I’ve started a new career in the financial services industry helping people protect their finances in the event of death, illness or disability.

I enjoy it and it goes right along with my mission on this website where I share how I grow and protect my wealth.

During the initial training at my new job I’ve learned a lot but one of the more surprising facts I’ve come across is the number one cause of bankruptcy in the United States.

The number one cause of personal bankruptcy in the United States is not student loans or credits cards. It isn’t gambling or home mortgages. The #1 cause of personal bankruptcy in the US is medical bills.

Source: http://www.cnbc.com/id/100840148

As a relatively young, relatively healthy person, I’m interested in making money, saving and investing it and building wealth.

But it is important to keep in mind the importance of protecting and preserving the wealth one does have. After all, what I spend 40 years building my wealth but then I get cancer and have to spend it all on medical bills?

If you own a home you probably have homeowners insurance to protect you from fires, floods and other damage. If you drive a car you have insurance for that. So why wouldn’t you insure your life and heath?

Medical bills are the #1 cause of personal bankruptcy so can you afford not to think about it?

What Is Insurance?

You can’t talk about insurance without talking about risk. A risk is the possibility of gaining or losing something of value. Insurance deals with pure risk. Pure risk is the possibility of a loss with no possibility of gain. For example, there is a risk of death, the risk of getting sick, the risk of your house burning down. Insurance provides financial compensation if one were to realize the risk the insurance policy covers.

True insurance is risk transfer. You trade a risk with a high cost (in the case of homeowners insurance let’s say your house burning down), in exchange for a lower cost loss (insurance premiums) and a high payout if you need it.

So if your $250k house burns to the the ground your insurance company will help you buy a new one. You hope nothing happens to your home but if it does you’re covered. You sleep better with the peace of mind knowing that if your house does catch fire you will be able to rebuild or buy a new place to stay.

So you’ve transferred the risk to your insurer.

Four Possible Outcomes

When discussing risks some people just don’t want to accept the possibility of a bad thing happening. They don’t want to think about getting sick, or their house burning down. So they deny the possibility of the risk or hope it doesn’t happen. “I’m not going to get sick!” they might say, or “That will never happen!” This is certainly one option. But is it a good option?

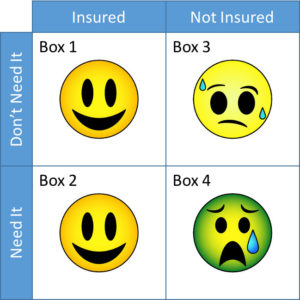

When it comes to insuring against a risk there are really only four outcomes. The first two are: either the bad thing doesn’t happen and you don’t need the insurance or the bad thing happens and you do need insurance.

Since you have a choice wether or not to purchase insurance you are either 1) insured or 2) you’re not insured.

An Example

There is a risk of getting cancer. I don’t know for sure that I will or I won’t get cancer but my family history is against me. I have a choice of wether or not to buy a critical illness plan that will pay in cash in the unfortunate event I get do get cancer.

So, I could choose to buy insurance, and it may turn out I don’t need it. I would be in Box 1. Personally I would be very glad and grateful if I never got cancer.

Would you?

Sure, I will have spent money on insurance premiums but I slept better knowing that if I did get cancer I would get a lump sum payment to help offset medical bills.

Which Box Represents the Situation You’d Rather Be In?

Well let’s say I do buy insurance and sadly I follow in the footsteps of my grandparents and parents and I do get cancer. I’ll get a lump sum payout that will help offset medicals bills or once I survive cancer (as I plan to do) I could use the money the plan pays me to go on a cruise to celebrate being alive. I’d be in Box 2.

Another option would be to not buy insurance and hope that I don’t need it. After all, maybe I won’t!

That would be nice, I’d save the money that I would have spent on the insurance premiums but I’d probably spend some time worrying about what I would do if I did get cancer. This is Box 3.

The final option would be that I choose not to purchase insurance and I do end up needing it. Medical expenses are costly! I could wind up being like one of the 2 million Americans who in 2013 went bankrupt because they couldn’t pay their medical bills. I don’t want that to happen to me. This is Box 4 and I don’t wind to end up there.

I’m certainly not saying to rush out and buy insurance today. You need to figure out what you’re at risk for, see if you’re financially vulnerable, and then find out if there are plans that meet both your needs and your budget.

But insurance is an important part of my own financial plan and it’s something I think more people should take time to think about.

Disclaimer: John is licensed with the State of Ohio for Life, Accident and Health Insurance, License # 1126312, NPN # 18149670