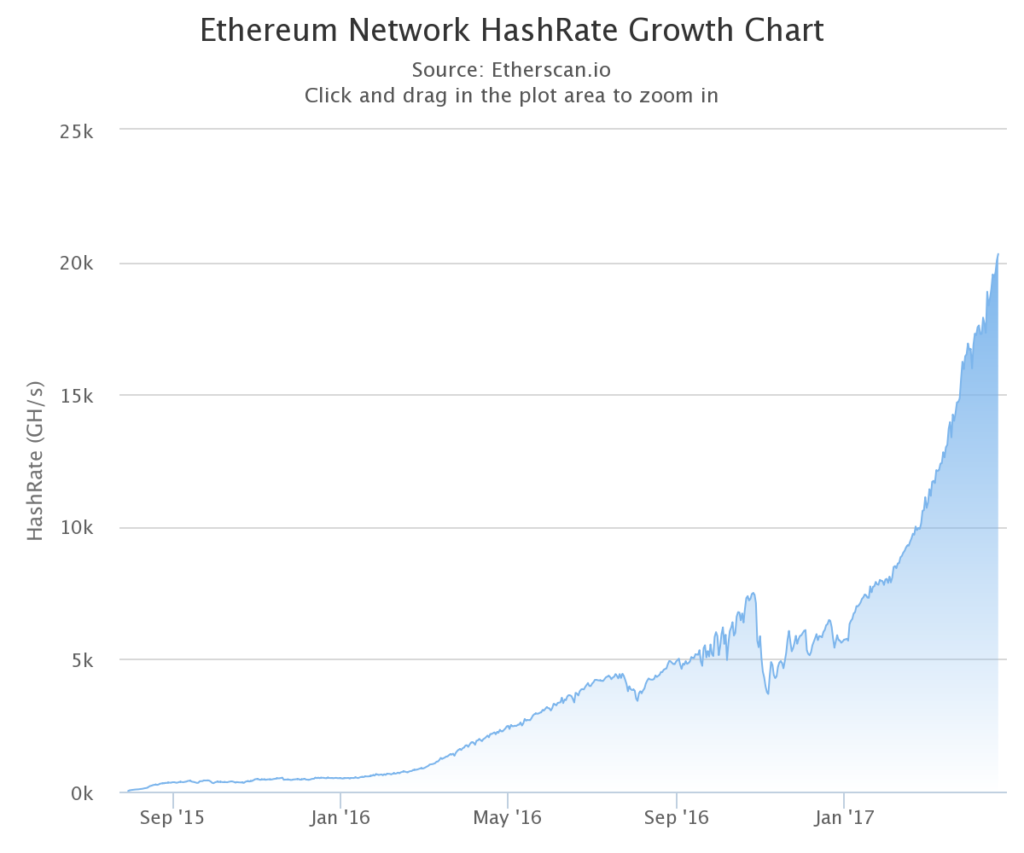

Projecting how much the network hashrate will increase over the life of the cloud mining contract is vitally important. You need to make a realistic estimate of how the network hashrate will increase because it will reduce the amount you get from mining each day.

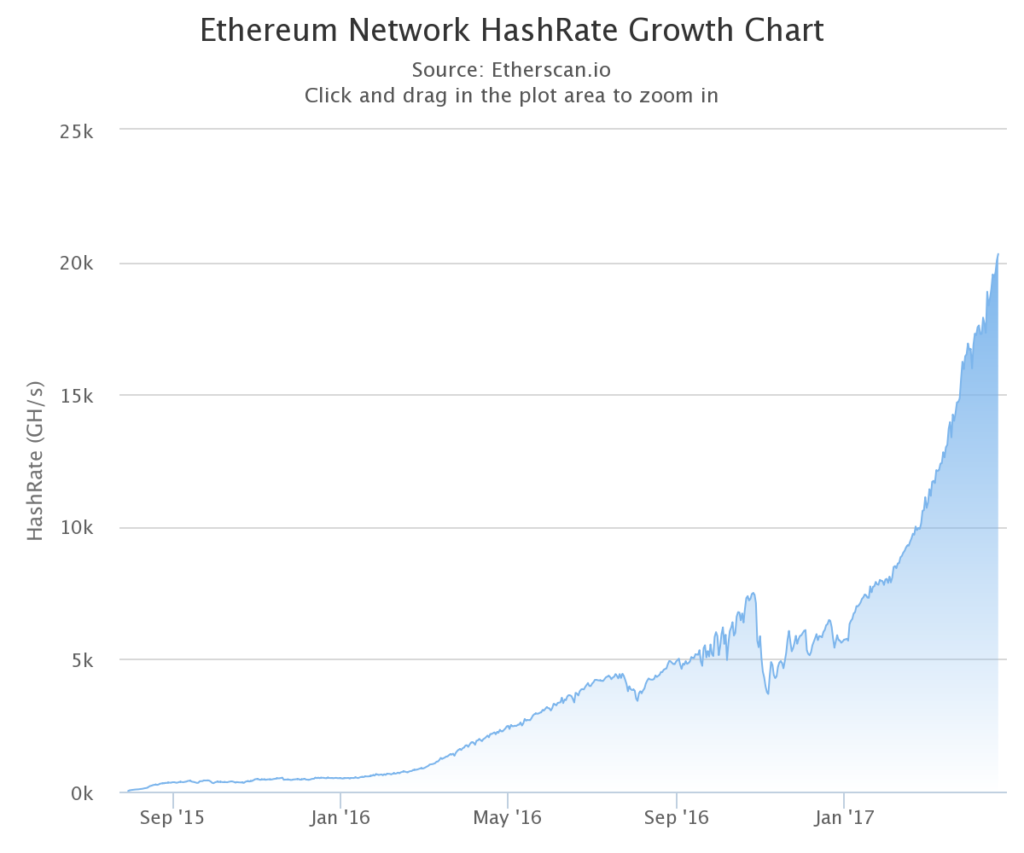

The chart above shows the Ethereum network hashrate growth. In this example, Hashflare.io contracts run in 12 month increments. So we need a realistic estimate of how much the hashing power (and thus mining difficulty) will go up over a 12 month period.

This takes some guesswork but the best indicator is the past.

The August 2015 hashrate of 55 GH/s to the August 2016 hashrate of 3,811 GH/s represents a 6,800% increase. This was the first 12 months of the Ethereum network coming online so I think this number is too high.

In 2016 the Ethereum network hashrate went from 511 GH/s to 5,700 GH/s. A 1,015% increase.

From April 2016 at 1752 GH/s to April 2017 of 20,300 GH/s was a 1,058% increase.

So I based on 2016 I think a 1,000% increase in hashing power is a good conservative guesstimate. That means the hashing power would be around 230,000 GH/s by April of 2018.

So then we follow step 1 again using the static calculator. Using the 1 MH/s and a network hashrate of 230,000 GH/s. The monthly ETH mined would be 0.004233 worth $.21.

Step Three of How to Calculate Cloud Mining Profitability

So at this point we have a projection of how much we’ll get from mining in the first month. And how much we’ll get in the last month. These are just a projections based on a static analysis and a guesstimate of where mining difficulty will be in the future.

But the amount mined doesn’t jump down from the first month to the last month. The amount mined is slowly and steadily decreasing.

I think a exponential decay model fits the data better but for the sake of ease I think a linear model will suffice.

I also think a simplified method works because the cloud mining rates I’ve seen are not close to what they would need to be for mining to be profitable.

Take the amount we think we’ll mine in the first month. In this case .043093. Then take the amount we’ll think we’ll mine in the last month, .004233. Subtract the first from the last. Then divide that by 11.

From that point you take the starting value of .043093 subtract the decay amount .003943 to get the second months value of .039149. You do this again until you get to month 12. By summing up each month’s value we get 0.283956. Multiply that by the price of ETH of 48.63 USD and we get $13.80.

The contract in this example cost 22 USD so this would not be profitable if the network hashing power goes up by 1000% (as it did in 2016) and the price of ETH stays the same.

You’d end up losing $8.2.

Okay, what if the network hashing power only goes up 500% so it goes up to 135,600 GH/s after one year? You’d mine about .3 ETH worth $14.66. You still lose.

What if the network hashing power only goes up 100% to about 45200 GH/s? You’d mine about .387 ETH worth less than $19. Loser.

What if the network hashing power only goes up 35% to 30,500 GH/s. You’d mine about .45 ETH worth $22.88. Small winner.

If Network Hashing Power Goes Up You Start to Lose

So what I hope this shows is that if the hashing power goes up, which in the case of Ethereum (and I suspect most coins as well) the amount of coins mined will drop and the profits will be eroded.

Easy Method

If you believe network hashing power will continue to go up then use this method to determine if mining is even worth a closer evaluation: use the static mining profitability calculator. Use the amount of ETH mined and the cost of the mining contract to see how much you’re effectively paying per ETH.

For example Hashflare.io is selling 1 MH/s for 22 USD for a year. That would yield 0.043093 ETH per month x 12 would be 0.517116 ETH for the year mined if the network hashrate stays the same. So the cost per ETH would be 42.54 USD. With ETH trading at 48.63 USD that is only a 14% discount over a year.

Unless you’re going to get ETH (or whichever other coin) at a significant discount using the static calculation (say 40-50% below spot price). It’s not worth it.

But the Price of ETH is going to double!

Great! Then buy ETH directly. Lets say the price of ETH does double in a year. It goes from 48.63 USD today up to $97.26. You could have bought $22 worth of ETH (.45 ETH) and the $22 worth of ETH would now be worth $43.76.

With a 1000% network hashrate increase you’d have only mined 0.283956 which would be worth $27.61. Unless the mining is profitable with the price of ETH fixed, you’re better off owning the currently directly even if the price of the currency goes up.

At what price would cloud mining be worth it?

As of today 23 April 2017, based on a 1000% increase in hashing power over the next year I would not pay more than around $7 for 1 GH/s of hashing power.

Based on my projections that would yield about 40%. Given the risk and volatility in cryptocurrencies I would need to see that kind of return for it to be worth the risk to me.

With 1 GH/s costing 22 USD, if the network hashing power stays the same I would still only make about 15%. Given the history of network hashrate increases that isn’t worth it.

Hashflare.io is nowhere close to $7 per GH/s. Genesis Mining offers 1 GH/s for 2 years for 29.99. Who knows where the network hash rate will be in 2 years.

Some People Claim Cloud Mining is Profitable

I have read testimonials from people who think cloud mining is profitable. My main question would be is it profitable because the underlying cryptocurrency went up, or because the mining itself was profitable? In other words would you have been better off just owning the cryptocurrency directly?

by John | Mar 21, 2017 | Cryptocurrency, Currencies, Learning from Mistakes, Personal Journey

I wrote back in June of 2016 in an article Ethereum Cloud Mining is Not Profitable. Today is exactly 1 year since I purchased an Ethereum cloud mining contract at Hashflare.io. As I recapped in that article:

In order to simply break even ETH would need to trade up to around 18.7 USD.

I would also be better off if I had just bought ETH.

That article was written about 3 months after I had made the investment in Ethereum Cloud Mining.

I wish I had done the in depth analysis in that article before I made the investment in Ethereum Cloud Mining so that I would have known not to make the investment.

And that is the lesson I learned:

Perform your due diligence before making an investment!

An artist’s representation of how I envisioned Ethereum Cloud Mining would go

I attempted due diligence but I did not consider all the relevant facts. These relevant facts were available to me at the time if I had known to look for them.

Since my mining contract is up I want to recap what actually happened with the benefit of all the facts.

The main beneficiary of my bad experience is anyone who is newly considering Ethereum Cloud Mining: caveat emptor.

There might be other cloud mining services out there that are profitable but in my experience Hashflare.io was not one of them.

Ethereum Cloud Mining Recap

On 21 march 2016 I spent $561 for a cloud mining contract at Hashflare.io. Ethereum was trading at $10.81 at the time. In the one year of mining I mined 41.27 Ethereum. As of writing Ethereum is currently trading at $42.6.

Source: http://coinmarketcap.com/currencies/ethereum/

So that 41.27 Ethereum would be worth $1,758 if I had held onto all of them and then sold today.

This is a $1,197 gain which sounds nice but it really isn’t and I’ll explain why.

Why a $1,197 Gain Wasn’t Very Good

But what if the price of Ethereum had not gone up 294%?

An artist’s representation of how Ethereum Cloud Mining actually went

What if it had stayed the same price of $10.81. Those 41.27 Ether I mined would be worth just $446.

What does that mean?

It means: The gain was entirely due to the increase in the price of ETH–the mining itself was not profitable.

In fact, if I had taken $561 and just purchased Ethereum directly, I could have acquired 51.89 Ethereum, which at current prices of $42.6 would now be worth $2,210 or a gain of $1,649.

So other than sounding cool Ethereum Cloud Mining through HashFlare.io provided no value.

The Problem with my Analysis

The downfall of my analysis when initially evaluating the investment in Ethereum Cloud Mining was assuming linear growth in hashing power of the Ethereum network.

I explain this in more detail in my original article and I also provide a process for making more accurate predictions wether a cloud mining contract will be profitable or not. Using that process I predicted I would mine about 30 ETH.

This prediction was much closer to what I actually mined compared to the 120 ETH predicted using static models.

It was a tough lesson to learn but thankfully the amount at risk was relatively small at $561.

by John | Jun 2, 2016 | Learning from Mistakes, Passive Income

Ethereum Cloud Mining on Hashflare.io is a losing investment. It is more profitable to simply buy Ether on an exchange.

(more…)