by John | Jun 15, 2017 | Cryptocurrency, Learning from Mistakes, Wealth Protection

I think the vast majority of my readers get it. I think my readers are smart, critical thinkers. However, I’ve gotten a few comments from people who somehow think that because ETH is now trading upwards of $300 that somehow my article Ethereum Cloud Mining is Not Profitable is no longer valid.

I’ll make myself clear. It does not matter how high ETH goes, Ethereum cloud mining was not profitable for me.

Did I make more money as a result of Ethereum cloud mining compared to simply holding onto the $561? Yes. But the fact remains that the Ethereum cloud mining contract was a slow, expensive way to acquire ETH.

Owning ETH was profitable. I made money on the appreciation in dollar value of ETH. I would have made more money if I had bought ETH directly, versus Ethereum cloud mining.

I wrote this very clearly three months after I purchased the Ethereum Cloud Mining contract from Hashflare.io:

I would also be better off if I had just bought ETH.

If I bought $561 of ETH for $9 (where it was trading when I started mining). I would have 62 ETH…

Through Ethereum cloud mining I mined 41.27 ETH.

I would rather have 62 ETH immediately than wait a year to get 41.27 ETH. The cloud mining contract increased my cost basis.

Now, if I could buy hashing power at a low enough cost Ethereum cloud mining could have been profitable. If mining difficulty went down over time, Ethereum cloud mining would be more likely to be profitable. However, mining difficulty has consistently gone up and the cost of cloud mining contracts is too high.

Ethereum cloud mining was not a good investment for me. I would have been better off simply buying ETH directly. This is true regardless of how high the price of ETH goes.

by John | Apr 23, 2017 | Cryptocurrency, Learning from Mistakes, Passive Income

Today I wanted to cover how to calculate cloud mining profitability. I had a recent comment on my article: Ethereum Cloud Mining is not Profitable that I’m concerned perpetuates the kind of static analysis that will cause someone to lose money on cloud mining.

I’m going to do my analysis for Ethereum Cloud Mining. However, this analysis will work for any coin that has increasing mining difficulty.

Assumptions: I’m assuming the price of ETH is static. Why? Because if it goes up, that is simply a bonus. If mining isn’t profitable unless the currency goes up, then one is better off buying the currency outright.

Step One of How to Calculate Cloud Mining Profitability

First you need to know how much the cloud mining will cost per unit of hashing power. As of 23 April 2017 Hashflare.io is selling 100 KH/s for 2.20 USD. That is 1 MH/s for 22 USD.

Use a static calculator first. This will provide the baseline static analysis. For Ethereum I like this calculator.

As of writing there is a network hashrate of 22595.62995398704 GH/s, a blocktime of 13.31 and one ETH going for 48.63 USD.

So with 1 MH/s I would earn 0.043093 ETH per month, worth 2.10 USD per month. Multiply that by 12 and the total ETH mined (0.517116) would be worth $25.2.

So if the price of ETH stays the same (which for the purpose of the static analysis we will assume it will), and the network hashing power stays the same. Then the profit will be $3.2 after a year IF THE NETWORK HASHING POWER STAYS THE SAME. The problem with a static analysis is that network hashing power does NOT stay the same.

Network Mining Difficulty Goes Up

If you stop with this static analysis you’ll surely lose money though. Why? Because the network hashing power has historically gone up and gone up A LOT.

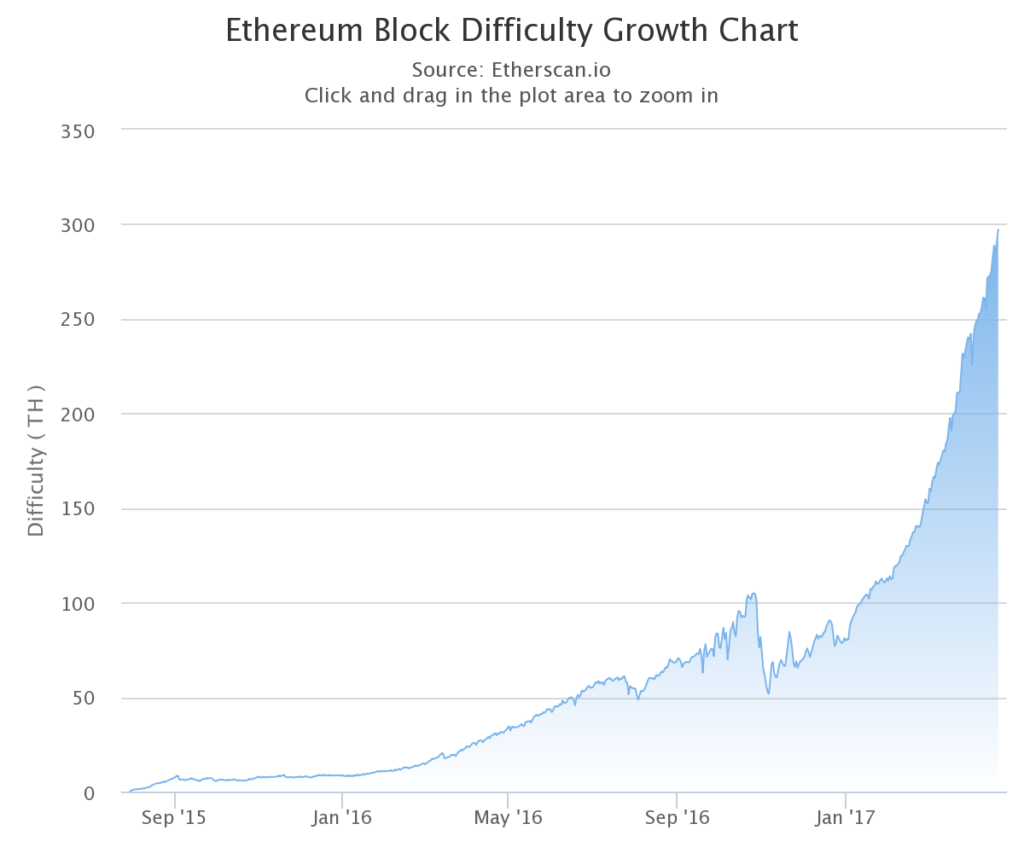

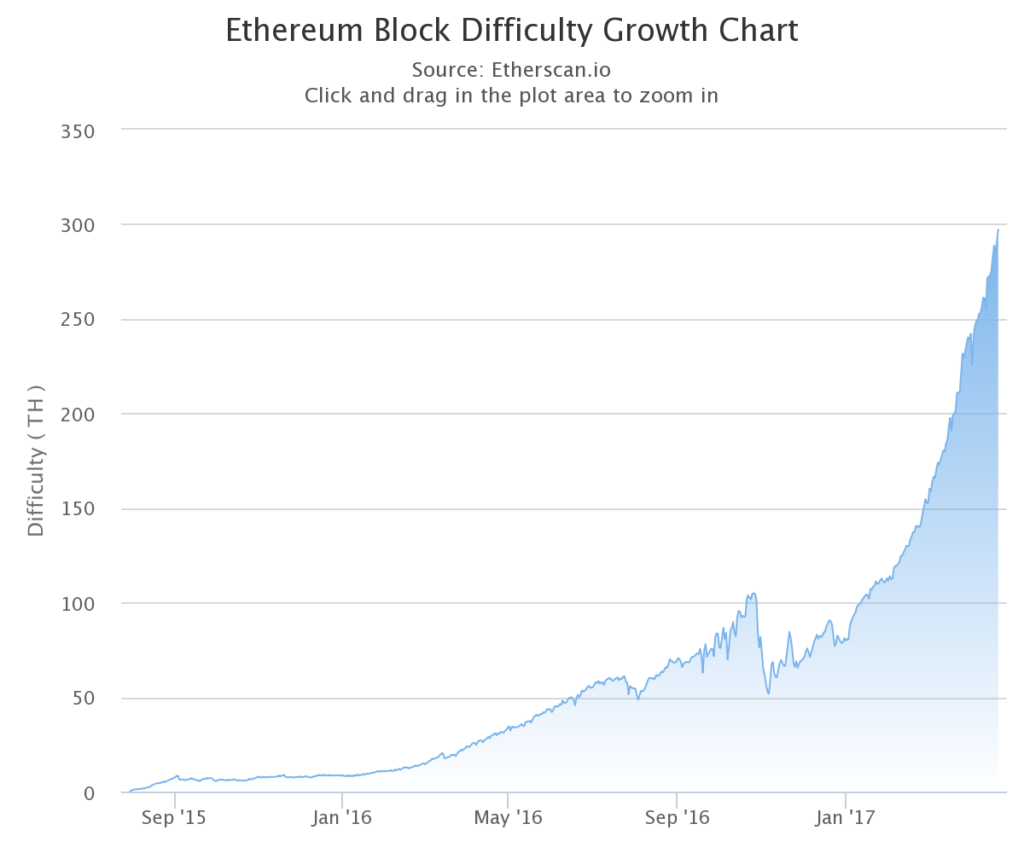

Ethereum Block Difficulty Growth Since 30 July 2015

In the first four months of 2017 alone, mining difficulty for Ethereum has gone up over 200% from under 100 TH/s up to nearly 300 TH/s. Which means the amount of ETH mined for anyone with fixed hashing power will have been reduced by over 66%.

Factoring in the growth rate of block difficulty is the most important factor when determining cloud mining profitability.

Step Two of How to Calculate Cloud Mining Profitability

Projecting how much the network hashrate will increase over the life of the cloud mining contract is vitally important. You need to make a realistic estimate of how the network hashrate will increase because it will reduce the amount you get from mining each day.

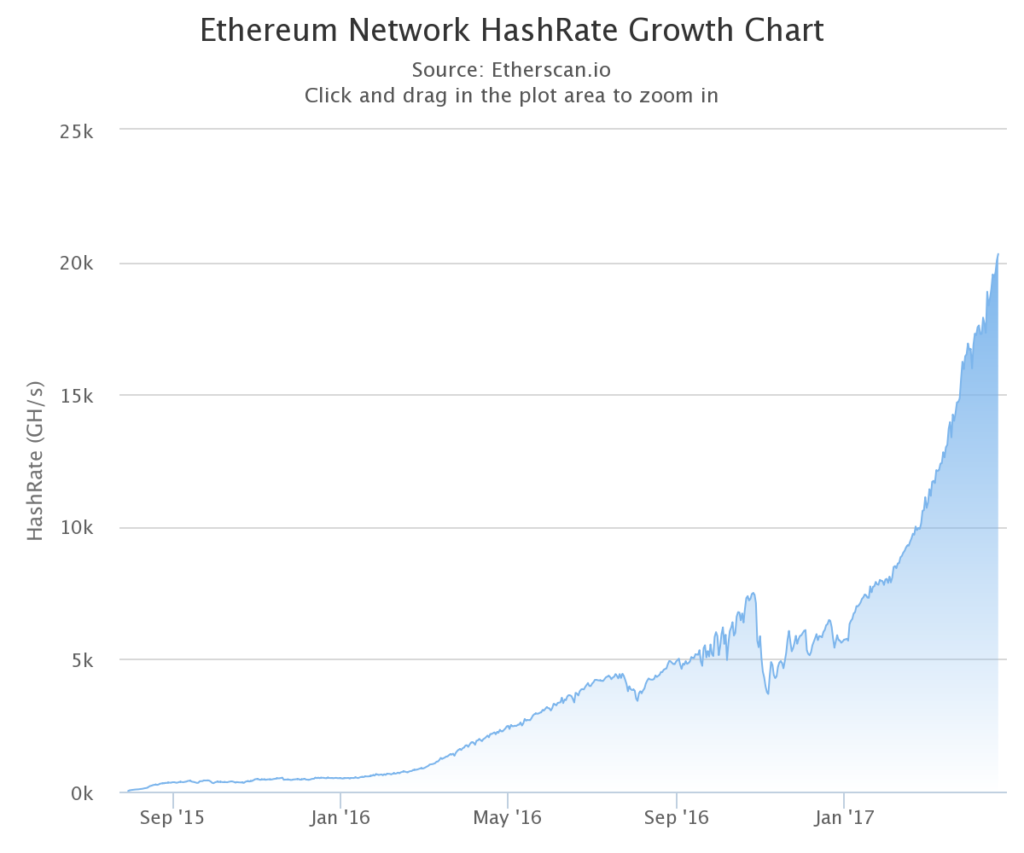

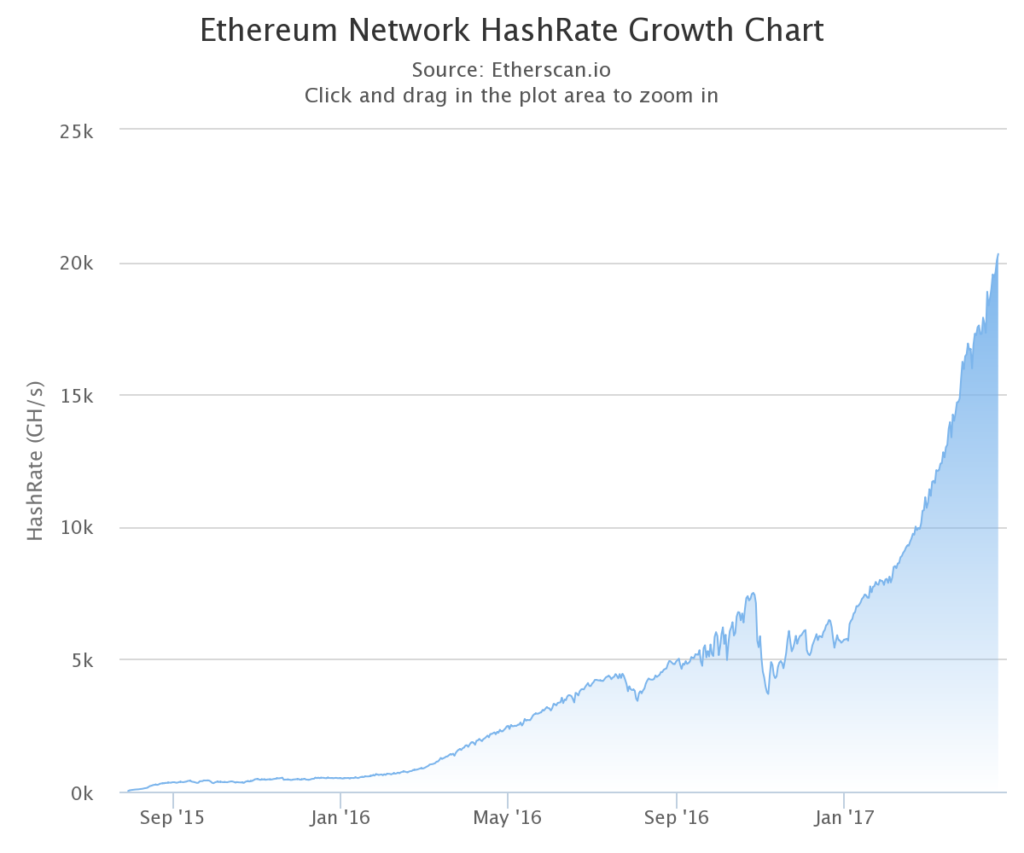

The chart above shows the Ethereum network hashrate growth. In this example, Hashflare.io contracts run in 12 month increments. So we need a realistic estimate of how much the hashing power (and thus mining difficulty) will go up over a 12 month period.

This takes some guesswork but the best indicator is the past.

The August 2015 hashrate of 55 GH/s to the August 2016 hashrate of 3,811 GH/s represents a 6,800% increase. This was the first 12 months of the Ethereum network coming online so I think this number is too high.

In 2016 the Ethereum network hashrate went from 511 GH/s to 5,700 GH/s. A 1,015% increase.

From April 2016 at 1752 GH/s to April 2017 of 20,300 GH/s was a 1,058% increase.

So I based on 2016 I think a 1,000% increase in hashing power is a good conservative guesstimate. That means the hashing power would be around 230,000 GH/s by April of 2018.

So then we follow step 1 again using the static calculator. Using the 1 MH/s and a network hashrate of 230,000 GH/s. The monthly ETH mined would be 0.004233 worth $.21.

Step Three of How to Calculate Cloud Mining Profitability

So at this point we have a projection of how much we’ll get from mining in the first month. And how much we’ll get in the last month. These are just a projections based on a static analysis and a guesstimate of where mining difficulty will be in the future.

But the amount mined doesn’t jump down from the first month to the last month. The amount mined is slowly and steadily decreasing.

I think a exponential decay model fits the data better but for the sake of ease I think a linear model will suffice.

I also think a simplified method works because the cloud mining rates I’ve seen are not close to what they would need to be for mining to be profitable.

Take the amount we think we’ll mine in the first month. In this case .043093. Then take the amount we’ll think we’ll mine in the last month, .004233. Subtract the first from the last. Then divide that by 11.

From that point you take the starting value of .043093 subtract the decay amount .003943 to get the second months value of .039149. You do this again until you get to month 12. By summing up each month’s value we get 0.283956. Multiply that by the price of ETH of 48.63 USD and we get $13.80.

The contract in this example cost 22 USD so this would not be profitable if the network hashing power goes up by 1000% (as it did in 2016) and the price of ETH stays the same.

You’d end up losing $8.2.

Okay, what if the network hashing power only goes up 500% so it goes up to 135,600 GH/s after one year? You’d mine about .3 ETH worth $14.66. You still lose.

What if the network hashing power only goes up 100% to about 45200 GH/s? You’d mine about .387 ETH worth less than $19. Loser.

What if the network hashing power only goes up 35% to 30,500 GH/s. You’d mine about .45 ETH worth $22.88. Small winner.

If Network Hashing Power Goes Up You Start to Lose

So what I hope this shows is that if the hashing power goes up, which in the case of Ethereum (and I suspect most coins as well) the amount of coins mined will drop and the profits will be eroded.

Easy Method

If you believe network hashing power will continue to go up then use this method to determine if mining is even worth a closer evaluation: use the static mining profitability calculator. Use the amount of ETH mined and the cost of the mining contract to see how much you’re effectively paying per ETH.

For example Hashflare.io is selling 1 MH/s for 22 USD for a year. That would yield 0.043093 ETH per month x 12 would be 0.517116 ETH for the year mined if the network hashrate stays the same. So the cost per ETH would be 42.54 USD. With ETH trading at 48.63 USD that is only a 14% discount over a year.

Unless you’re going to get ETH (or whichever other coin) at a significant discount using the static calculation (say 40-50% below spot price). It’s not worth it.

But the Price of ETH is going to double!

Great! Then buy ETH directly. Lets say the price of ETH does double in a year. It goes from 48.63 USD today up to $97.26. You could have bought $22 worth of ETH (.45 ETH) and the $22 worth of ETH would now be worth $43.76.

With a 1000% network hashrate increase you’d have only mined 0.283956 which would be worth $27.61. Unless the mining is profitable with the price of ETH fixed, you’re better off owning the currently directly even if the price of the currency goes up.

At what price would cloud mining be worth it?

As of today 23 April 2017, based on a 1000% increase in hashing power over the next year I would not pay more than around $7 for 1 GH/s of hashing power.

Based on my projections that would yield about 40%. Given the risk and volatility in cryptocurrencies I would need to see that kind of return for it to be worth the risk to me.

With 1 GH/s costing 22 USD, if the network hashing power stays the same I would still only make about 15%. Given the history of network hashrate increases that isn’t worth it.

Hashflare.io is nowhere close to $7 per GH/s. Genesis Mining offers 1 GH/s for 2 years for 29.99. Who knows where the network hash rate will be in 2 years.

Some People Claim Cloud Mining is Profitable

I have read testimonials from people who think cloud mining is profitable. My main question would be is it profitable because the underlying cryptocurrency went up, or because the mining itself was profitable? In other words would you have been better off just owning the cryptocurrency directly?