by John | Mar 18, 2018 | Cryptocurrency, Investor Mindset

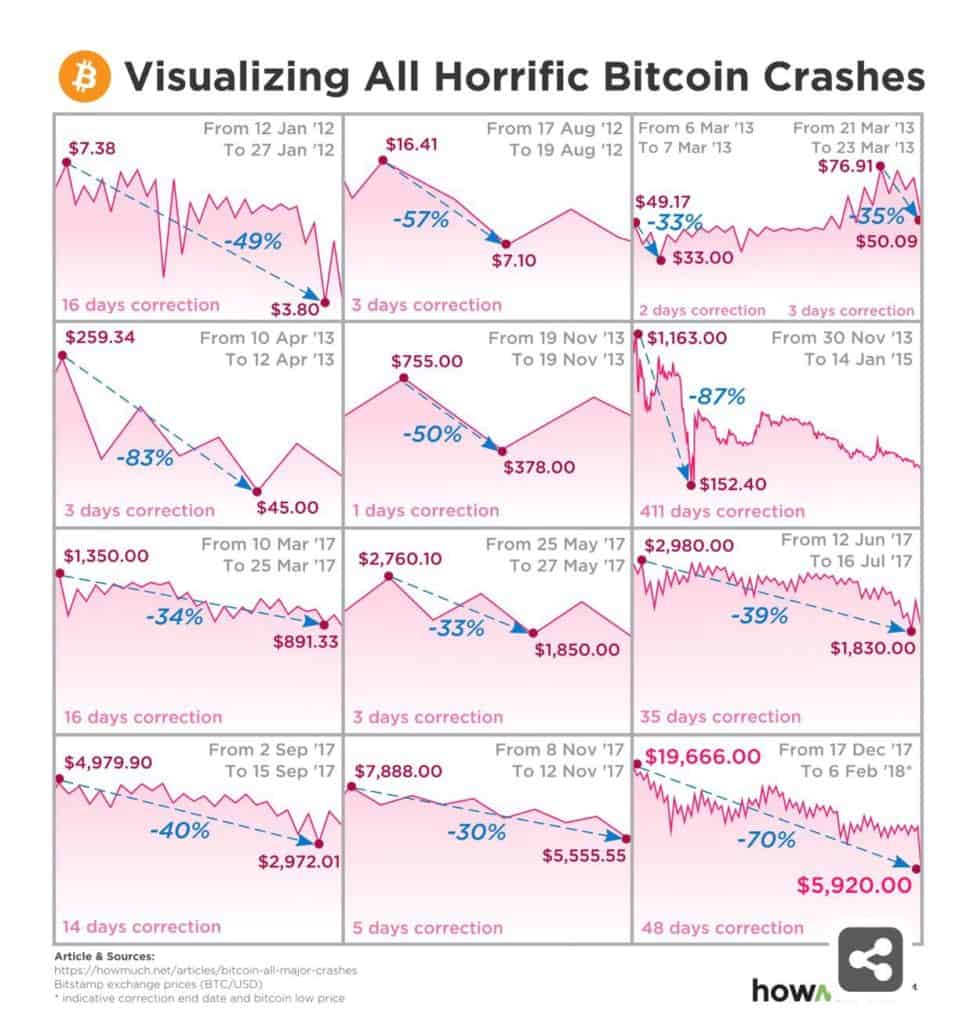

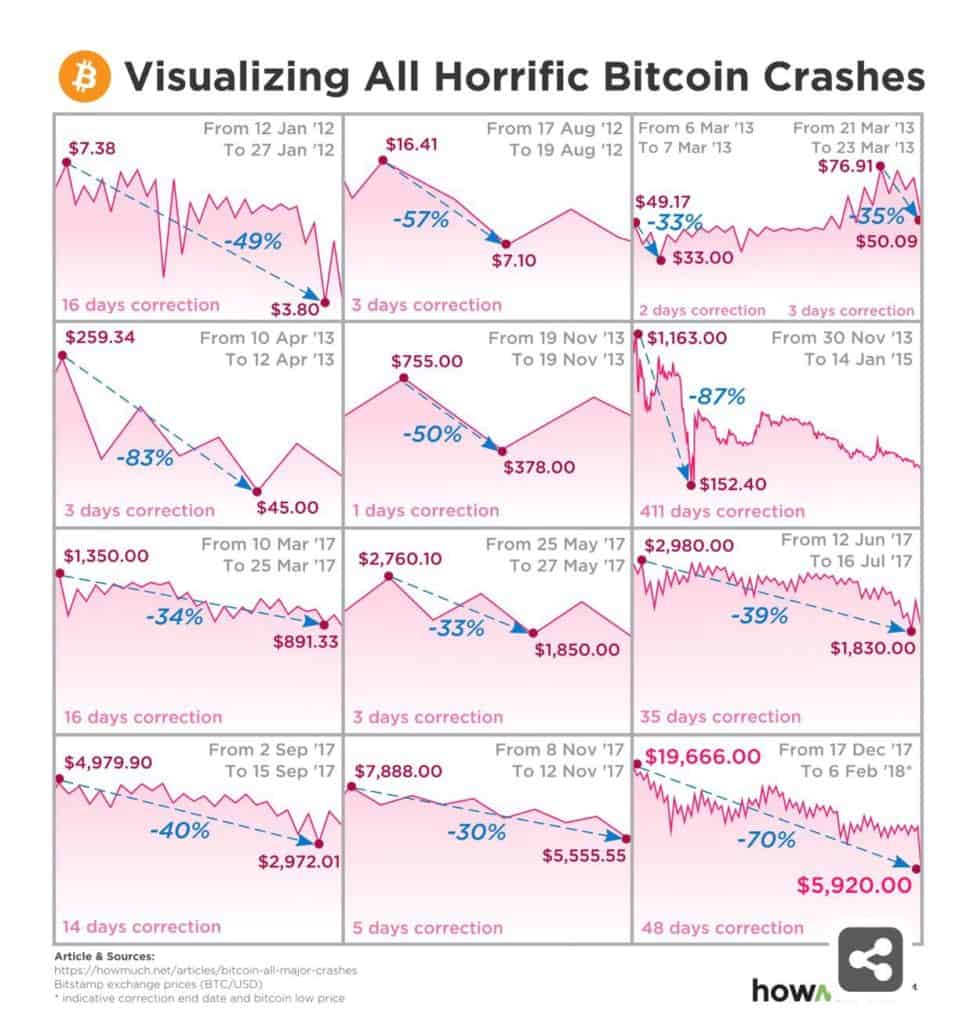

If you follow the markets at all you know that Bitcoin and other cryptocurrencies have been crashing. Depending on the exchange Bitcoin was trading up to around $19,500 in December of 2017 and is now trading down to around $7,500–a crash of around 60%.

There have actually been 2 crashes that have been worse. In just a few days in April of 2013 Bitcoin went from $259.34 down to $45 in an 83% drop. Between November of 2013 and January of 2015 Bitcoin fell from $1,163 down to $152.40 in an 87% drop.

Bitcoin fell as low as 70% when it went from $19,666.00 on 17 December 2017 down to $5,920.00 on 6 February 2018. We have to wait and see if this is part of that crash or if $5,920.00 is the low preceding a new high.

The point is that cryptocurrencies are volatile and they have sold off like this before.

Source: https://www.reddit.com/r/CryptoCurrency/comments/84kr25/historical_bitcoin_price_crashes/

If you already own some crypto, I would stay the course. If you are thinking about speculating on cryptocurrencies, now could be a good time to buy in. Just don’t get caught up in the mania and consider How to Actually Prevent Your Bitcoin Financial Armageddon.

by John | Dec 29, 2017 | Cryptocurrency, Geopolitical Risk Protection

Cryptocurrencies are all the rage and gold remains time tested. Over the last few years cryptocurrencies like Bitcoin have been extremely volatile (mainly to the upside) while gold has been fairly stable and moved mostly sideways. Growing and protecting my wealth through alternative investments has been my focus for the last four years so I watch both the precious metals and cryptocurrency markets with great interest.

Bitcoin has risen exponentially in 2017. Clearly buying Bitcoin at $900 and riding it up to $20,000 was a fantastic trade in which the initial capital would have appreciated over 2,000% in less than a year.

How anyone besides a time traveller would have known to do that other than faith or luck is beyond me. I still think there are problems with cryptocurrencies. Even though there are several aspects of cryptocurrencies that I do like and a number of tokens and coins I choose to own.

Gold on the other hand has been slow and boring. As I wrote about in April this year, 2016 looks like it was the start of a new bull market in gold. Prior to 2016 gold had steadily declined since it’s $1,900 highs in 2010.

Since 2016 gold has steadily risen in price

A Place for Gold

I believe that now as much as any time in history gold (and silver) remains an important part of a diversified portfolio.

Dorian Nakamoto was accused by Newsweek of being Bitcoin founder Satoshi Nakamoto

I don’t know how high Bitcoin will go. However, in 50 years I believe that Bitcoin will be worth less than a few dollars and gold will have at a minimum retained it’s value in terms of purchasing power if not appreciated beyond that.

I think it’s entirely possible that some other cryptocurrency will be commonly used as a medium of exchange fifty years from now but it won’t be Bitcoin.

I could be wrong about that so I do own some Bitcoin but I’m not willing to take out a mortgage in order to buy Bitcoin on margin, as some people are doing.

Litecoin founder Charlie Lee announced 20 December 2017 he sold all his Litecoin

Source: https://www.engadget.com/2017/12/12/bitcoin-mania-mortage-house-investors/

If you want to speculate and trade I think Bitcoin and other cryptos are great for that.

I buy Bitcoin on Coinbase and move it to other exchanges to diversify into my “Group of Six” and it has worked out well so far.

If you have some money you can afford to lose then trade and speculate away.

However, I think that gold remains the gold standard in wealth preservation.

23 year old Ethereum Founder Vitalik Buterin

I don’t think there is any substitute for buying physical gold and silver from a reputable dealer.

Physical bullion you have in your possession is the ultimate way of removing yourself from an out of control wall-street/banking system. I don’t want to go down the path of radical Cartesian skepticism but with precious metals you aren’t betting on the Janet Yellens and Jamie Dimons of the world having everything under control and are looking out for the little guy.

With gold you don’t have to worry about Satoshi Nakamoto, Charlie Lee or Vitalik Buterin making a bad decision and tanking cryptocurrencies.

Geopolitical Risks Remain

The risks haven’t gone anywhere. The stock market continues to climb but this is one of the longest periods in the history of the stock market without a correction. Meanwhile the fundamentals are not strong.

Debt at the governmental, municipal and personal level continue to grow with no end in sight.

Central banks throughout the world have printed trillions in fiat currency. One of the most important alternative investments to hedge against these risks are precious metals. Blockchain technology, while revolutionary and disruptive to the status quo do not replace gold and silver as the ultimate insurance policy against central bank insanity.

by John | Dec 11, 2017 | Cryptocurrency, Investor Mindset

If Bitcoin were to crash and lose 95% of it’s value would it result in your own financial armageddon? If so you need to keep reading. Even if a Bitcoin crash wouldn’t cause your financial downfall you should keep reading.

I understand it’s tough to stay rational when Bitcoin up by 100% in a matter of months or weeks. I could continue to be wrong and Bitcoin could double in weeks, months or years ahead and go to $40,000 or $100,000 or the moon.

But before you take out a second mortgage on your house, cash out your retirement, and put all your life savings plus money you’ve borrowed into buying Bitcoin at 50% leverage (all of which I think are horrible ideas)–consider the following six guidelines that will help prevent a Bitcoin crash from causing your own person financial armageddon.

- Don’t Buy Because You’re Afraid of Missing Out

- Only buy what you can Afford to Lose

- Commit a certain amount of Bitcoin your are simply going to Hold

- Take Some Profits off the Table

- Be Content with the Gains you Have

- Diversify

1) Don’t Buy Because You’re Afraid of Missing Out

Fear of Missing Out (FOMO) can strike us all. But buying something simply because it is going up, has gone up or because you fear missing out on future gains is a horrible approach.

I dislike missing out when something is going up too. I struggle with that like many people. But I have to reign myself in and remind myself not to buy simply out of fear of missing out.

There are always more opportunities out there and if you make a bad decision out of fear of missing out you will have less capital to put towards the next opportunity.

2) Only buy what you can Afford to Lose

When an asset like Bitcoin goes up so dramatically people start to think much less rationally. They get greedy and less cautious. They start to think that Bitcoin will always go up–so they start to buy more than they can afford to lose.

This is bad for two main reasons:

1) If your life savings is in Bitcoin and it drops by 20%, 30%, 40% or more the natural human instinct is to sell and stop the pain.

Markets never go up or down in a straight line. Bitcoin is particularly volatile and it has dropped by several thousand dollars before rallying back to new highs. Limiting your speculation to an amount you can afford to lose will better enable you to stomach the inevitable drops and corrections and weather the downturns.

2) Assets like Bitcoin could lose 95% or more of it’s value and never recover. Bitcoin could drop 50% and never make a new high. Even if you hold through a large drop, you may never recover your principle and if you’ve lost more than you can afford to lose you’ll be in a world of hurt.

3) Commit a certain amount of Bitcoin your are simply going to Hold

I bought into Bitcoin when it was trading under $100. I bought and sold it as it went up and down and made some money. But I wish I had held onto some portion of the Bitcoins I had bought (maybe 1 or 2) and just held them to see how high Bitcoin could go. I now have the benefit of hindsight–but it’s better to make that decision up front.

Perhaps you are going to hold (“HODL” in crypto-speak) Bitcoin you buy until you reach age 65. Maybe you are going to hold Bitcoin until it reaches $20,000. Maybe you are going to hold until you can use Bitcoin to pay your rent or your luddite Uncle Ned starts using Bitcoin and it’s reached widespread adoption.

Whatever the criteria you choose–stick to it. I wish I had set aside a percent of the Bitcoins I first bought and decided I was going to hold them based on a rule.

4) Take Some Profits off the Table

I think it is good to have a percent of Bitcoin that you can afford to lose that you are going to hold based on criteria of your choosing. But I also think it is good to take some profits off the table. Lets say you have 6 Bitcoins you bought at $5,000, Bitcoin is trading at $17,000 and you are sitting on $72,000 in profits with a $30,000 cost basis. Consider selling 2 Bitcoins and taking $35,000 in profits. That way you are guaranteed to have made money on Bitcoin and you’re effectively playing with the houses’ money (to use a gambling analogy).

5) Be Content with the Gains you Have

I wish I kept more of the Bitcoins I bought when it was trading under $100. But instead of feeling regret I am focused on the fact that I have made a few thousand on Bitcoin and other cryptocurrencies and I’m grateful for those gains. If you are fortunate enough to have made some gains in Bitcoin be content with those gains and don’t let greed or FOMO get the better of you.

Being grateful for the gains I have made helps prevent me from getting greedy and unwisely putting an amount of money towards the crypto-space that I cannot afford to lose and/or doesn’t make sense given my asset allocation goals.

6) Diversify

I think it is important to diversify across asset classes: stocks, precious metals, cryptocurrencies, I would like to diversity into real estate and into other areas as well.

Part of that diversification includes diversifying within each asset class. I own multiple value stocks in different industries–I own different precious metals and I own different cryptocurrencies besides just Bitcoin.

If you recognize diversification is important don’t just buy Bitcoin. Consider some of the other cryptocurrencies out there. I’ve shared with my newsletter subscribers my own “Group of Six” cryptocurrencies that I’ve chosen to speculate on. Research some of the other tokens or coins out and there if you think they are right for you perhaps you buy those in addition to Bitcoin.

I think it is possible that Bitcoin is the future of cryptocurrencies. But I personally think it is more likely that some other newer and better coin replaces it.

If You Do Want to Buy Bitcoins Here is an Easy Way to Do It

If you’ve decided you want to speculate on Bitcoin here is a way to buy Bitcoins.

I can’t emphasize enough the importance of educating yourself on blockchain technology and the risks of owning cryptocurrencies. Bitcoin could lose 95% of it’s value or more. It could also go to $100,000. I don’t know what the future holds.

Not Speculating in the Cryptocurrency Space is a Perfectly Valid Approach

Don’t let anyone convince you that you NEED to buy Bitcoin or any other cryptocurrency.

It’s a perfectly valid approach to simply refrain from speculating on cryptocurrencies like Bitcoin. It’s a new frontier–it’s very risky and speculating on cryptocurrencies isn’t right for everyone.

But if you have decided to speculate on cryptocurrencies and Bitcoin then consider the above guidelines. They could help you avoid losing your life savings and ending up living in a van down by the river if it turns out Bitcoin is a speculative bubble and crashes.

by John | Dec 3, 2017 | Cryptocurrency

The stock market is overvalued, gold markets could very well be manipulated, bonds are a bug in search of a windshield and central banks have done little more than give lip service to unwinding their balance sheet.

So I turn to alternative investments.

Some of those alternatives are value stocks precious metals but I’m always looking for additional alternative investments.

One such alternative investment (really more of a speculation) is cryptocurrencies. While I remain somewhat skeptical of cryptocurrencies, particularly bitcoin, they continue to go up in price. Early adoptors of cryptocurrencies like Bitcoin have made millions. While I think trying to make millions in cryptocurrencies is incredibly risky, I do think having some money in cryptocurrencies isn’t the worst idea ever.

To that end I do own some of the cryptocurrencies that I think are more promising. I’ll be sharing which cryptocurrencies I own exclusively with my Newsletter Subscribers.

There are specifically six cryptocurrencies that I’ve chosen to own. I only purchase what I can afford to lose. Given the extreme volatility of cryptocurrencies and the difficulty in valuing them I can’t emphasize enough how risky it is to own cryptocurrencies.

But for those willing to take the risk a cryptocurrency going to zero for the potential of large return, cryptocurrencies are a great way to speculate. I’ve put together a summary of the group of six cryptocurrencies I own.

I’ll be sending it out to my newsletter subscribers this Wednesday the 6th.

by John | Nov 20, 2017 | Cryptocurrency

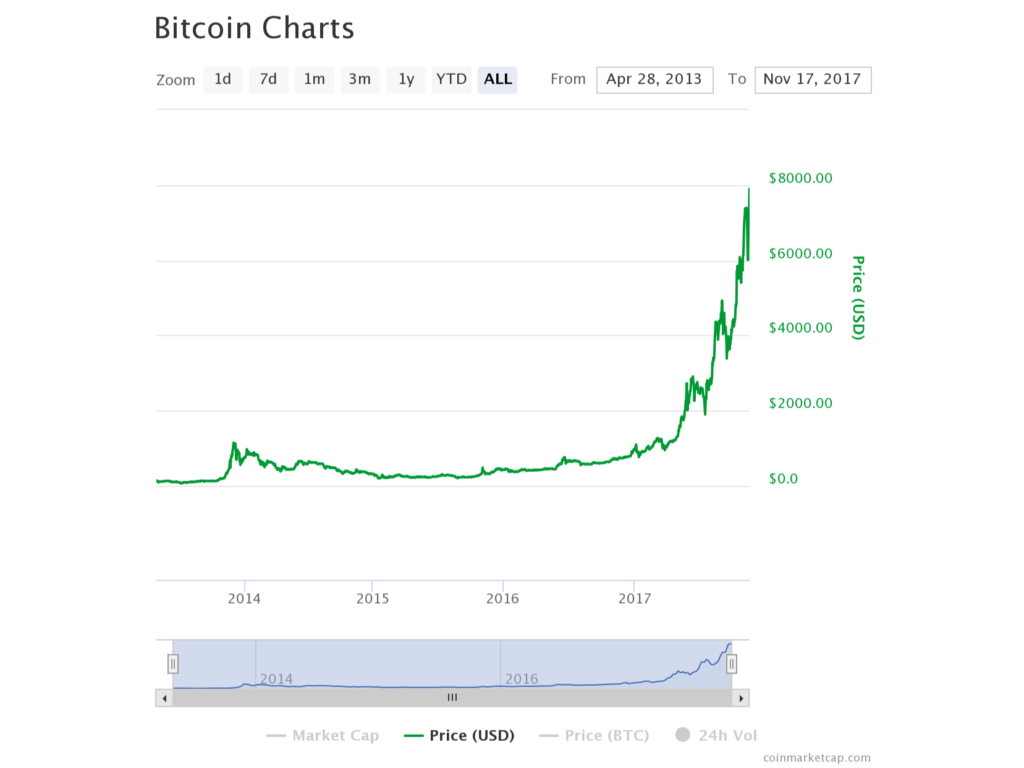

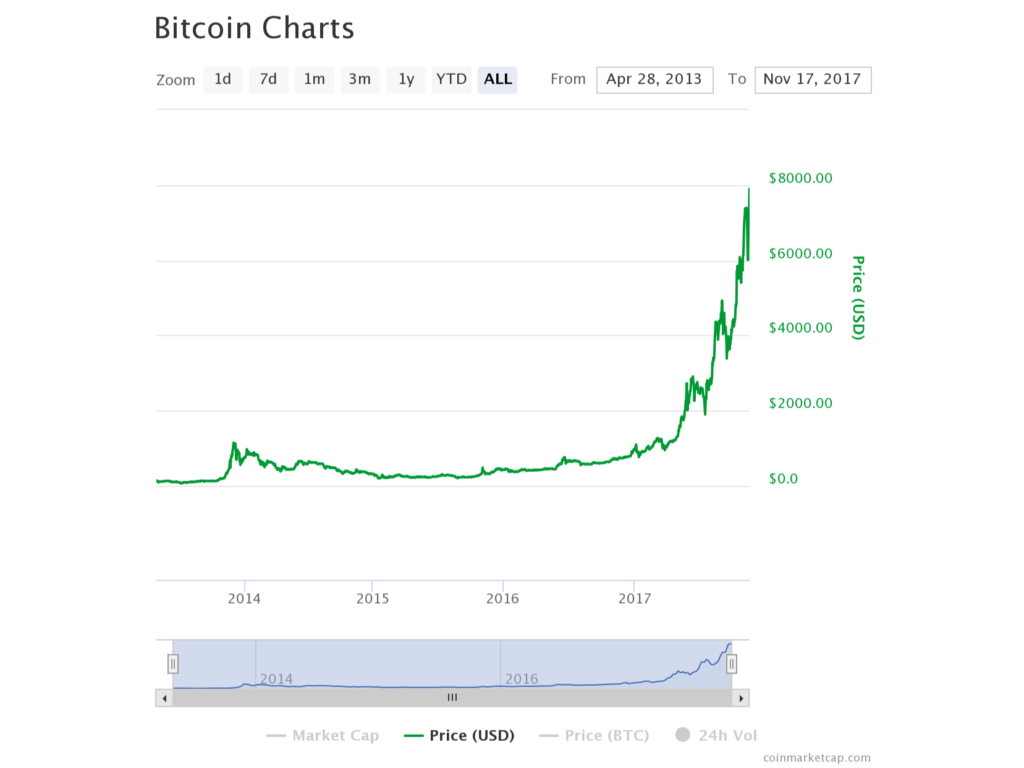

One Bitcoin is currently trading north $8,000 as of writing. The total market capitalization of all cryptocurrencies is over $240 billion.

Bitcoin (BTC) is up over $2,000 since last month alone.

Since 2013 BTC has gone up, up, up thousands of percentage points.

Cryptocurrencies like Bitcoin have made millionaires. An entire industry that didn’t exist ten years ago has a market capitalization of hundreds of billions.

Much of the focus of this website is in alternative investments. I think the stock market is overvalued and a lot of the financial products peddled by wall street are bad deals, at least for customer. The alternative investment du jour is without a doubt cryptocurrencies more specifically Bitcoin, which as of writing is trading northwards of $8,200.

Are you afraid of missing out on the cryptocurrency craze? There a couple ways to squelch this fear.

I’m not quite this excited about Bitcoin and Cryptocurrencies and I think it’s important to be informed

Option A: Don’t Own Any Cryptocurrencies

You don’t need to own any cryptocurrencies. You don’t need to own one Iota (that is a cryptocurrency) of Bitcoin, Litcoin or Lisk. If you don’t want to learn more about them, or speculate on them that is your choice. It’s a valid choice and it might even be a great choice.

But I’ve decided to make a different choice.

As I’ve said before I’m personally skeptical of cryptocurrencies as a long term store of value. I also think there are superior alternatives.

But the market has continued to grow and a lot of people think it is the next big thing. They compare it to the “dot com” boom that took place earlier in the century (there was also quite a bust if I remember correctly). I was skeptical of Bitcoin when it was $1,000 and $4,000 and I’m skeptical of it now that it’s over $8,000.

Option B: Take a Measured Approach

Bitcoin could continue to climb to the moon or it could go to zero. It could also do both.

Being on the sidelines and watching cryptocurrencies climb higher and higher is difficult. People like to buy things as they are going up. But buying out of fear of missing out is a horrible idea that will in all likelihood results in bad decisions and losses.

In my most reasonable mind, I believe that Bitcoin will not be the future of cryptocurrencies. I think it’s unlikely to go to zero but I think it will drop precipitously. I don’t think cryptocurrency technology is going away, but I think some other, better cryptocurrency technology will eventually supplant Bitcoin.

The nature of digital technology is that it becomes obsolete and is replaced by newer, better technology.

I don’t know the future. That is just my opinion and my best, most reasoned judgement of the technology and the facts as I understand them. I know I could be wrong.

So I own some cryptocurrency so that I’m not on the sidelines and I am benefiting from the rise in price. But I only own what I can afford to lose.

Is Bitcoin the Google or the Next HotBot.com?

Is Bitcoin the next Google or Apple? Or is Bitcoin the next hotbot.com or pets.com?

If you’ve never heard of hotbot.com that is exactly my point.

Is Bitcoin the next Facebook, or is it the next MySpace?

I don’t know.

I do think that from a technology perspective there are many other coins and cryptocurrencies that I think are superior to Bitcoin. I know that when I’ve tried to use Bitcoin as a medium of exchange it stinks. It’s expensive, especially when the network is busy, and it takes a minimum of 10 minutes, and usually 20-30 minutes.

There are other cryptocurrencies that are faster, more anonymous and more secure.

Bitcoin is lousy for payments and attempts to make it better have thus far not come to fruition.

Maybe it will be better for payments in the future. Or maybe, as some people argue, Bitcoin doesn’t need to be used to day to day payments, that it can just be a “store of value” like gold that doesn’t change hands very often.

I can’t foresee the future but I do see benefits in cryptocurrency technology. But at the same time this technology is, in my opinion, very difficult to value.

Is BTC expensive or cheap at $8,000? I don’t know. It seems expensive to me, but I’ve been wrong (or early) for years.

Will Bitcoin’s robust network, name recognition and first mover advantage allow it to maintain it’s dominance? I don’t know.

Fortunately I don’t need to know.

As I said before, no one needs to own cryptocurrencies. It’s a personal choice. But I don’t want to sit on the sidelines in case cryptocurrencies are the “next internet” or “next radio”.

So what are some details of this option?

How not to Fear Missing Out on the Cryptocurrency Craze: A Strategy

Part 1: Only buy what you can Afford to Lose

Cryptocurrencies are highly speculative and highly volatile. That is why I think it is very important to only purchase an amount of cryptocurrency you can afford to lose.

For example, I bought about .5 BTC on Coinbase at $7,000 before the Bitcoin segwit2x fork (which didn’t happen). I intended only to hold it through the segwit2x fork. I then watched as BTC fell to $6,000, representing a $500 loss. But because I had only bought what I could afford to lose I was able to hold through that dip, and when Bitcoin rallied back to mid $7,000 I was able to reduce my position at a profit.

If I had bought more than I could afford to lose, it would have been harder not to panic and sell to cut my losses.

Part 2: Diversify

If cryptocurrencies become mainstream and go up another gazillion percent, you won’t need to own that much of any one to make a handsome profit. There are over a thousand cryptocurrencies with a market capitalization over $244 billion. Of that $244 billion Bitcoin accounts for the lion’s share, at $140 billion and the top ten account for nearly $220 billion, or about 90%.

Some are going to go to zero and disappear, others might stagnate, and still others might continue to go up in value and over the next 20-30 years and represent a great speculation.

Some cryptocurrencies like “1337” (see https://en.wikipedia.org/wiki/Leet), MiloCoin, or the cryptocurrencies named after an English-language obscenities, are in my opinion not worth owning at all.

By owning a handful of the more promising cryptocurrencies, one increases the likelihood of owning one that really takes off.

Part 3: Goals and Discipline

If I had kept all the Bitcoins I bought several years ago, and sold them today, I would have made somewhere around $45,000. If I had kept holding them who knows how much they would be worth in the future. Instead, I’ve bought and sold Bitcoins and other cryptocurrencies over the years and probably made a few thousand instead (I’d have to check my tax returns to know for sure).

Throughout that time I’ve held some cryptocurrency and it has steadily gone up. One of my mains goals with cryptocurrency was not not lose money and I’ve succeeded thus far in that goal.

Is your goal with cryptocurrencies to try to pick the top? Is it to double your money and get out? Is it to buy and hold until Bitcoin goes to $100,000?

Because cryptocurrencies are so volatile right now I think it’s good to have a goal and then exercise the discipline to follow it. Decisions made based on emotion tend not to consistently work out.

If you decide speculative risk is right for you, you can buy Bitcoins on Coinbase.

by John | Nov 5, 2017 | Cryptocurrency

8 November 2017 Update: The fork that was supposed to happen has been called off. It was decided there was not enough support.

Here are some other opportunities you don’t want to miss:

Bitcoin is likely forking again as a result of new code known as Segwit2x. Forks are negative for a cryptocurrency from a store of value perspective because they are essentially inflationary. However, this could present an opportunity similar to when Bitcoin forked to create Bitcoin Cash (BCH).

In theory, if a cryptocurrency hard forks it should reduce the value of one currency by the amount gained by the other. So if the market cap of Bitcoin is $6,000, it forks, and the new crypto is $500 the “original” BTC should be worth $5,500 all else given. This is similar to how dividends work with companies, where the value of the share is automatically reduced by the amount of the dividend. Now there are two cryptocurrencies instead of one, which compete for market share.

However, one of the last times Bitcoin had a significant fork, the advent of Bitcoin Cash, both Bitcoin and Bitcoin Cash went up. I think this is illogical, but the market will do what the market will do.

I’m skeptical of Bitcoin in particular and cryptocurrencies in general. However, I’m willing to try to profit from them provided I only use money I can afford to lose. People who bought into bitcoin when it was trading for a few dollars have made a fortune with BTC trading upwards of $7,000. A new hard fork is scheduled to happen on November 16 called Bitcoin2x (B2X). It is another attempt to address some of Bitcoin’s shortcomings.

Bitcoin Cash and Bitcoin Gold are some of the recent Bitcoin Forks

This fork is somewhat unique because it might not be a fork at all, at least practically speaking, because everyone might switch over to this new Segwit2x code.

But this could an opportunity to get some “free” coins–albeit not without significant risk. Simply buy some BTC on coinbase and then transfer them to your account on GDAX (run by the same folks who run Coinbase). GDAX has already indicated they will credit accounts with BTC with an equal amount of B2X.

So, if you were to have 1 BTC, after the fork you would then have 1 BTC and 1 B2X. It is my opinion that B2X will probably not be worth as much as the BTC, but will still be valued and it is “free” money.

Some of the Risks with Segwit2x

There is certainly a lot of risk with cryptocurrencies and they increase during hard forks. Here are the possible scenarios:

1) Bitcoin forks, there is now BTC and B2x.

2) Bitcoin does not fork, B2X is not adopted

3) B2X is adopted, and everyone switches over to it

I don’t have an opinion on Segwit2x as a technology at this time. In either of the three scenarios the desired outcome (as far as my strategy goes) is for the overall value of the BTC and or B2X to be higher than it is now.

However, it is possible that the fork does not go well and in the ensuing chaos both the price of Bitcoin and any forked coin goes down, or bitcoin goes down, or the new coin goes down.

So it’s certainly not a strategy for widows and orphans. But I think it is worth considering. I took this approach when BTC forked to create Bitcoin Cash (BCH) and it worked out for me.

It’s important to make sure you have BTC in GDAX or another location where you will be able to take advantage of the fork and that your BTC is there by the 14th or 15th (fork will likely happen at some point on the 16th).

As always I’m not recommending any particular course of action or strategy. You need to make up your own mind.

If you already own bitcoin, you might consider ensuring that they are held in an exchange that will support B2X, so that you get this “dividend” as some are calling it. If you don’t have any Bitcoin and would like to buy some, you can do so AND at the same time support this site. Simply buy $100 or more of BTC using this Coinbase referral link. If you do we’ll both get $10 worth of BTC. Not bad.

The Bitcoin Segwit2x is risky, but recently it seems like all news is good news for Bitcoin and despite large setbacks Bitcoin continues to rally higher.