by John | Jun 4, 2017 | Geopolitical Risk Protection, Investor Mindset, Investor Psychology, Personal Journey, Wealth Protection

There is a story in the Old Testament (or Torah) in which a man named Noah was instructed by God to build a large boat (called an Ark) in order to save himself, his family, and a lot of animals from a flood that would cover the entire earth.

Although it’s not clear exactly where Noah resided before the flood, and he must have had access to large quantities of lumber, there is reason to believe that he lived in a rather arid environment. We’ll call it the desert.

Put simply Noah was building a giant boat, on land, in the desert. He must have looked rather foolish. But Noah had good reason to believe building the Ark was a good idea and he built it in spite of what I can imagine would have been a lot of derision and mockery from his contemporaries.

Now, I’m not saying for a minute that the next financial crisis is going to be a biblical, extinction level event equivalent to the great flood in the bible. There are a lot of enterprising folks around the world and if the economy crashes and the government stays out of the way, entrepreneurs will be able to provide solutions to whatever problems ensue. Life will go on, even if it is painful for some or even many people.

But the point is, it sometimes takes courage to go against the common wisdom of the day and make some prudent preparations. If other people knew what Noah knew, I’m sure they would have been building boats as well.

As I’ve said before it’s important to have some moderation. After all, the excessive debt, spending, and general recklessness has gone on for some time, and could continue for some time to come. There is no reason to panic or go live in a bunker.

But some day, there will be a point in which governments will no longer be able to borrow and spend money beyond what the economy is producing. The United States in particular cannot continue to borrow money at low interest rates forever. When the marketplace equalizes and goes back to a normal level, a lot of the wealth people thought they had will no longer exist.

That’s why it makes sense to take some steps to consider building your own financial ark. I’ve written about various ways to do this, such as gold, value stocks, holding some cash and maybe even taking a chance on some cryptocurrencies, even though right now they are at the high side of their historic ranges. Silver, which I don’t write about that often, is also significantly undervalued in my opinion.

Some people will say owning gold is crazy. They’ll say cryptocurrencies are a large bubble or ponzi scheme (they could be right about that). They’ll say that buying stocks at all time highs is the only way to go. They’ll say that bonds are safe. They’ll say it’s impossible to beat the market and that if a stock is undervalued there is a good reason for it. They’ll say the dollar will always be relatively strong and that the US debt is manageable.

But that is head in the sand thinking. It’s dangerously naive. Being aware of the risks is important and it’s also important to take some practical steps to protect yourself.

Some people may think you’re silly for building an ark in the middle of the desert, but when the waters start rushing in, you’ll be glad you did.

by John | May 28, 2017 | Economic Outlook, Geopolitical Risk Protection, Wealth Protection

Some people think the United States economy is doing well. The unemployment rate is low. Major US stock indices continue to rise.. There has not been hyperinflation of consumer prices.

So one might be tempted to think the economy is doing pretty well and everything is good and normal. I don’t think this is accurate but I think it is important to look at some of the measures that do seem to support the view that the US economy is on strong ground.

The following are some facts that people will point to when they say that everything is fine.

The “Good”

Stocks are Up

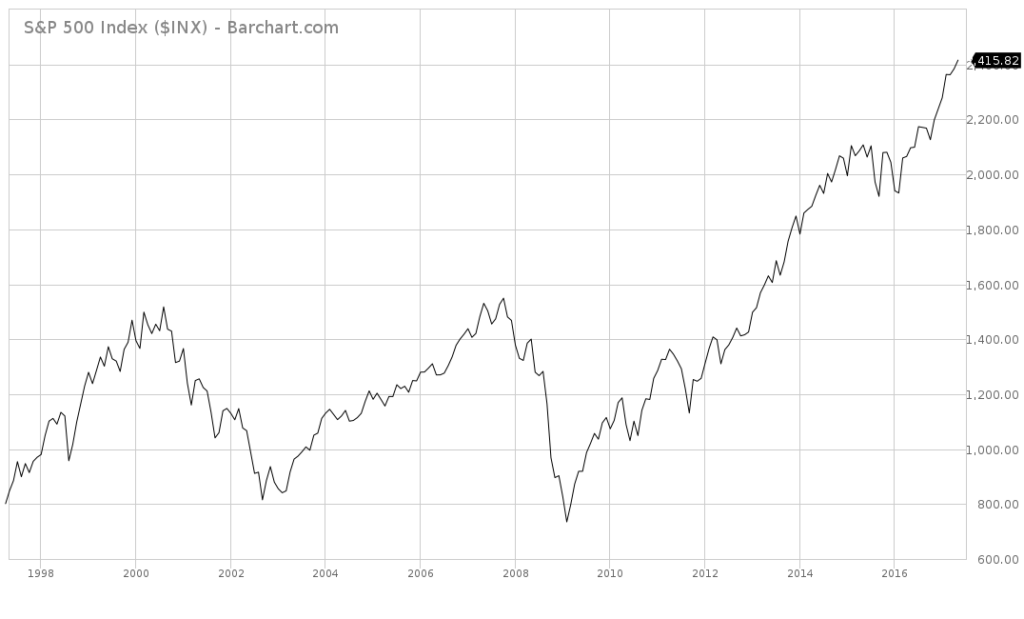

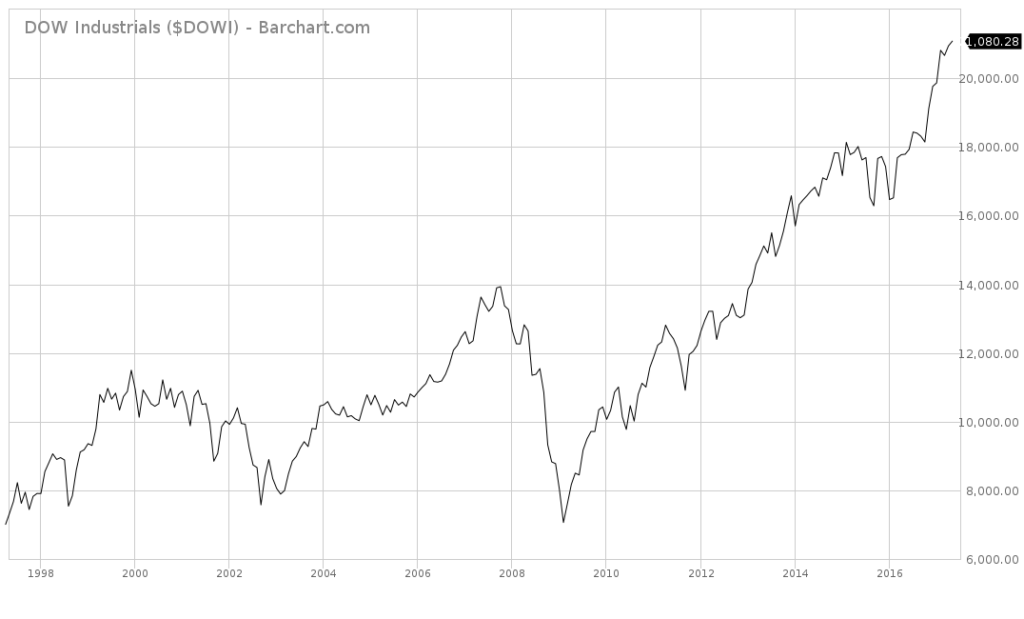

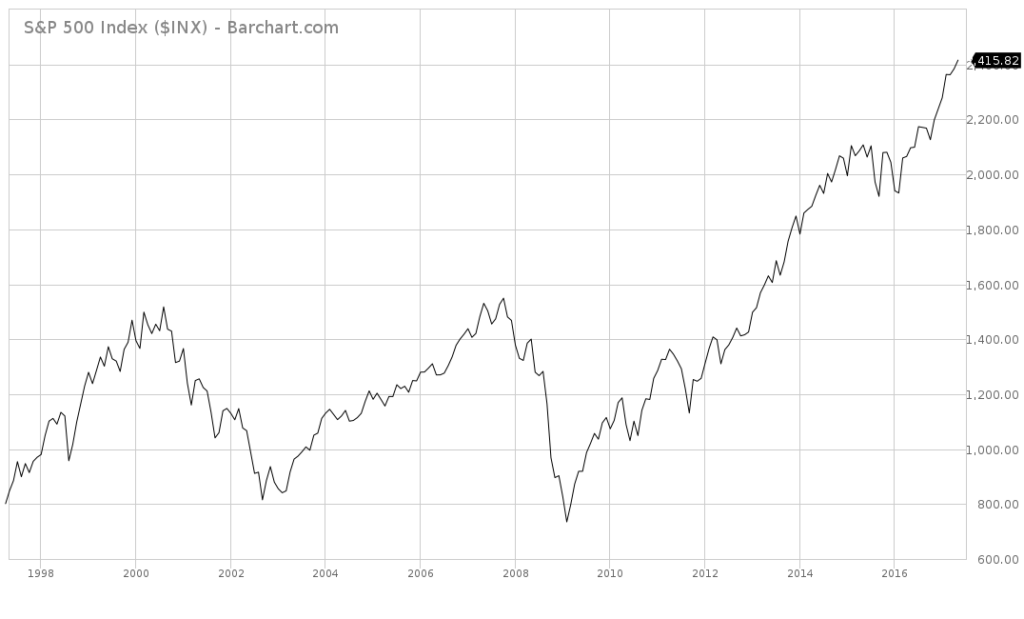

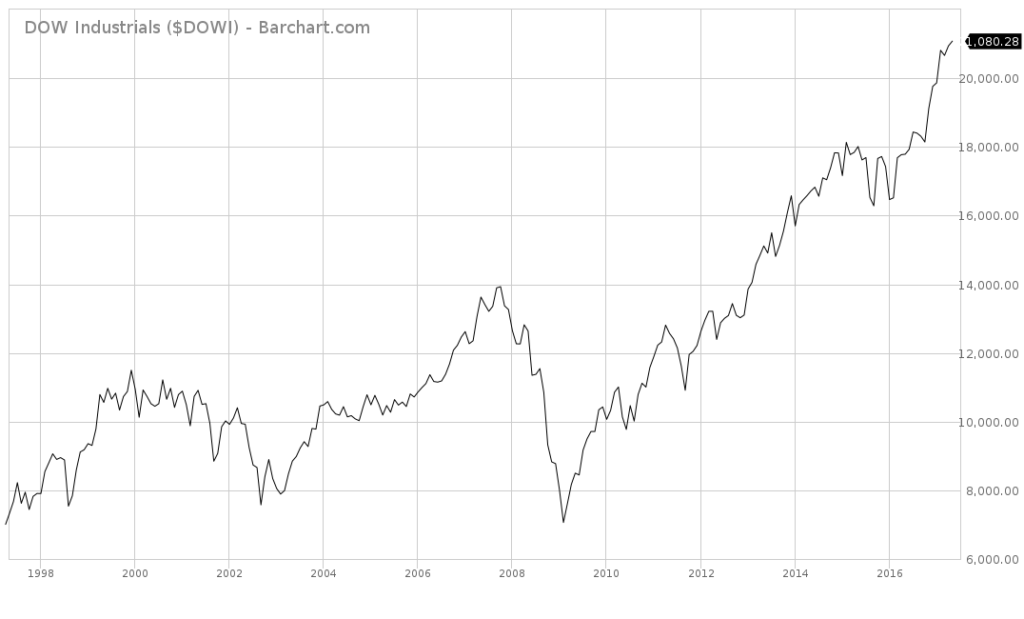

US Stock investors have been handsomely rewarded since the lows of the 2008 financial crisis.

Led by darlings such as Apple, Alphabet (Google), and Amazon, the NASDAQ composite has reached new all-time highs.

The S&P 500 has been on a tear, also making new highs without any significant corrections.

The Dow Jones Industrial average is also making new highs.

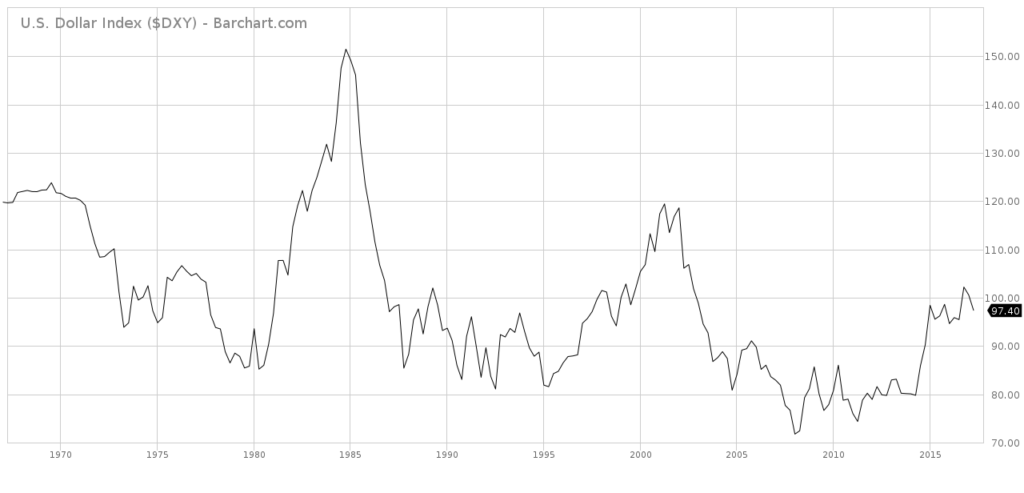

The Dollar is Relatively Strong

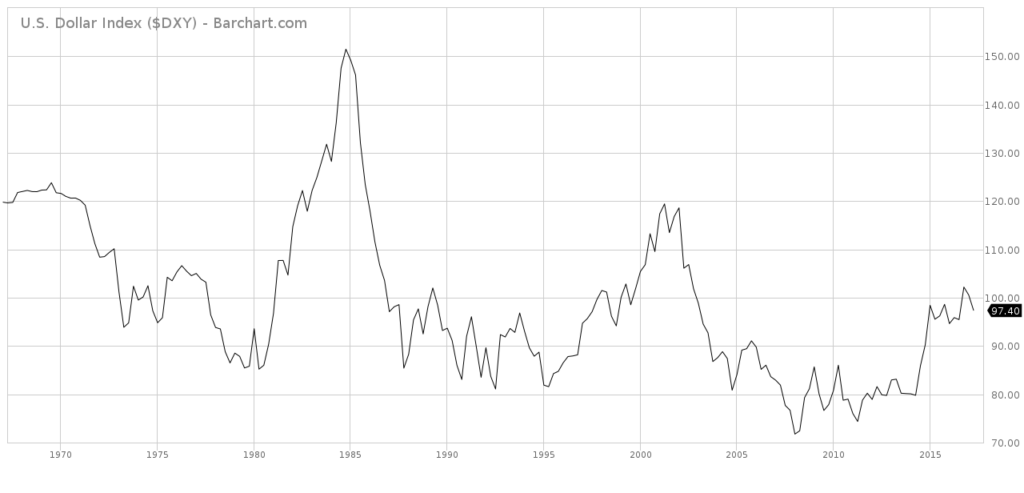

Despite unprecedented central bank intervention and record US debt the US Dollar Index is holding.

US GDP Continues to Rise

United States Gross Domestic Product continues to climb.

source: tradingeconomics.com

Low Unemployment

The unemployment rate is below 5%.

Source: https://data.bls.gov/timeseries/LNS14000000

The Bad

But if you look a little deeper than the headlines there are systemic problems in the United States economy.

A lot of People Aren’t Working

Labor Force Participation is at levels not seen since the 70s. And no, it’s not because of baby boomer’s retiring. Labor force participation from those age 25-54 has dropped from 82.8% in 2004 down to 80.9% in 2014. Participation from those age 65 and older has increased from 14.4% in 2004 up to 18.6% in 2014. Source: https://www.bls.gov/emp/ep_table_303.htm

Just because the unemployment rate is low doesn’t mean people aren’t unemployed. If someone is unemployed for long enough, they simply drop off. If someone is fired from a good paying salaried position, and they get two new part time jobs, that is considered a net job gain.

United States GDP Growth is Slowing

The growth rate of US GDP has been trending down.

source: tradingeconomics.com

US Debt is Growing

US National debt is up to nearly $20 trillion, not counting the unfunded liabilities of Social Security and Medicare. Source:

It is politically impossible to cut spending. As Simon Black recently pointed out:

In 2016, for example, the government spent $2.87 trillion on Defense, Social Security, and Medicare, plus an additional $433 billion paying interest on the debt.

That totals over $3.3 trillion, which is more than they collected in tax revenue.

Source: https://www.sovereignman.com/trends/and-now-for-the-bad-news-21884/

In other words all spending on the department of energy, education, homeland security, everything else besides defense, social security and medicare could be cut completely and there would still be a budget shortfall.

I believe it is politically impossible to cut social security, medicare or defense spending in the United States.

The Debt to GDP is Rising

The debt to GDP ratio is at levels not seen since the United States was fighting a World War in the 40s. Source: https://en.wikipedia.org/wiki/File:Public_debt_percent_of_GDP.pdf

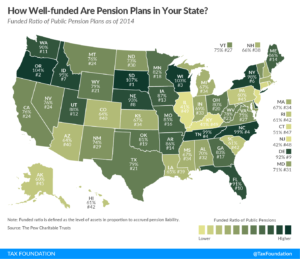

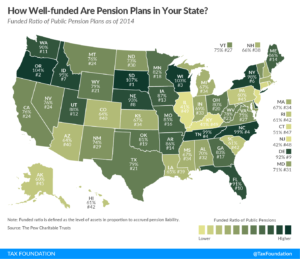

State Pension Funds are Underfunded

The majority of State Pension funds are underfunded.

Source: https://taxfoundation.org/state-pensions-funding-2017/

Social Security and Medicare are Underfunded

This isn’t some alarmist drivel. The people in charge of the Social Security and Medicare Trust Funds are issuing statements like following:

“Both Social Security and Medicare face long-term financing shortfalls under currently scheduled benefits and financing.”

Source: https://www.ssa.gov/OACT/TRSUM/

As well as statements like:

Under the intermediate assumptions, DI Trust Fund asset reserves are projected to become depleted in the third quarter of 2023, at which time continuing income to the DI Trust Fund would be sufficient to pay 89 percent of DI

scheduled benefits. Therefore, legislative action is needed soon to address

the DI program’s financial imbalance. The OASI Trust Fund reserves are

projected to become depleted in 2035, at which time OASI income would be

sufficient to pay 77 percent of OASI scheduled benefits.

Source: https://www.ssa.gov/OACT/TR/2016/tr2016.pdf

I haven’t even touched on consumer debt, state debt, low home ownership, and low savings per capita.

The US Economy isn’t Fine

So despite headlines like the low unemployment rate and stock markets making new highs that seem to indicate a recovery from the 2008 financial crisis there are systemic issues in the US economic system. I don’t think that the United States will be able to continue to borrow and spend without consequences. The fact as the United States has a printing press and the world reserve currency doesn’t mean it can borrow and spend forever.

There are ways to protect yourself but you have to be aware of the problems.

by John | May 28, 2017 | Economic Outlook, Geopolitical Risk Protection, Investor Mindset, Investor Psychology, Personal Journey, Preservation of Purchasing Power, Wealth Protection

I’ve written about problems with the United States dollar and the US economy.

I’ve been influenced by folks like Peter Schiff and Simon Black. To say the least these guys are not bullish on the US economy. I think they’re right and I think it’s wise to listen to what they say, be aware of the risks, and determine what course of action makes sense for your unique situation.

But while things aren’t great, particularly for those on fixed incomes without assets or investments, there hasn’t been a significant stock market correction and the US dollar is still relatively strong. Does that mean that people like Peter Schiff or Simon Black are wrong? Does that mean I’m wrong?

Things aren’t getting better. The underlying problems remain and only get worse. Governments have tremendous debt, interest rates are distorted, governments continue to spend recklessly, central banks are out of control and asset prices are inflated.

In the face of these problems I think there are two mains risks when it comes to behavior that fall on opposite ends of a spectrum. To willfully embrace either of these mindsets and their resultant behavior is, I think, crazy.

The First Kind of Insanity: Doing Nothing

Proud as a Peacock

On the one hand there is a person who does not take the risks seriously because they don’t think there are any significant risks.

People with this mindset believe that the United States can manage it’s debt. They laugh at anyone who suggests the recovery isn’t real or that the stock market growth isn’t based on sound fundamentals.

Subscribers to this attitude think the United States is the richest and freest and greatest country in the world and that $20 trillion in debt and trillions in unfunded liabilities is not a problem. They think the US government can just print money or increase taxes or grow the economy and everything will be fine.

Folks with this type of attitude hold their savings entirely in dollars and US-centered assets. They are comfortable being heavily invested in US stocks. They believe that government promised programs will be there for them when they most need them.

They can’t envision a world in which the United States isn’t the dominant world superpower. They can’t imagine the US dollar not being the world reserve currency.

This mentality is common in those who are blissfully unaware of the lessons of history and the facts of math.

This is the peacock mentality. People with this mentality strut around and deny there are any problems and so do nothing to protect themselves.

An Ostrich Hiding

Similar to the peacocks of the world there are people who realize there are problems with the economy but still choose not to do anything about it. Maybe they think there isn’t anything they can do about it. They think if the dollar falls and the stock market crashes then they have no choice but to go down as well. They’re either unwilling to learn about alternatives or simply don’t think alternatives exist.

They also might willfully ignore anything suggesting there are problems. If pressed they would concede that another 2008 or 2000 crisis are possible and that government debts won’t be repaid, but they really don’t want to think about it.

People with this type of attitude don’t have the misplaced confidence of the peacocks but they make the same choice not to take any decisive action to protect themselves.

They stick their head in the sand. This is the ostrich mentality.

A Second Kind of Insanity: Living Life around Anticipation of Crisis

But at the same time I think there is a risk of having a bunker mentality. This attitude that crisis is imminent and the sky will fall any day now. Individuals who think this way might go 100% into cash. Or go 100% into gold. Or go 100% into guns and food. Or they take huge risks trying to short the stock market.

A Turtle in it’s Shell

But I think this attitude of going into one’s shell is not particularly helpful. It’s hard to accomplish anything or live a fruitful life when you’re hunkered down and metaphorically looking over your shoulder all the time. This is the turtle mentality.

The Golden Mean

Aristotle and the ancient Greek philosophers spoke of a golden mean. The idea that the correct course of action or virtue is the middle path between two extremes. For example, courage is the golden mean between recklessness and cowardly inaction.

The key to sanity in an insane financial world is decisive, measured and purposeful action when it comes to preparation. Two extremes when it comes to investing would be on the one end of the spectrum shorting the S&P 500 with one’s life savings. On the other end would be buying a 3x bull S&P 500 ETF.

But just because I believe US stocks are in a bubble doesn’t mean I’m going to go with the extreme of shorting the market. It does mean that I’m going to limit my exposure to US stocks and be very selective about which stocks I own.

When it comes to dollars the two extremes would be 100% in dollars or 0% in dollars. But just because I think dollars are overvalued and will continue to lose value doesn’t mean I have to go to the extreme of 0%. It doesn’t mean I go 100% into gold or I only own precious metals and cryptocurrencies. I actually advocate holding some cash. Emphasis on some. I also earn money in dollars and invest in value stocks.

This applies to attitude as well. Being negative and pessimistic isn’t going to do anyone any good. Thinking everything is awesome and always will be isn’t a very good approach either. But there are still many great businesses in the US and there is lots of opportunity in the United States and in the world.

The United States has problems. Lots of economies around the world have problems too. There are going to be winners and losers. Many promises that have been made will be broken. But in the midst of all this there is tremendous opportunity. The important thing is to remain calm, take some practical steps to protect yourself and live your life.

by John | May 7, 2017 | Retirement, Tax Strategies, Wealth Protection

Taxes are a large cost when it comes to investing. In the United States long term investments (held 366 days or longer) are taxed at 15% for most people. For those in lower tax brackets long term capital gains are taxed at 0% and for those in the top tax bracket the IRS calls for a 20% cut.

So, if one has $20,000 in gains 15% would be $3,000. In another example $100,000 in gains would be $15,000 paid to the IRS. It’s not an inconsequential amount. Furthermore that amount of gains is very realistic, particularly over a long period of time, $10,000 invested over a period of 40 years with an 8% interest rate would grow to over $217,000.

Fortunately there are ways to shield long term retirement savings from these destructive taxes. One way is a 401(k) and another is an individual retirement account (IRA).

Traditional 401(k)s and IRAs

Many employers offer 401(k) plans. A 401(k) allows pre-tax money (money for which income tax hasn’t been paid) to be invested. Unfortunately the medicare and social security payroll taxes are still due. One can start taking money out of a 401(k) at age 59 and 1/2. Any distributions from a 401(k) (with some exceptions) prior to age 59 and 1/2 will result in taxes being due plus a 10% penalty.

No capital gains taxes are owed when the investments are sold and distributions are made but the money is taxed as ordinary income at the state and federal level.

The main advantage to a traditional 401(k) or IRA is that the money grows tax deferred and it is only taxed once. If one were to simply invest money from a paycheck without a retirement vehicle it would be first taxed at the Federal and State level and then any capital gains would be taxed as well.

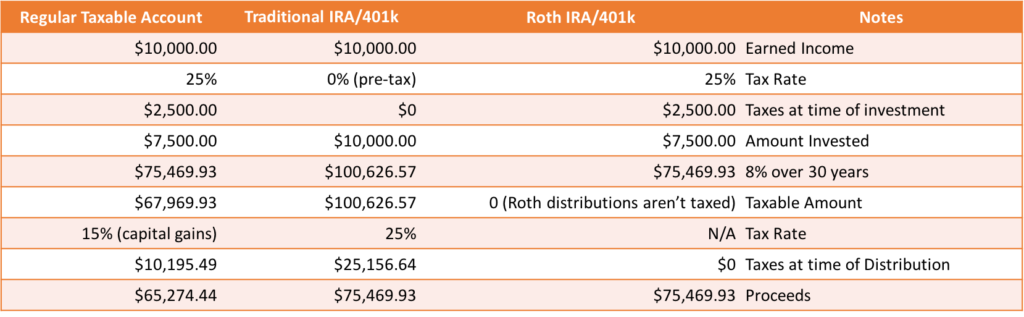

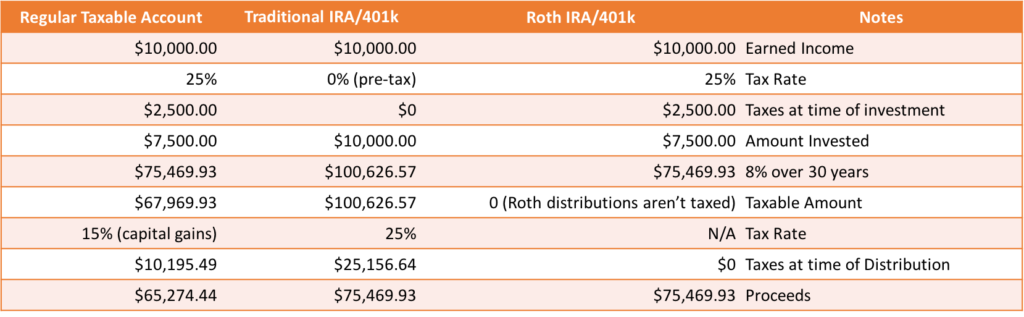

For example, if one were to allocate $10,000 from a paycheck to an IRA or 401(k) it would not be subject to any state or federal taxes. It would hopefully grow (lets say at 8% over 30 years). After 30 years it would have grown to $100,626.57 and all the money is withdrawn from the 401(k). At this point (assuming the person is over 59 and 1/2) the money would be taxed as ordinary income. Let’s assume for the purposes of this example it is taxed at the 25% tax bracket, and thus the IRS would be expecting $25,156.64. The total proceeds would be $75,469.93.

A traditional IRA would work the same way with an important caveat. Your employer isn’t aware of the IRA so you will be overpaying in your federal and state withholding taxes in each paycheck (and get a larger refund which I think is a BAD thing), because the income reduction won’t come until you file your taxes the following April. But you can compensate for this by increasing withholding allowances.

This brings up the secondary advantage of IRAs and 401(k)s: they allow you to reduce your taxable income. This can be particularly helpful if one is on the cusp of a tax bracket. For example, lets say you made $40,000 in otherwise taxable income in 2016. If you contributed $4,000 to a 401k, instead of having to pay 25% on the amount over $37,651, you’d be taxed no more than 15% on any earnings that year.

Roth 401(k)s and IRAs

Traditional 401(k)s and IRAs are not taxed initially, but are taxed when money is withdrawn. Roth IRAs and Roth 401(k)s work in reverse. You don’t get any tax benefits initially with a Roth 401(k) or Roth IRA. You use after tax money to save for retirement but you don’t have to pay any taxes on distributions.

If your tax bracket is the same when you put money in the IRA as when you withdraw the money, it doesn’t matter if you have a Roth IRA or a traditional IRA, the tax savings is going to be the same.

However, if you’re in a higher tax bracket later in life as compared to earlier in life, the Roth 401(k)/IRA is better because you can pay taxes at say 15 or 25%, invest the money, it grows tax free, then if you’re in a 35% tax bracket because you’ve made it big and you’re still working at age 59 and 1/2 you can withdraw that money and you don’t have to pay any additional taxes.

Conversely, if you’re in a lower tax bracket when you retire the traditional IRA or 401(k) is going to be better.

But because of the move towards a more socialized society and given the monstrous debt in the US I anticipate taxes will only go up in the future. So I’d rather pay them now when tax rates are lower.

The Advantage of an IRA or 401(k)

Let’s compare a Roth IRA/401(k), to a traditional IRA/401(k), to simply investing the money without a retirement savings vehicle in a regular taxable account. Let’s say you earned $10,000 of W2 income and want to invest all of it. I’m ignoring social security and medicare taxes because there is no way to avoid those on W2 income in the US, for all three scenarios they are due up front.

As you can see, if one is in the same tax bracket when the investment was made, as when the distributions are made, it doesn’t matter if one has a Roth or traditional 401k/IRA. But there is a $10,000 advantage over a non-tax advantaged brokerage account.

3 November 2019: However, this is only true when you assume that the loss of tax savings is taken out of the amount saved in a Roth IRA or 401(k). If the same amount is in both accounts the Roth IRA/401(k) is better.

Roth or Traditional?

I prefer after-tax, Roth IRAs/401(k)s in general but in specific circumstances using a pre-tax vehicle makes more sense. I like Roths because I can check the balance of my Roth IRA or Roth 401(k) and I know that is how much I would have access to when I achieve an age of 59 and 1/2. I don’t have to figure in taxes. I also hope to be making more when I’m 60 than I am now. Plus, I think taxes are going to be going up in order to pay for unfunded entitlement programs and to pay the national debt (not that I think it is repayable).

I also generally prefer IRAs versus 401(k)s of any kind because with an IRA you can choose a broker that has more investment options than the limited range of choices employer sponsored plans typically allow. Pretty much all the investment options I’ve seen for company sponsored 401(k)s are very limited and are focused in the US.

But I will use a traditional 401(k)/IRA under certain circumstances. 1) If I can use it to get to a lower tax bracket. 2) If my employer offers a 401(k) with company matching–I will contribute to the 401(k) until I’ve maxed out the employer match. 3) If I’ve already maxed out the Roth IRA contribution for the year ($5,500 for a single person under 50 years old in 2017) then I would consider contributing to a 401(k).

Wether you go with a Roth IRA or traditional IRA you can only contribute up to a combined total of $5,500 in 2017 if you’re under 50. If you’re 50 or over you can contribute $6,500.

For 401(k)s the 2017 contribution limit is $18,000 but goes up to $24,000 if you’re 50 or over.

So if you contribute to both a 401(k) and an IRA you could save a total of $23,500 in tax advantages funds ($30,500 if you’re 50 or older).

Source: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

Source: https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

So in general I prefer Roth to traditional, and I prefer IRAs to 401(k)s. However, if my employer offers matching I take advantage of that.

SEPs, solo 401(k)s

There are other tax-advantaged ways to save for retirement, like a SEP or a solo 401(k). I haven’t taken advantage of these options but it is something I’m researching.

I think saving and investing for retirement is important. But there are some strong headwinds working against folks planning for retirement in the US: taxes reduce income and gains, pensions are becoming a thing of the past, Social Security is woefully underfunded, inflation ravages savings.

Tax-advantaged retirement savings vehicles like IRAs and 401(k)s provide needed advantages when it comes to investing for retirement. It’s important to understand how they work and to make use of the tax-advantaged benefits they provide when suitable.

by John | Apr 16, 2017 | Geopolitical Risk Protection, Preservation of Purchasing Power, Wealth Protection

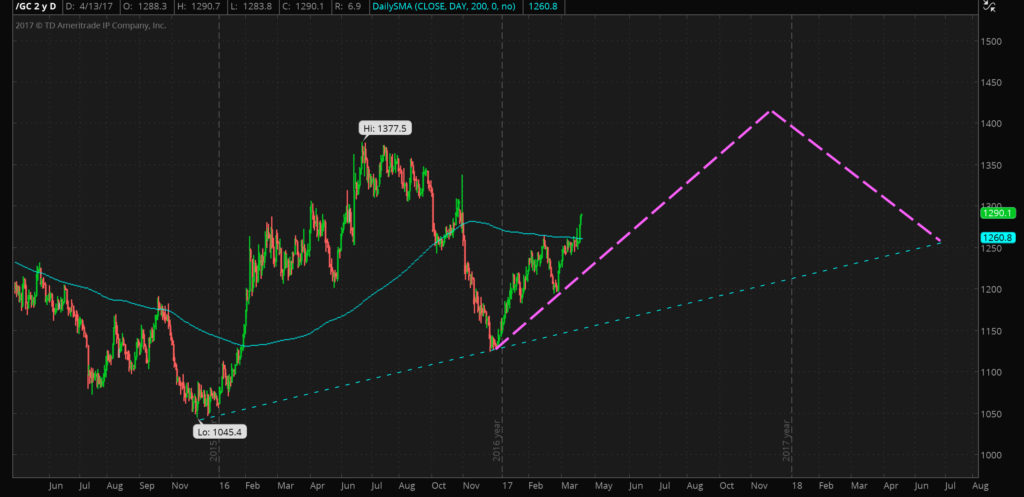

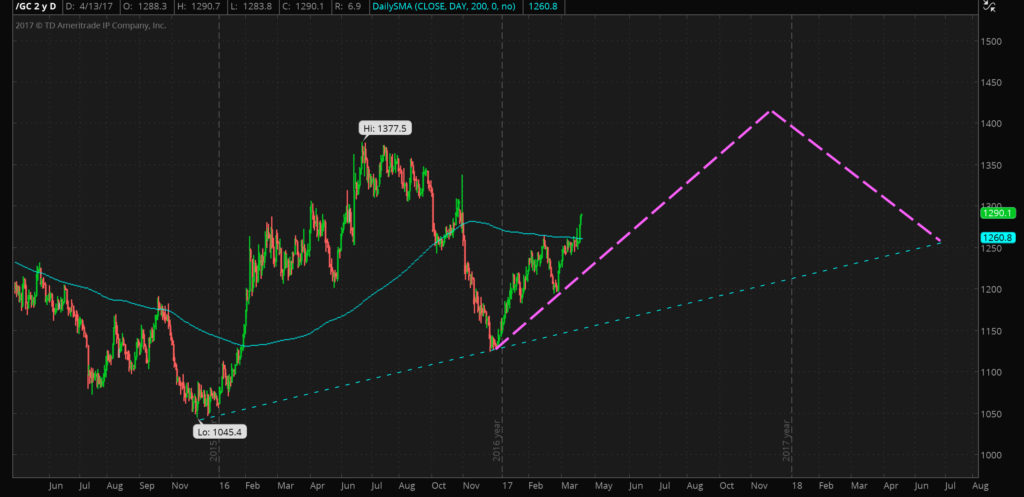

Starting in October of 2008 gold made a run from 680 US dollars per ounce up to and over $1920 in September of 2011 for a gain of 182% in less than 3 years. Gold traded sideways and down for the next year and a half until April of 2013 when it crashed down to the low $1300s. For the next few years gold trended down in a falling wedge pattern. Gold was negative for years 2013, 2014, and 2015.

The recent multi-year low of $1045 was logged in December 2015 and I believe this price is the new bottom for the gold market.

Below is a chart of the gold market with my comments. Click the link if you’re not familiar with reading candlestick charts.

2016 was a positive year for gold even though a lot of the gains were surrendered in November. On the whole for 2016 the yellow metal was up over 9%. It’s my opinion 2017 will continue this trend of gains in extension of a new multi-year bull market.

Gold is up over 11% in 2017. It started the year around $1,155 per ounce and is currently trading over $1,290.

Gold still Undervalued and US Dollars are Overvalued

Despite these positive moves I still believe gold is significantly undervalued at this price.

Why?

Paltry efforts at “tightening” at the United States Federal Reserve notwithstanding interest rates are at historic lows. There is also record debt and unfunded liabilities paired with an unbalanced budget. The United States Federal Reserve balance sheet remains over $4 trillion. Globally interest rates are also historically low and debt is high. There are even negative interest rates in Europe and Japan. Geopolitical risk of war in North Korea and Syria may have caused the most recent bump in precious metals price.

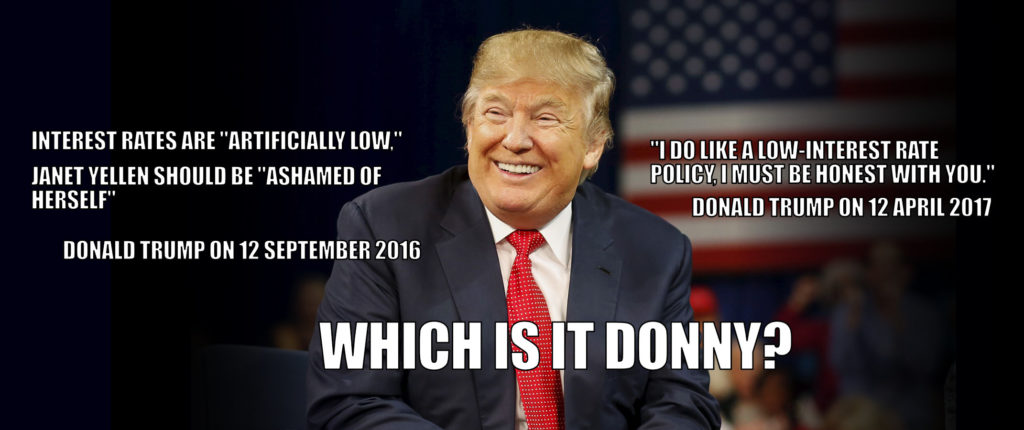

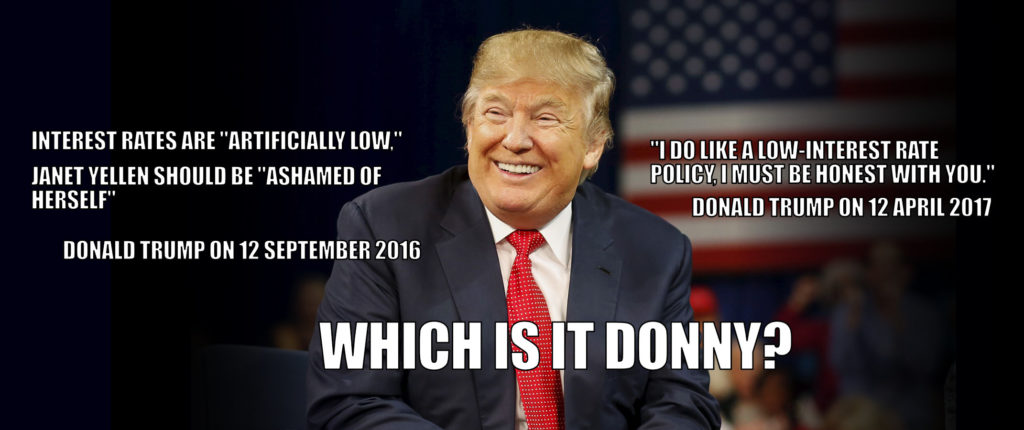

President Trump has recently done a 180 on several issues. He told the Wall Street Journal the dollar “is getting too strong.” He has also warmed to Janet Yellen and has stated: “I do like a low-interest rate policy, I must be honest with you.”

Source: https://seekingalpha.com/news/3256891-trump-talks-dollar-yields-gold-jumps?ifp=0

Source: https://www.wsj.com/articles/trump-says-dollar-getting-too-strong-wont-label-china-currency-manipulator-1492024312

The Recent Past of Gold

Last week gold made a strong move up through the 200 day moving average (the solid light blue line above is the 200 day simple moving average.

My Predictive Guesses as to the Price of Gold

The following are my guesses/predictions as to where the price of gold will move over the next year. I’m not recommending anyone buy or sell gold based on these predictions.

Gold has been trending upward since the December 2015 bottom. I think gold will make a new intermediate high between 1400 and 1425 in the fourth quarter of 2017. From that peak it should drop back down to 1260 sometime in mid-2018 perhaps around June.

Of course if there is another 2008-style crash or a hot war in the middle east then all bets are off.

The dashed purple line is my predictive guess as to the price of gold

Longer term I expect gold to make a new high above $1920 within the next four to eight years.

Although there is no substitute for physical possession of a percentage of one’s precious metals I also think it is vital to have some gold stored offshore.

The most cost effective way to own physical gold offshore, particularly for investors will less capital, is through Goldmoney.

I personally own several grams worth of gold via Goldmoney and I’ve been extremely pleased with the service.

Gold has been valued across cultures for thousands of years. It has no counter party risk and I believe it is an excellent defensive holding.

by John | Apr 2, 2017 | Cryptocurrency, Currencies, Wealth Protection

I have a love/hate like/dislike relationship with cryptocurrencies. But one thing I feel confidently about is that Bitcoin is not the future of cryptocurrencies.

By market capitalization Bitcoin is currently sitting in the #1 position as the largest cryptocurrency.

Source: https://coinmarketcap.com/

But it isn’t there because it’s the best. It’s there because it was first.

There is something to be said for the network effect but Bitcoin has several fatal flaws that leave it vulnerable to being overtaken by newer and better technology.

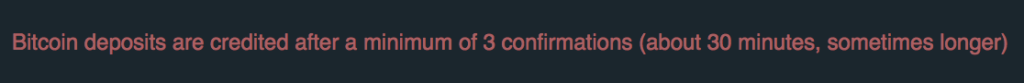

Bitcoin Transactions take “forever”

A screen capture from bitcoin.org. I don’t consider 10-30 minutes fast unless we’re talking about glaciers or the the average US bureau of motor vehicles

If I buy something digital online I want to be able to download it instantly.

Imagine buying a song on iTunes but having to wait 10-30 minutes to start downloading it. If Apple used bitcoin instead of credit cards that’s probably how long you’d have to wait.

Or what if you want to buy a latte on the way into work? Would you want to wait 10-30 minutes in the coffee shop before you can leave with your drink?

Obviously not.

But why is Bitcoin so slow?

Bitcoin takes 10 minutes per block. A block is a set of transactions. So at best Bitcoin takes 10 minutes to confirm a transaction. Most vendors however, require 2-3 confirmations before they consider the bitcoin transferred, which means 20-30 minutes of waiting.

Bitfinex requires 3 confirmations before it considers Bitcoin transferred

You need a Trusted Third Party to make Fast Payments

Websites like Overstock.com accept Bitcoin as payment. However, they do so by utilizing a trusted third party, like Coinbase, to serve as a middleman.

No doubt they do this to avoid the issue of double-spending, refunds and transactions taking thirty minutes.

But the fact that overstock.com uses a trusted third party pours cold water on the idea Bitcoin has “Fast peer-to-peer transactions”.

Bitcoin has Scalability Problems

In addition to confirmations being slow, Bitcoin has issues with scalability of the network, or the number of transactions the network can process. There are competing camps about how to resolve this issue but there has been much more debate than action.

This could lead to hard forks of the cryptocurrency. More on that later.

Bitcoin Transactions aren’t Anonymous

One of the previously oft touted benefits of Bitcoin was anonymity in transactions. While Bitcoin transactions are pseudonymous, unless you buy bitcoins in cash from someone on the street, there are links back to the exchanges and thus bank accounts.

I’m sure there are ways to purchase Bitcoins anonymously but it’s not easy or safe. If you know how to do this I’d value your input in the comments section below.

Bitcoin is Centralised and the Centralised Powers don’t have Their Act Together

A screen capture from the Bitcoin Foundation (bitcoinfoundation.org) website

Despite propaganda that Bitcoin is decentralised–it is in fact controlled by the Bitcoin Foundation in conjunction with the Bitcoin Core developers and the larger miners who can afford the expensive application specific integrated circuit hardware required to successfully mine Bitcoin.

In sort of an Orwellian double-speak both the Bitcoin Core developers and Bitcoin Foundation talk about how they keep Bitcoin decentralised.

The Bitcoin Core development team is not very big.

I don’t see how a group of 3 “maintainers” and a dozen or so contributing developers is “decentralised”.

If I wanted to be really mean I would compare the Bitcoin Foundation to the Federal Reserve and the miners to the big wall street banks.

But I won’t do that.

The main advantage Bitcoin has over the Federal Reserve is that the number of Bitcoins that will be created is fixed at 21 million whereas there is no limit to how many dollars the Federal Reserve can conjure from within the shady halls of the Eccles Building.

A screen capture of a written statement from bitcoin.org/en/bitcoin-core/

However, if Bitcoin forks, like Ethereum did, then the number of Bitcoins will effectively double.

I don’t necessarily have a problem with a cryptocurrency being centrally controlled.

While I have a general bias towards decentralisation and subsidiarity (when possible)–I think that a benevolent dictatorship can be good–provided it is easy to jump ship if the centralised power becomes corrupt.

Bitcoin is Squandering it’s First Mover Advantage

But despite large issues with Bitcoin the Bitcoin Foundation and the Bitcoin Core developers haven’t gotten it together to make progress in fixing the aforementioned systemic issues with Bitcoin.

Could these problems be fixed? Sure. Smart, motivated individuals working together towards a common goal can accomplish amazing things. But I don’t see the Bitcoin community taking these problems seriously.

For these reasons I believe that Bitcoin is not the future of cryptocurrencies.

If you are interested in purchasing Bitcoins, I show you how to buy Bitcoins on Coinbase.