by John | Aug 27, 2017 | Economic Outlook, Geopolitical Risk Protection, Wealth Protection

Article image above is by Chloe Cushman

Humpty Dumpty sat on a wall,

Humpty Dumpty had a great fall.

All the king’s horses and all the king’s men

Couldn’t put Humpty together again.

Denslow’s Humpty Dumpty

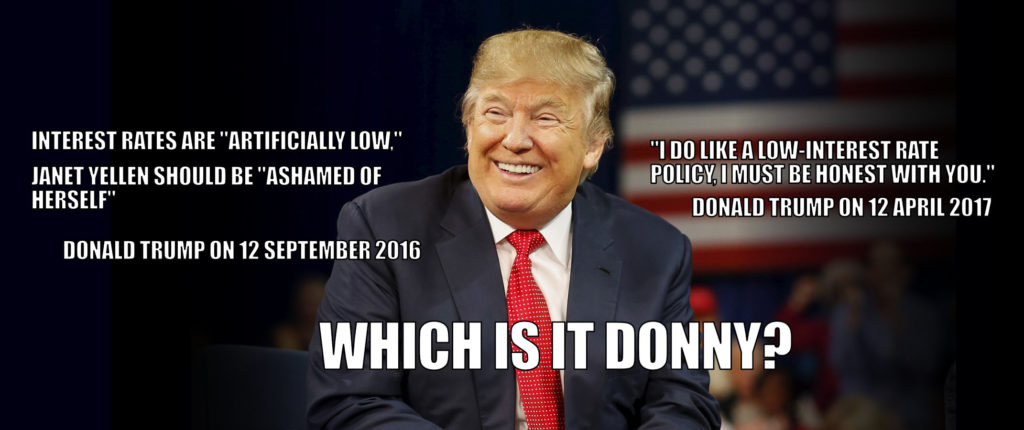

Back in February of 2016 Candidate Donald J. Trump stated, “I hope I’m wrong, but I think we’re in a big, fat, juicy bubble.”

Source: https://www.cnbc.com/2016/02/08/trump-markets-in-a-big-fat-juicy-bubble.html

In the first presidential debate in September of 2016 Trump stated the US economy is, “in a big, fat, ugly bubble.”

He also presciently said that when Obama returns to the golf course (did Obama ever leave the golf course?) that the U.S. Federal Reserve would raise interest rates.

Source: http://www.businessinsider.com/we-are-in-a-bubble-trump-debate-attacks-federal-reserve-chair-yellen-2016-9

Candidate Trump seemed to have some understanding that U.S. Stocks and Bonds are in a Bubble.

So President Trump should be concerned that the bubble is going to pop on his watch. But he seems to have pivoted to taking credit for the stock market just a few weeks after his election.

“We’re doing really well. The fake news media doesn’t like talking about the economy. I never see anything about the stock market” setting new records every day, he said.

Source: https://www.cnbc.com/2017/02/16/donald-trump-tweets-that-hes-the-reason-the-stock-market-is-rallying.html

I don’t know that Trump listens to any of his advisors, but if he did and I was one of his advisors, I’d encourage him to distance himself from the stock market.

Why?

President Obama got the advantage of the stock market high induced by low interest rate monetary heroin, and Trump is likely going to have to cope with the inevitable stock market crash and withdrawal.

President Trump is a Humpty Dumpty, perched upon the top of a stock market bubble, which is about to collapse.

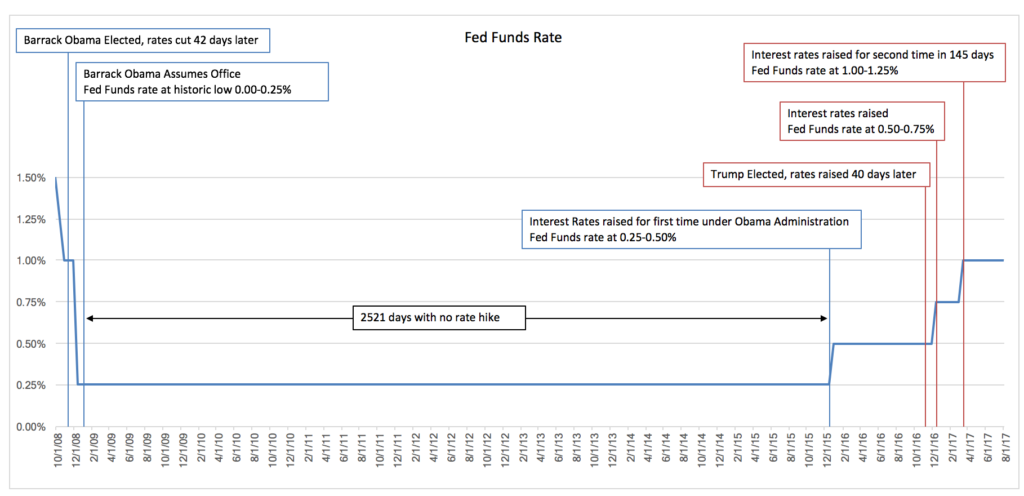

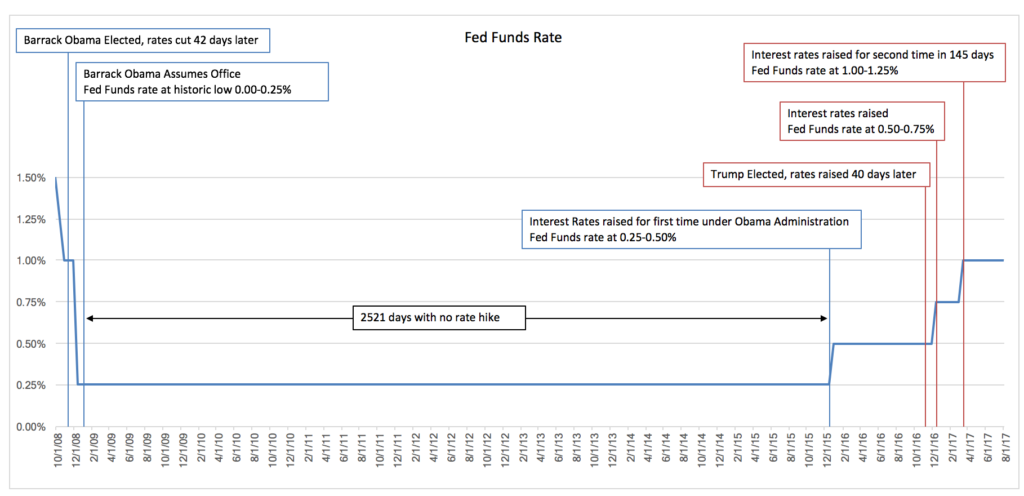

President Obama had just 2 rate hikes over 8 years

President Obama began his presidency going into a time when the US Federal Reserve was providing extremely accommodative monetary policy. He then had near zero interest rates for the first 2,521 days of his presidency (just one month shy of 7 years out of 8) then the Fed Funds rate was hiked once for his last year.

Technically it was hiked a second time, but only for the last month he was in office and after Trump had won the election.

Effectively, rates were only hiked once in 8 years.

Rates have been hiked 3 times since Trump was elected

If you count the last rate hike during the Obama presidency, Obama had two rate hikes. If you consider the second hike during Obama’s Presidency was just 37 days before he would vacate the White House, he really only saw one rate hike.

Within 54 days of Trump’s inauguration the Fed raised rates from 0.50–0.75% range to the 0.75-1.00% range. Within 145 days of Trump’s inauguration, rates increased again to the 1.00-1.25% range. So Trump has began his presidency going into less accommodative monetary policy and has already seen 2 hikes during his presidency and 3 since he was elected.

Setting Trump up for a Fall

Virtually no one who lives inside the Washington, D.C. beltway likes Trump. The established powers in Washington hate Trump. The leaders in Trump’s own party hate him.

Trump’s whole presidency was based on spitting in the face of the established powers in the Imperial City of Washington, D.C.

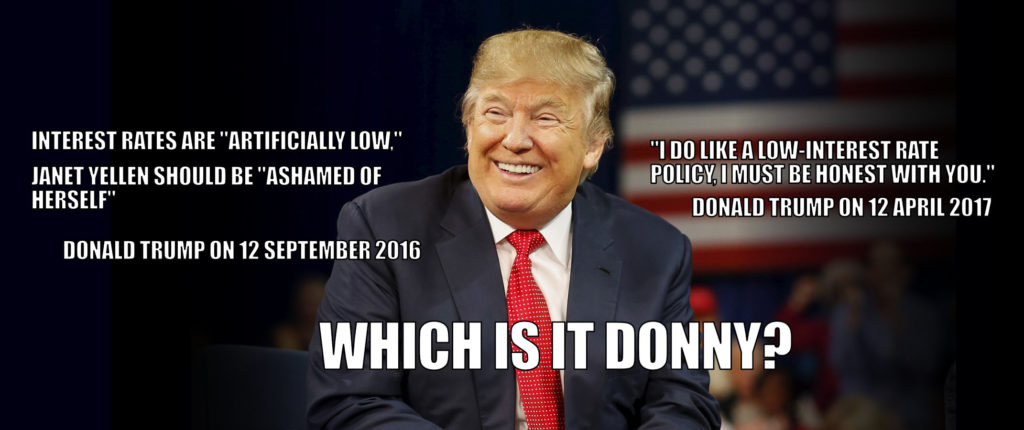

Fed Chair Janet Yellen is a Democrat appointed by Obama and she was criticized by Candidate Trump during the campaign–if she is like virtually everyone else in the Imperial City then she can’t stand Trump.

Artificially low interest rates that are manipulated down by the US Federal Reserve and other central banks cause asset values to become artificially inflated in a bubble. President Obama received the “benefit” of these artificially low interest rates: the economy was able to limp along and the stock market continued to rise as valuations were artificially inflated by the cheap money.

In order for the US Federal Reserve to normalizes interest rates they need to pop the asset bubble they’ve created. I don’t know if the Fed realizes they’ve created a bubble, but if they do, then popping it on Trump’s watch would be ideal from their perspective.

What better way to get Trump out of office than to raise interest rates, pop the stock market bubble which would result in a recession and then ensure that President Trump is not reelected?

In the Machiavellian world of short term political expediency, Trump would do well to distance himself from the markets and put pressure on the fed to retain a more accommodative policy. It will make the problems worse but it will delay the pain. It’s certainly not the right thing to do but it’s what Presidents have been doing for decades.

by John | Aug 21, 2017 | Preservation of Purchasing Power, Wealth Protection

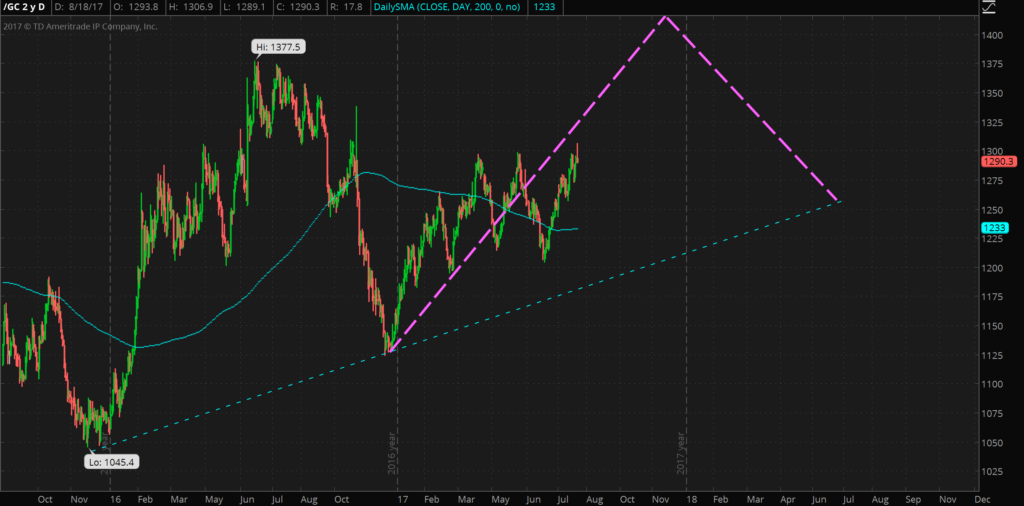

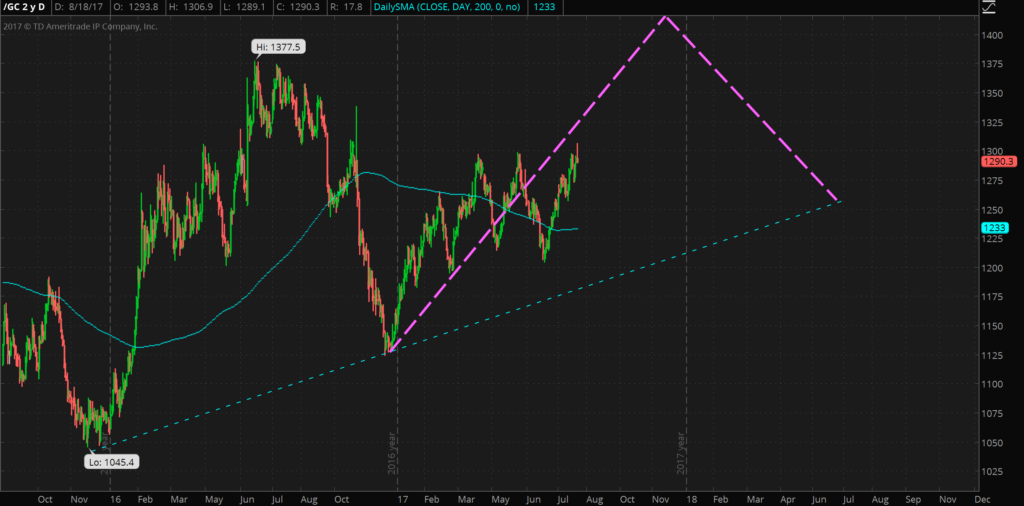

Gold recently traded above $1,300 per troy ounce for the first time time in 2017. It immediately fell back down to the mid $1,280s. This is the third time the price of gold has been beaten back down when attempting to breakout above $1,300.

Price Resistance at $1,295 continues to hold.

In April of this year I made some “predictive guesses” as to the price of gold. Thus far gold has traded around the purple dotted line that I anticipate will be the general price of the yellow metal.

The purple line is my predictive guess as to the price of gold, made in April of 2017.

My predictive guess calls for gold to trade up to $1,400 in November before tailing off again. I expect gold to continue to trend slowly upward in the long term, until there is some large external catalyst such as a stock market crash, physical supply shortage, war or currency crisis, that propels the price upward.

I think holding some gold in one’s physical possession is wise, it’s also important to hold some offshore out of one’s home jurisdiction. While I only hold a portion of my assets in physical gold and silver I think it’s an important component of a diversified portfolio.

Click here to learn about one of my favorite ways to own physical gold.

by John | Jul 28, 2017 | Cryptocurrency, Currencies, Wealth Protection

Bitcoin is going to undergo a hard fork.

What is a Hard Fork Anyway?

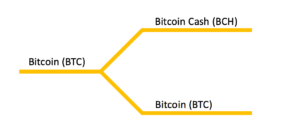

A hard fork in cryptocurrencies is when one cryptocurrency effectively becomes two and the number of units of currency is effectively doubled, albeit existing in two separate, incompatible blockchains. This has already happened to the second largest cryptocurrency by market capitalization: Ethereum.

Ethereum underwent a hard fork back in 2016, so there are now two blockchains, Ethereum and Ethereum classic, which both trace their origins back to the 30 July 2015 launch of Ethereum in a modern day Ship of Theseus paradox.

More information about hard forks.

Hard Forks are Logically Bad for the Price of a Cryptocurrency

As I’ve written about in the past in What I Dislike About Cryptocurrencies cryptocurrencies, like Bitcoin, aren’t scarce.

More correctly, cryptocurrencies are not very limited in supply.

There are currently 16,475,250 BTC in circulation and that number will continue to grow by design until 21 million are mined, at which point the supply of BTC will cease to grow.

So while only 21 million Bitcoins will ever exist on a given Bitcoin blockchain because of how the cryptocurrency is programmed, if Bitcoin forks, there will eventually be 21 million units of Bitcoin A and 21 million units of Bitcoin B.

In one sense the number of Bitcoins that will exist is 42 million. Now certain places might only accept Bitcoin A and not accept Bitcoin B and the price of Bitcoin B could drop to a low value and no one uses it. So in that sense there are still only 21 million Bitcoins. But when a cryptocurrency hard forks, some people favor one fork over the other and the price is lower than it otherwise would be if there was only one blockchain.

If Ethereum had not forked there would only be around 93 million ETH in existence right now. But because Ethereum did hard fork there are now 93 million ETH and 93 million ETC. The market capitalization of ETH is currently around $18.3 billion and the Market cap of ETC is around $1.3 billion. It’s beyond the scope of this article to posit how much the hard fork impacted the price of ETH, but I think it is logical to believe that the price of ETH would be higher if not for the hard fork.

Bitcoin Hard Forks

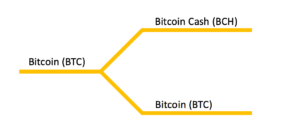

On August 1st Bitcoin is also going to fork, forming two separate and incompatible blockchains: Bitcoin (BTC) and Bitcoin Cash (BCH).

On August 1st Bitcoin is also going to fork, forming two separate and incompatible blockchains: Bitcoin (BTC) and Bitcoin Cash (BCH).

The market does not seem to care and Bitcoin is trading near all time highs around $2,800.

Time will tell what kind of impact this will have on the network and the price of the cryptocurrencies. If the hard fork does not go well and the network is adversely impacted I could see short term price drops. It’s possible (although I would guess unlikely) that Bitcoin Cash becomes more popular than Bitcoin and overtakes it in price. It’s also possible (and in my opinion much more likely) that it becomes a somewhat niche cryptocurrency like Ethereum Classic.

Bitcoin currently has a market capitalization of $46,622,650,965. It’s certain that after the fork both Bitcoin Cash and Bitcoin will not both have a $46.6 billion market capitalization.

While we wait and see what unfolds I’ve taken one important step. I had my modest BTC holdings at Coinbase. Coinbase is NOT supporting the hard fork.

So I’ve moved my BTC to Kraken. Kraken IS supporting the hard fork. By moving my BTC to an exchange that does support the fork I will get Bitcoin Cash in addition to Bitcoin.

The reason for this is because if one were to hold one BTC (Kraken uses the abbreviation XBT) at Kraken during the hard fork, Kraken will award the holder of that BTC one BTC as well as one BCH. Whereas if BTC is held at Coinbase no BCH will be credited.

I like Coinbase and I plan to move my BTC back to Coinbase after the hard fork takes place.

If you don’t currently own any Bitcoins and are interested in purchasing some, check out my easy to use walkthrough guide How to buy Bitcoins on Coinbase. Using my affiliate link when buying Bitcoins on Coinbase to get $10 worth of bitcoins free when you buy at least $100 worth of Bitcoin.

by John | Jul 4, 2017 | Economic Outlook, Geopolitical Risk Protection, Wealth Protection

In order to grow wealth one does need to live in a society that values personal responsibility, property rights and equal protection under the law. Of course if one is fortunate enough to be born into an elite ruling class or a wealthy family that isn’t necessarily the case.

The United States of America was a country that made more wealthy people than any other up to that point was because the majority of people in the United States, among other things, valued personal responsibility, property rights and equal protection under the law.

It wasn’t because the United States had any special divine right, or “manifest destiny.” There wasn’t anything exceptional about the skin color of it’s residents or that the average person there was exceptionally smart.

There are certain values and principles that enable wealth creation and the United States adopted many of them.

Unfortunately many in the United States no longer hold those values. There is the attitude that the United States is inherently rich. “It’s the richest country in the world!” And that whatever financial decisions the US makes is good because it’s the US.

This nationalistic hubris has resulted in poor decision after poor decision by political leaders and the decline of the wealth of the US. Sure, there are wealthy people in the United States and the average person in the US is much better off than the average (or above average) person in the Somalia. But the debts, the decline in life expectancy (albeit small), the failed and pointless wars in Iraq and Afghanistan, the insolvency of states like Illinois and the collapse of the value of the dollar are all indicative of the decline of the United States.

Spending Like a Drunken Sailor

Both of my parents were in the Navy and exemplars of sobriety, so please forgive the analogy, but the United States has a huge spending problem.

The biggest and most entrenched are: Defense, Social Security, and Medicare.

I quote from Simon Black of Sovereign Man:

…just between those three programs, plus paying interest on the debt, the US government already spends MORE than it collects in tax revenue.

In 2016, for example, the government spent $2.87 trillion on Defense, Social Security, and Medicare, plus an additional $433 billion paying interest on the debt.

That totals over $3.3 trillion, which is more than they collected in tax revenue.

In other words, they could cut EVERYTHING ELSE in government: Homeland Security, national parks, funding for the arts, the Department of Energy. Everything.

And there would still be a budget deficit.

Source: sovereignman.com/

There is no mainstream US politician that discusses cutting defense spending. There is no mainstream US politician that discusses cutting Social Security spending. There is no mainstream US politician that discusses cutting Medicare. Politicians on the American “left” don’t cut defense spending. Politicians on the American “right” don’t cut defense spending.

Independence Day

Many in the United States celebrate Independence Day today. Ostensibly celebrating fireworks, food and America. Originally the celebrating was to commemorate the Declaration of Independence of 13 British colonies.

Dependence on Debt

However, the colonies that would become states that would become the United States have become enslaved to debt. This debt is a problem. A large problem.

The debts owed by the United States certainly won’t be repaid honestly. The United States could default on it’s debt, which would be the honest thing to do, or it could monetize the debt by printing the money the repay the debts. This has and will continue to destroy the dollar.

High taxes and regulations are also a crushing burden on the productive capacity of the United States. Honest productive business that bring valued goods and services to consumers are most hurt by this, while politically connected businesses with powerful friends benefit from unequal enforcement and cronyism.

The United States became an economic superpower because people who created value were rewarded. People who took calculated risks to bring value to others were able to reap the benefits. Capital was allocated not by government ministers or overlords but by private individuals closest to the decisions being made. People worked hard and smart and those that didn’t work hard and smart had to suffer more negative consequences than they do today.

The United States has strayed far from those principles that made it successful but the 4th of July celebration of this country goes on.

by John | Jun 18, 2017 | Geopolitical Risk Protection, Wealth Protection

When an entity has no savings and the entity spends more money than it gains in revenue it must be going into debt.

This basic truth applies to people, households, businesses, governments and any other organization.

Many people and most governments don’t particularly care about this fact. Spending today and paying for it in the future is more politically popular than saving and fiscal discipline.

A great example of this recklessness and the ensuing crisis is Illinois. But the dire warnings aren’t coming from some fringe blog or conspiracy theorist. They come from Illinois Comptroller Susana Mendoza.

“I don’t know what part of ‘We are in massive crisis mode’ the General Assembly and the governor don’t understand. This is not a false alarm,” said Mendoza, a Chicago Democrat. “The magic tricks run out after a while, and that’s where we’re at.”

Source: http://www.seattletimes.com/business/official-warns-illinois-finances-in-massive-crisis-mode/

As of today the state of Illinois has a payment backlog of $15.1 billion. It’s not because the state isn’t making the payments fast enough. It’s because the state of Illinois doesn’t have the money to make the payments.

Source: http://ledger.illinoiscomptroller.gov/

Illinois hasn’t had a budget in 2 and a half years. The state’s debt has the lowest credit rating of any of the United States.

It’s also very telling what “solutions” are being proposed. Raising taxes and printing money.

Mendoza channels her inner Yellen stating: “Once the money’s gone, the money’s gone, and I can’t print it.”

The answer is never that there has been financial recklessness and irresponsibility. The answer is never that spending should be reduced. It’s borrow more, print money and raise taxes.

Illinois is a preview of the United States

The borrow, print and tax is a tired set of plays from an old playbook that doesn’t work. But I think it’s the same set of strategies the Federal United States government has been and will continue to use. The main difference is that the Federal government has a virtual printing press and can monetize the debt. Illinois doesn’t have it’s own currency that it can create more of out of thin air.

When the US Federal government has a debt that is due, they can issue more debt (US Savings Bonds, Treasuries, etc) and they find a willing buyer in the United States Federal Reserve as well as private investors and other governments.

When the Federal Reserve buys US government debt it is very harmful to the economy and it’s the reason why the US dollar has lost most of it’s value.

But knowing the playbook the government uses allows you to pick appropriate defensive plays. Insolvent governments try to raise taxes so investing in tax advantaged retirement vehicles is smart.

The government inflates the money supply so invest in assets like gold and silver that can’t be devalued by money printing.

Some folks like Simon Black even recommend US citizens getting a second passport so that if things get really bad, one can simply leave the country.

I’ll be keeping an eye on Illinois. It’s a example of how a government will react when it’s insolvent. I think it will look very similar to what the US will do when it’s debt problem hits the fan. The X factor is that Illinois does not have a printing press, so the effects of fiscal recklessness are much harder to paper over (pun intended). But the printing press only delays the inevitable. If a government could print wealth then Zimbabwe, Venezuela and Weimar Germany would be the richest countries in the world.

by John | Jun 15, 2017 | Cryptocurrency, Learning from Mistakes, Wealth Protection

I think the vast majority of my readers get it. I think my readers are smart, critical thinkers. However, I’ve gotten a few comments from people who somehow think that because ETH is now trading upwards of $300 that somehow my article Ethereum Cloud Mining is Not Profitable is no longer valid.

I’ll make myself clear. It does not matter how high ETH goes, Ethereum cloud mining was not profitable for me.

Did I make more money as a result of Ethereum cloud mining compared to simply holding onto the $561? Yes. But the fact remains that the Ethereum cloud mining contract was a slow, expensive way to acquire ETH.

Owning ETH was profitable. I made money on the appreciation in dollar value of ETH. I would have made more money if I had bought ETH directly, versus Ethereum cloud mining.

I wrote this very clearly three months after I purchased the Ethereum Cloud Mining contract from Hashflare.io:

I would also be better off if I had just bought ETH.

If I bought $561 of ETH for $9 (where it was trading when I started mining). I would have 62 ETH…

Through Ethereum cloud mining I mined 41.27 ETH.

I would rather have 62 ETH immediately than wait a year to get 41.27 ETH. The cloud mining contract increased my cost basis.

Now, if I could buy hashing power at a low enough cost Ethereum cloud mining could have been profitable. If mining difficulty went down over time, Ethereum cloud mining would be more likely to be profitable. However, mining difficulty has consistently gone up and the cost of cloud mining contracts is too high.

Ethereum cloud mining was not a good investment for me. I would have been better off simply buying ETH directly. This is true regardless of how high the price of ETH goes.

On August 1st Bitcoin is also going to fork, forming two separate and incompatible blockchains: Bitcoin (BTC) and Bitcoin Cash (BCH).

On August 1st Bitcoin is also going to fork, forming two separate and incompatible blockchains: Bitcoin (BTC) and Bitcoin Cash (BCH).