by John | Feb 19, 2017 | Tax Strategies, Wealth Protection

I hate tax refunds. Some people think, “I can’t wait for my tax refund so I can do X.” If you really don’t want to wait for your tax refund, take steps so you don’t get one.

See, a tax refund is just that, a refund. It’s not a bonus, new money, or an extra paycheck. An income tax refund is money you could have had earlier in the year, that you overpaid to the government, which is now being returned to you, without any interest.

The United States Tax System

First, a bit of a background on the tax system in the United States.

HowIGrowMyWealth.com has a global audience. I focus on the US with respect to taxes because I am subject to income taxes in the United States and have no experience with taxes outside the US.

While I’m not tax attorney, accountant, CPA or guru, I have been in charge of my own income tax returns since college and I have over 10 years experience doing my own taxes.

There are a myriad of tax situations. I’m just writing about my own experience through 2016 as a W2 income earner.

Income taxes in the United States are imposed at various levels. There are Federal Taxes, State Income Taxes (in most states but not all), and in some cases income taxes on an even more local level.

The US has a pay-as-you-go tax system. That means one is taxed throughout the year at a rate that assumes you’ll make the same amount each pay period.

So if one were to make $4,000 in January, the United States Internal Revenue Service (IRS) assumes you’ll make $48,000 ($4,000 x 12) and taxes will be withheld by one’s employer from each paycheck as if you were going to make $48,000.

But the US tax code is hopelessly complex (you can ask 3 different accountants a tax question and get three different answers all of which could be correct) and tax withholding doesn’t take into account changes in income, deductions, credits, allowances, or capital gains/losses.

As a result one could end up owing more or less in tax at the end of the year, once the myriad of factors that factor into an income tax return are known.

Why I Hate Tax Refunds

Imagine you go to a store and buy a shirt and you pay $100 for it. But the shirt really only cost $50. An honest storekeeper would give you $50 change at the point of sale.

But this store owner holds onto your $100 for over a year and then finally tells you that you overpaid and gives you $50 back.

If you didn’t realize you overpaid you might be glad, “Hey, I’ve got an extra fifty smackers!” But what if you needed that $50 a year ago to pay rent, or buy food, or to buy a pair of pants to go with your shirt, or better yet, save that money and earn interest on it. You’ve lost out on all kinds of opportunities for those funds.

Try to Be Rational

Now I get it, just like if you were to find a $20 bill in your couch that you thought you had lost, there is a certain emotional thrill of getting money back.

I also get that as humans, myself included, we’re very emotional creatures.

Sure, humans have the capacity for reason, but unfortunately and all to often emotion rules the day.

I quote my favorite playwright, Oscar Wilde:

Lord Caversham: No woman, plain or pretty, has any common sense at all, sir. Common sense is the privilege of our sex.

Lord Goring: Quite so. And we men are so self-sacrificing that we never use it, do we, father?

- An Ideal Husband, Oscar Wilde

In the witty quote above, I think Oscar Wilde is basically saying that too few of us (men and women) use common sense or reason as often as would be ideal.

Rationally it doesn’t make sense to get a tax refund. A tax refund is money that has been overpaid that is being returned much later with no interest.

I strive to be a rational person. Not in the sense of being a robot, but rather having rational thoughts in the driver seat and emotions serving more of a supporting role, rather than using reason to justify my emotions.

It’s much more reasonable to avoid a tax return and be happy that one has the money throughout the year, rather than get the money in April.

My next article will provide ways in which I’ve avoided getting a tax refund in the past, so that I had more money throughout the year and I didn’t give the government an interest free loan.

by John | Jan 9, 2017 | Insurance, Tax Strategies, Wealth Protection

With the dawn of the Affordable Care Act (ACA, more often called ObamaCare) individuals are now taxed for NOT buying something.

I encountered this for the first time the 2016 calendar year during my 100 days of unemployment. For for the first six months of 2016 I had what the Affordable Care Act calls “minimum essential coverage” (MEC) through my employer.

Starting in July I no longer had employer provided health insurance.

I hardly considered continuing my employer coverage via COBRA because it’s so expensive.

Even though I’m relatively young and healthy, accidents do happen. The number one cause of bankruptcy in the US is medical bills and I don’t want to be part of that statistic.

I could have signed up for a 2016 ACA plan within 60 days of losing my employer provided coverage but I didn’t think that was a good option.

The Affordable Care Act Made Healthcare Less Affordable For Me

The least expensive plan for me on healthcare.gov was $203.55 per month and had a $6,650 deductible, $40-$80 co-pays and/or 40/60 co-insurance and $6,850 maximum out of pocket.

This ACA health plan would have cost $2,442.60 per year or $1,221.30 for six months.

But even when you pay the premiums one still has to meet the $6,650 deductible.

For those not familiar with insurance jargon, a deductible is an amount that must be paid out of pocket by the insured (in this case me) before the insurance plan will cover anything.

So, in the course of a year you’d have to spend over $9,000 before this plan would kick in and start covering medical bills.

No thank you I’ll find a better plan.

What I Decided to Do for the Second Half of 2016

I purchased a non-MEC health insurance plan for $52 per month. It had a $5,000 deductible 30/70 co-insurance and a maximum out of pocket of $16,666.

I also got an accidental medical expense plan for $57.36 per month with a $250 deductible. I would be paid out up to $10,000 in the event of a disability or cancer/stroke.

So for a little over half the cost I was able to buy what I think is better coverage from both a cost and benefit perspective. My total cost was $656.16 for six months of coverage.

Minimum Essential Coverage

The only problem with the plan I purchased is that it does not fit into the government’s definition of “minimum essential coverage” (MEC).

Not having MEC results in one having to pay the Orwellian “Shared Responsibility Payment” which is $695 in 2016 or 2.5% of Adjusted Gross Income, whichever is higher, prorated for any months in which there was no coverage.

Since I had MEC for 6 months through work, but non-MEC for the 6 month I was unemployed, I would be “responsible” for paying half of the “Shared Responsibility Payment”. This “tax penalty” in 2016 is $695 or $347.5 or 2.5% of my AGI, whichever is higher.

So my total cost for health insurance in the last six months of the year was $1,003.66. Which is still $200 less expensive than if I had gone with the least expensive healthcare.gov plan.

Would I Have Done Anything Differently?

In hindsight I think I would have done the following.

After losing my employer coverage I would have gone without insurance for about 50 days or so (if I had gotten catastrophically ill in that time I would have bought an ACA plan since I would still be within that 60 day window). Then after 50 days of going without insurance I’d sign up for the least expensive ACA plan.

The ACA plan would have cost me $203.55 per month for four months or about $815.

You can go up to 3 months without MEC provided you have MEC for the rest of the time. So I wouldn’t have had to pay the newspeak “Shared Responsibility Payment.”

Lessons

My mistake was not factoring in the “tax penalty”. The health insurance I did buy was less expensive than buying the cheapest ACA plan for four months, but NOT once I factor in having to pay the penalty.

In 2016 I was right in the heart of the people who DON’T benefit from the ACA.

Young healthy single people who don’t need most of the extras health insurance HAS TO HAVE to be considered MEC and thus avoid the “tax penalty”.

At my stage in life I don’t need or want maternity and newborn care or pediatric services. I don’t need or want coverage for rehabilitative services and devices or nursing home care. All things that increase the cost of an insurance plan that MUST be included in an ACA approved plan.

I also was making enough money that I didn’t qualify for any tax subsidy.

Other people my age might opt to go without any health insurance and just pay the fine/tax. That would have been the least expensive option for me in 2016 but not one I was willing to take.

I didn’t want to go without insurance.

I know some people benefit from the Affordable Care Act. However, I was not one of them. The ACA made healthcare more expensive for me and limited my choices.

by John | Sep 18, 2016 | Capital Appreciation, Investor Mindset, Investor Psychology, Tax Strategies, Value Investing

Warren Buffett is considered to be one of the most successful investors. He’s one of the wealthiest people in the world and he’s also fond of publicity and public appearances.

If you have some humility and don’t get caught up in jealousy you can learn a lot from wealthy and successful people like Warren Buffett.

My own Father is fond of saying that poor people should take rich people out to lunch. The idea being that the wisdom that can be gained from the wealthy is worth more than paying for lunch.

So what lessons can we learn from Warren Buffett?

Do As Warren Buffett Does, Not As He Says

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

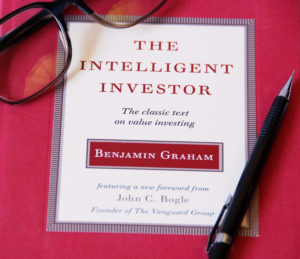

Warren Buffett talks A LOT and shares a lot of opinions. But you shouldn’t follow what he says as advice because he might actually be doing the opposite of what he is saying.

In order to learn lessons from Buffett one must first filter out a lot of what he says.

There is a quote from Daniel Loeb that summarizes Buffett’s contradictions quite succinctly.

“He criticises hedge funds yet he really had the first hedge fund,” Loeb said. “He criticises activists. He was the first activist. He criticises financial service companies, yet he likes to invest in them. He thinks that we should all pay more taxes but he loves avoiding them himself.”

Source: http://www.smh.com.au/business/warren-buffett-is-full-of-contradictions-hedge-funds-say-20150507-ggwv2o.html

Without further ado here are three lessons we can learn from Warren Buffett.

Lesson 1: Reduce Your Taxes

While publicly discussing how he wants to pay more taxes Warren Buffett has taken extraordinary steps to reduce his taxes.

Source: http://www.nytimes.com/2011/08/15/opinion/stop-coddling-the-super-rich.html

From how he structures his businesses to how he is paid to how he has bequeathed his inheritance Warren Buffett does all he can to reduce his taxes. He gets paid through dividends and long term capital gains rather than ordinary income. He’s also left 99% of his fortune to a private charity to avoid paying inheritance taxes.

Lesson number one from Warren Buffett is Reduce Your Taxes.

There are a variety of ways you can legally reduce your taxes: IRAs, 401ks, FSA, HSAs, charitable contributions, capital gains. I discuss some of them in Five Tax Strategies to Keep More Income.

Real estate is also an excellent way to increase your wealth in a tax advantaged way. BiggerPockets.com is an excellent Real Estate resource.

Lesson 2: Invest in High Quality Companies that are Undervalued

Warren Buffett loves great value. Much of his investing philosophy can be traced back to Benjamin Graham, the father of value investing.

According to Investopedia Buffett looks at six criteria for stock investments:

1. Has the company consistently performed well?

2. Has the company avoided excess debt?

3. Are profit margins high? Are they increasing?

4. How long has the company been public?

5. Do the company’s products rely on a commodity?

6. Is the stock selling at a 25% discount to its real value?

Source: http://www.investopedia.com/articles/01/071801.asp

Warren Bueffett is a value investor and I think value investing is an excellent way for the enterprising investor to achieve outsized returns. I’ll be writing more about value investing in future posts.

If you’re interested in reading one of Graham’s seminal works “The Intelligent Investor” use this link to buy it on Amazon and help support this site: The Intelligent Investor by Benjamin Graham. Buffet calls it “the best investing book ever written.”

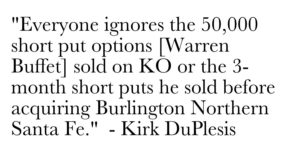

Lesson 3: Use Derivatives Wisely

Warren Buffett has written “derivatives are financial weapons of mass destruction.”

Source: http://www.fintools.com/docs/Warren%20Buffet%20on%20Derivatives.pdf

But Buffett has billions in derivatives as pointed out by Kirk DuPlesis of OptionAlpha.com.

Source: https://optionalpha.com/warren-buffett-options-trading-strategy-19655.html

In the article above Kirk talks about two ways Buffett uses derivatives:

1) Uses naked, short puts to lower the cost basis for purchasing stock or target companies that he wants to acquire.

2) Sells short index put options when volatility is at it’s highest, knowing that volatility is the one factor that is overpriced all the time.

I’ve written about trading options and think that done correctly it can be an excellent way to bring in monthly income. I’m interested in utilizing strategy one above more often as I open new stock positions.

Lessons from Warren Buffett

Those are three lessons I’ve learned from looking at what Buffett does, not what he says. Buffett probably gives some advice that is worth following directly but you have listen through a filter and weigh heavily what he actually does over his words.

by John | Sep 11, 2016 | Capital Appreciation, Getting Started, Passive Income, Preservation of Purchasing Power, Tax Strategies

The Building Blocks of Personal Finance

If you haven’t already read parts I and II start there!

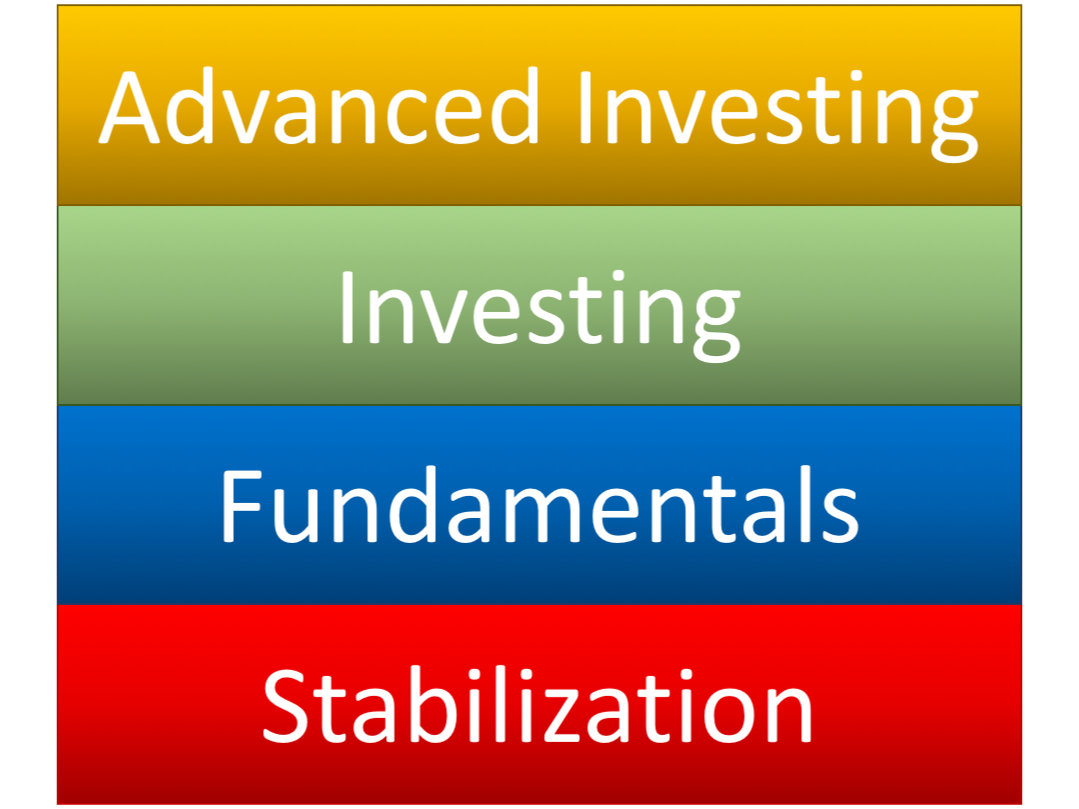

I visualize personal finance as building blocks stacked on top of each other (shown to the right).

You must master the lower levels before you can get to the upper levels.

Level 3: Basic Investing

I consider basic investing saving for retirement in a 401k and Individual Retirement Account (IRA) via mutual funds and bonds, and general savings in mutual funds.

Both the 401k and IRA are ways to invest for retirement and get some tax benefits. 401ks are through an employer, and IRAs can be setup through a company like Vanguard, Fidelity, TD Ameritrade, or any number of other firms that act as the “custodian”. I talk about them in a little more detail in my article Five Tax Strategies to Keep More Income under strategies one and two.

Employer Matching 401k

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.

I prefer Roth 401ks to 401ks because I believe tax rates are going up in the future. Roth 401ks are more rare but I have had employers who offer them.

The vast majority of the investment options offered by the employers I’ve been at are VERY limited. The easiest option is to go with a target retirement fund. Target retirement funds are basically funds on autopilot, they automatically adjust their asset mixes to become more conservative as investors approach the target retirement date.

If there are more options I avoid bonds and favor international funds but investments depend on your risk tolerance and goals.

Individual Retirement Accounts

IRA’s come in the Roth and Traditional flavor. It all depends if you’d rather pay taxes now, or in retirement. I prefer to pay the taxes up front.

I would open up a Roth IRA and try to max it out ($5,500 in 2016). Another neat trick is that you can contribute to a traditional IRA and then convert contributes to a Roth (you do of course have to pay the taxes though), so if you want to save more than $5,500 in after tax income, that is an option.

One of the things I like about IRAs is that the investment options are much, much more flexible. I think part of the reason employer sponsored 401ks have such limited investment options is because employers are afraid of being sued if an employee makes poor decisions and loses a lot of money, so employers only offer with the most conservative investment options.

If you want to save money and not think about, you’re asking for trouble, but one option is to open up an account at a low cost company like Vanguard (my favorite) or Fidelity. Setup auto-deposit and buy a balanced fund like the Vanguard STAR fund (VGSTX).

You can also buy additional index funds, like the S&P 500 index fund, Nasdaq, large and small cap US funds, etc. These index mutual funds are setup to track the gains and losses of the index they are based on. Again, I think it is good to have money in the emerging markets as well.

Vanguard has investment professionals that will help you decide how to allocate money to different mutuals funds. (Disclosure: I have been a vanguard client for years, but gain no benefit from listing them as an option).

By setting up auto-deposit and auto-invest into Vanguard (or your IRA custodian of choice) from your paycheck you’re dollar cost averaging into the fund and not trying to time the market.

Over time this is a good, conservative strategy, and one discussed by Benjamin Graham in his seminal work “The Intelligent Investor”. Ben Graham was a mentor to Warren Buffet, who you may have heard of, and has done decently well as an investor.

Conventional wisdom is often something like a 40% bonds and 60% stocks (mutual funds) as a conservative approach. Unless you’re retired and relying on your savings for monthly income, I would not buy bonds, but a portfolio that does not include bonds is considered more risky.

You can follow these same investing principles to buy non-retirement mutual funds.

Now I do think that US stocks and bonds are in a bubble. But if the Federal Reserve responds to the bubble bursting as I think they will, stocks and bonds will still go up. I just think there are other asset classes that will go up faster.

Consider Physical Gold

Consider Physical Gold

While this could be considered more advanced, I think it is very important to have somewhere around 10% of one’s assets in physical gold and silver bullion. While I don’t give investment recommendations I think that even some of the more conservative and traditional investment advisors would admit this is not a bad idea. I gain no benefit from mentioning them, but I buy bullion from Scotsman Auction house in Saint Louis. They have been in business a long time and have great pricing. I don’t buy numismatics or “rare” coins as an investment. I’m partial to Silver American Eagles and Gold Canadian Maples, but that is just personal preference.

There are lots of gold bullion companies but I would not want to pay more than around 2% over spot price for gold. I avoid numismatics unless they can be acquired at bullion prices.

Level 4: Advanced Investing

Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending, real estate investments, private equity, foreign stocks, offshore brokerage accounts, options, cryptocurrencies, physical precious metals like gold and silver, and physical gold stored remotely through a Goldmoney personal account.

Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending, real estate investments, private equity, foreign stocks, offshore brokerage accounts, options, cryptocurrencies, physical precious metals like gold and silver, and physical gold stored remotely through a Goldmoney personal account.

These techniques are generally considered more risky, although I think that buying US stocks at all time highs and negative yielding bonds is much more risky, even though conventional foolishness wisdom says these are the safe bets.

Get Started!

To get started figure out where you stand in the four phases. Master that phase and work towards the next.

It’s an iterative process once you’re out of stabilization and focusing on the fundamentals and investing. I’m often re-evaluating my fundamentals such as my budget and my goals. I work on my basic investing like maxing out my 401k company match and Roth IRA.

Which phase are you in and what are your savings and investment goals?

by John | Jul 24, 2016 | Tax Strategies, Wealth Protection

Five Tax Strategies I use to Keep More of My Hard Earned Income

You work hard for your money and you deserve to keep it! Today I share five US tax strategies that allow me to keep more of what I’ve earned.

I don’t know if these tax strategies are suitable for you. You need to make your own decisions with the input and advice from a licensed tax professional and investment advisor.

I have a Master’s Degree in Human Resources and have studied employee benefits but I’m not a CPA or tax advisor. What I’ve written below is accurate and lawful to the best of my knowledge as of posting this article but I can’t guarantee that my understanding of the tax code is complete, accurate or up to date. Tax laws do change and in the future the below information could become outdated and/or incorrect.

I’m sharing what has worked for me!

Tax Strategy 1: Contribute to a 401k

A traditional 401k allows you to save money for retirement using pre-tax dollars. Your contributions are exempt from state and federal income tax. You do still have to pay social security and medicare taxes on 401k contributions.

Trivia: a 401(k) plan is the tax-qualified, defined-contribution pension account defined in subsection 401(k) of the IRS code.

When you retire and are eligible to make 401k withdrawals you do pay taxes on your withdrawals but your money will have (hopefully!) grown and if you’re retired you might be in a lower tax bracket then when you were working.

If my employer offers a 401k plan with company matching I contribute as much as I can to get the full company match but no more. That’s because the investment choices most companies offer are very limited. I do max out the company match so I’m not leaving money on the table.

I go with a Roth 401k if my employer offers it but they’re less common. With a Roth 401k you pay taxes up front but when you withdraw the money in retirement that income is tax free. I think taxes in the US are going to go up so I think it’s better to pay taxes now at the lower rates and get tax free retirement income later.

If your tax rate is the same during retirement as when you contribute to the 401k there is no advantage between a Roth 401k and 401k.

Two of my employers have offered Roth 401ks and company matching. When I left those employers, I rolled my Roth 401k into a Roth IRA and any 401k contributions into an IRA.

Tax Strategy 2: Contribute to an Individual Retirement Account (IRA)

The Roth IRA is one of my favorite tax strategies. Like 401k’s you get to pick your “flavor” of IRA: Roth or traditional. I favor Roth IRAs for the same reason I favor Roth 401k’s: because I believe tax rates will be going up in the future. Whether your employer offers a 401k or not you can open up an Individual Retirement Account (IRA) on your own.

To open a Roth IRA you just need some money and a custodian like Vanguard or TD Ameritrade. Once I’ve maxed out my employer matches for my 401k (if offered) I contribute additional retirement savings to my Roth IRA.

Through Vanguard I’m able to invest in many more securities and mutual funds than any employer offered investment options I’ve seen.

With a Roth IRA I will be able to enjoy tax free income during retirement, and it grows tax free while I wait. I’ve had a Roth IRA since I was 16 and it has been a great way to save for retirement.

If I gave investment advice I would implore everyone with $1,000 they could afford to set aside to open a Roth IRA today. I posit it is the most powerful of all five of these tax strategies.

Tax Strategy 3: Contribute to a Flexible Spending Account (FSA)

This is my second favorite of the five tax strategies. Your employer might offer a Flexible Spending Account. All of my employers have. Like a 401k, you use pre-tax dollars to set aside money for eligible medical expenses like doctor visits and prescription drugs.

In addition to the tax benefits are three nice perks to an FSA.

1) You can spend the money right away as long as it is an eligible medical expense

2) Not only do you not pay state or federal income tax on FSA contributions, but you don’t pay social security or medicare taxes either

3) If you stay at the company but don’t spend all the contributions you’ve made they roll over to the next year

One NOT so nice feature of the FSA is that if you leave your employer you lose it. You can’t take it with you.

But one crazy loophole that an HR representative once told me about was that you can spend all the FSA contributions you would have made for the year, even if you leave the company.

For example, lets say you’re set to contribute $20 per month to your FSA. That is $240 per year. Lets also say the company’s fiscal year starts on January 1 and you get paid on the first of each month. If you enroll in the FSA program and are set to contribute $20 per month, and you leave your employer at the end of March, before your last day of employment you can spend up to $240 on eligible expenses using your FSA, even though you’ve only contributed $60. Crazy!

If you have recurring medical expenses like prescription drugs, dental cleanings, doctor visits or eye exams an FSA is a no brainer if your employer offers one. Some employers will even match FSA contributions.

I’ve had an FSA at my last three employers and it’s a great way to save on medical expenses.

Tax Strategy 4: Contribute to a Health Savings Account (HSA)

Not everyone qualifies for an HSA. The IRS tells us you’re eligible to open an HSA if you meet the following:

- You must be covered under a high deductible health plan (HDHP)

- You have no other health coverage except what is permitted under “Other health coverage”

- You are not enrolled in Medicare

Plans with the following deductibles qualify as High deductible Health plans:

- Self-only coverage minimum annual deductible $1,300 / Maximum annual deductible and other out-of-pocket expenses* $6,450

- Family coverage minimum annual deductible $2,600 / Maximum annual deductible and other out-of-pocket expenses* $12,900

Having recently gained the status of unemployed and having bought a high deductible healthcare plan, I opened up an HSA through a company called Select Account. My very good friend who is self employed recommended them to me. Assuming I remain eligible for the HSA, I should be able to deduct my HSA contributions on my taxes.

I like HSAs because unlike FSAs they stay with you. What I don’t like about them is that you can’t invest the HSA contributions, so you’re stuck in depreciating dollars. The IRS is also very particular about who qualifies for an HSA, so when I start my next job, and that job offers health insurance, I might lose my eligibility for the HSA.

If you want to torture yourself you can read more about HSAs over at the IRS website.

Tax Strategy 5: Stop Getting a Tax Refund!

I don’t understand why people get excited about tax refunds. A tax refund means you overpaid on your taxes, you haven’t had that extra money all year and now the government is giving your money back to you that you loaned to them interest free.

I calculate/estimate what my taxes are going to be and then tweak the allowances and deductions on the W-4 worksheet so that I will owe about $900 in federal taxes at the end of the year.

Depending on the state you can do something similar for state income taxes.

By owing a small amount of money to the IRS on April 15 I’ve essentially got the refund through the year in the form of slightly higher paychecks. I’ve also held onto my hard earned money for as long as possible.

You do have to be careful with this because if you underpay by over $1,000 on your Federal taxes you get penalized. States that allow this will probably also penalize you if you underpay by too much, I know Illinois does.

Again I’m no CPA so consult a competent tax advisor before you try something like this. You can read more about the underpayment penalty over at the IRS website.

What do you think of these Five Tax Strategies?

These are five tax strategies I use to keep more of my hard earned income. I will say if you don’t have a Roth IRA you’d better have a darn good reason.

Do your own research, determine what is suitable for your situation and ask your tax advisor if one or more of these strategies is right for you.

If you’re interested in saving more money from the “inflation tax” consider keeping a portion of your savings in gold.

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

There is an old expression “Do as I say, not as I do.” With Warren Buffett it is “Do as I do, not as I say.”

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.

Some employers will match your 401k contributions. As an example lets say your employer matches your contributions up to 5% of your salary. If you make $50,000, and you save $2,500 in your 401k, your employer will add an additional $2,500 to your 401k. I put money in my 401k up to but not beyond the point where I’ve maxed out the match.  Consider Physical Gold

Consider Physical Gold Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending,

Advanced Investing techniques are what I’m most passionate about. Examples of what I consider advanced investments are: Investing in individual company stocks, gold mining stocks, peer to peer lending,