On Tuesday 11 April 2017 one of my Value Stock Picks: AmTrust Financial Services (AFSI) dropped from $18.87 down to as low as $13.65 then closed at $15.30. The catalyst was a Wall Street Journal Article titled “Secret Recordings Play Role in SEC Probe of Insurer AmTrust”.

Source: https://seekingalpha.com/news/3256590-amtrust-knocked-12-percent-secret-tapes

AmTrust Financial Services has been on the rocks anyway after advising that financial statements dating back to 2014 were not to be trusted.

Source: https://www.wsj.com/articles/amtrust-shares-drop-after-admission-of-errors-1489766314

About half of the selloff occurred pre-market

The initial panic selling in these instances is often overdone.

Using Stock Options to Manage Risk

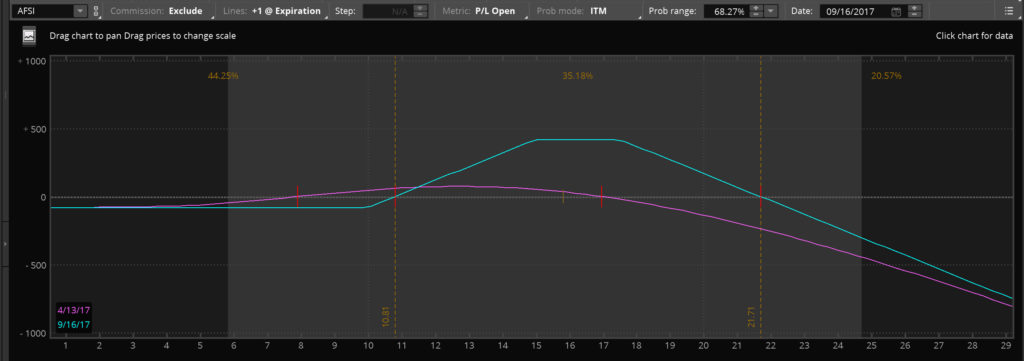

With the implied volatility of the stock so high I decided to sell a vertical bull put spread around noon eastern time. The vertical bull put spread is an option position that makes money if the stock is above a certain price (in my case $12.80) when the options expire.

I sold a 15 put and bought the 10 put with a September expiration. Total credit was $220.

By mid-morning on the 12th AFSI had rallied back to around $16.

On paper I had already made some money on the vertical put spread. I decided to sell the 17.5 September call for $200 in credit. I did this for downside protection. This created a half strangle/half iron condor.

Just looking at the options, my break even point on the downside is $10.81 and on the upside it is $21.74. The option market seems to think there is a greater chance of AFSI going back down as opposed to rising. Currently my position is fairly centered. If AFSI does sell off and start to approach my downside break even I will roll down the call I sold.

My maximum gain is $420 if the stock is trading between $15.06 and $17.40 at expiration in September. I will look to close out this position if I get to 50% of that profit.

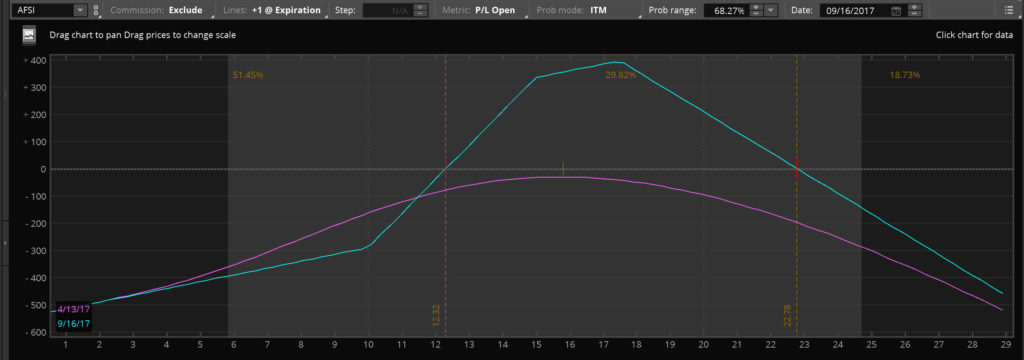

I’m currently long 25 shares of AFSI. If I didn’t have the option position and the stock dropped down to say $10, I would be at a paper loss of about $211. With the options the loss at a stock price of $10 would be $160. So by adding options to my stock position I’m limiting my losses and also increasing my potential gains if the stock settles down between $10.81 and $21.74 and volatility drops.

The main risk I have, is if the stock were to really take off above $21.74 before September, I would start realizing losses on the option position, whereas if I was simply long the stock I would be sitting on gains.

Given the large drop and the negative press I think this is unlikely. The September 17.5 call also indicates this is unlikely, with a 25% chance of AFIS being above $19.51 in September. Furthermore, if AFSI would to start to go up significantly, I would anticipate implied volatility dropping and I would probably be able to close out the short call at a small loss or perhaps even a gain.

My overall gain/loss looks as follows.

Obviously using options like this isn’t for the feint of heart. Options used emotionally and incorrectly are a great way to loose lots of money fast.

But in this case I’m actually limiting my risk and increasing safety. If AFSI sells off I reduce my downside risk, if volatility drops and AFSI stays rangebound I make money. The main risk is if AFSI takes off again before September and trades above $22.79. In this case I start to lose money. Based on the option probabilities and recent history I judge this to be an unlikely scenario.

AmTrust Financial has issued a statement essentially denying the Wall Street Journal article’s claims and while I am waiting to hear more this selloff could represent a buying opportunity.

As always this is not investment advice. I’m not advising or recommending anyone buy or sell any security, stock or option. I’m simply sharing what I am doing.