by John | Sep 4, 2016 | Getting Started

This article is part two of my three part series of getting started in personal finance. Part I is Stabilization. If you haven’t already read part one start there!

Part II: Fundamentals

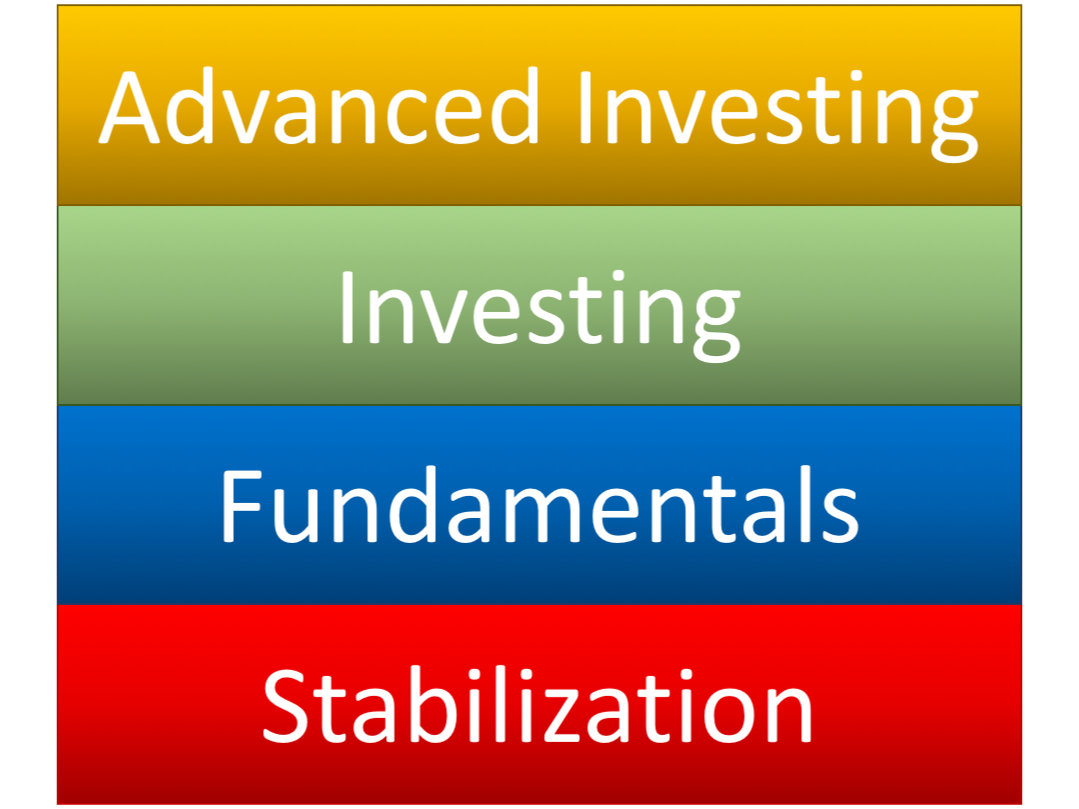

The Building Blocks of Personal Finance

Level I is stabilization. Once you’ve stabilized your finances (you’ve stopped the bleeding, you’re no longer increasing your debts) it’s time to go onto the fundamentals.

Level 2: Fundamentals

You’d think that the Fundamentals would come first but I list it second intentionally. When you take on bad debt you’re starting your wealth growing journey BEHIND. You’re not even beginning at the starting line!

Piggy Bank

Setup a budget.

Having a written budget on paper, an excel spreadsheet, or your tool of choice enables you to produce and save more than you consume.

For excellent resources on budgeting, I refer you to McClain Griffin of ijustwanttobewealthy.com. He has an excellent process for setting a budget, broken down into three parts (1), (2), and (3). He also has a great Ultimate Budgeting Check List to help in this process.

Your budget should include a plan for paying off any outstanding debts you have.

You’ll want to start with the loans with the highest interest rate. You might also look into a debt consolidation loan.

In a simplified example let’s say you owe $1,000 and are being charged 20% interest per year ($200). If you can take out an additional loan for $1,000 that only costs 8% interest and use that money to pay off the loan that costs 20%, you’ve just saved yourself 12% in interest. 8% of 1000 is $80 so you’ve just lowered your costs by $120. This example doesn’t factor in payments or compounding interest but the principle is the same.

Part of getting started in Personal Finance is Saving up money for an emergency fund

Save for a rainy day.

Part of your budget should also include saving for an emergency fund. I like to keep a months income in cash in a safe.

You’ll know you’re well established in the fundamentals of finance when you stick to your budget and you have more money in your bank account at the end of each month than when you started.

Once you’ve setup an emergency fund, what is there to do with the rest of the money?

Oh what a nice problem to have. In Part III I discuss the third and fourth levels of personal finance, investing and advanced investing.

by John | Aug 28, 2016 | Getting Started, Investor Mindset, Investor Psychology

I was having coffee with some new acquittances a few weeks back and mentioned I run a blog website about personal finance. I was asked a very good question which I don’t think I answered very well!

The question was: “Where do I start?”

I’ve been saving and investing for a long time and thus far this website has often focused on alternative and more aggressive investment strategies.

I can appreciate it’s hard (and likely unwise) to jump right into advanced investing so I want to write what I think are some things to consider when just getting started in the world of personal finance.

I originally wrote this as one big article. But realized it was too much! So I broke it down into three digestible parts. Today is Part I: Stabilization

Disclaimer: I don’t give financial advice. One of the reasons I don’t give investment advice here on my website is because there are exceptions to many rules and your personal situation could merit additional considerations. What is suitable for me might not be suitable for you.

Basic Principles about Personal Finance

The Building Blocks of Personal Finance

I visualize these principles like building blocks. You have to have the lower levels in place before you can move to the upper levels.

Here are the basic principles:

– Debt for consumption is bad (Stabilization)

– You must produce and save more than you consume (Fundamentals)

– Have your money work for you (Investing and Advanced Investing)

The first level: Stabilization

In the health and medical field it is wise to make sure that a patient is stable and healthy before they try to fix some less pressing long term issue.

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.

The first step on the path to growing your wealth is to stabilize your financial situation.

These things don’t make you rich but they stop you from getting poorer.

One of the great financial traumas to an individual’s finances is bad debt. This bad debt must be controlled before any other steps can be taken.

Stop Adding Bad Debt!

Bad debt is when you borrow money (usually at higher interest rates) to buy something that goes down in value and produces no income.

Examples of bad debt:

– Credit card debt (if you don’t pay it off every month)

– Auto loans

– Payday and title loans

Stop racking up bad debt!

$5 per day on coffee is $150 a month and $1800 per year

Stop buying things you don’t need via debt! Downgrade or cancel your cable plan. Stop buying $10 lattes. Stop eating out as much (I’m really bad at this one!).

If you live in a swanky single apartment maybe you could bring on roommates, downsize, or some combination of both.

Don’t buy a a new car every 2 years. Buy a used car you can afford.

If it doesn’t involve clothing your naked body, providing shelter, eating, or isn’t required for your job, consider cutting it out.

Yeah, this is no fun, but it pays off in the longer term.

If you don’t address your bad debt, its like having an uncontrollable bleed and wanting to start training for a marathon. You must stop the bleeding and get stabilized before you can start training for a race.

Next up Part II: Fundamentals

In Part II I discuss the importance of a budget and setting goals. Not only will this help you get and stay out of the stabilization level, but will help you save more than you spend and prepare you for level III: Investing.

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.

If an out of shape person is hemorrhaging blood due to an injury it would be absurd to focus on ways to improve their cardiovascular fitness until they are stable and healed from their injury.