September 2016 Option Trades

Below is a summary of the option trades I closed in the month of September.

If you’re not familiar with stock options you might first read my introductory article Get Started Trading Options.

Monthly Trade Summary

September was a tough month. In total I lost $602.03. My win rate was 69% (9 out of 13). I had a total of 19 positions throughout the month: 9 of my trades were profitable, 4 were not, and 6 were “wash” trades. If I gain or lose less than $20 I count it as a wash and don’t use it to calculate my win rate.

My account is about $10,000. Some of my margin usage includes other options trades not listed here because they are made based on the trades placed by Kirk DuPlesis over at OptionAlpha.com and I am not going to post those out of respect for his paid service. I’m also NOT including any profits or losses from the OptionAlpha trades I make.

Again, the trades listed below are MY trades closed out in the month of September.

What I learned from losing $600

You can often learn more from mistakes than successes. It’s easy to Monday morning quarterback with the benefit of hindsight. I like to evaluate my trades based on what I knew at the time and what I reasonably could have foreseen.

I learned/reinforced several valuable lessons. In fact if I had followed the rules I know I need to follow to be successful and I had been more careful that $600 in losses would have been ~$70 in gains.

I want to talk about my three mistakes and the three lessons I learned from each.

Lesson One: Small Position Size

“Bears make money and bulls make money. Pigs get slaughtered.” – Old Wall Street Adage

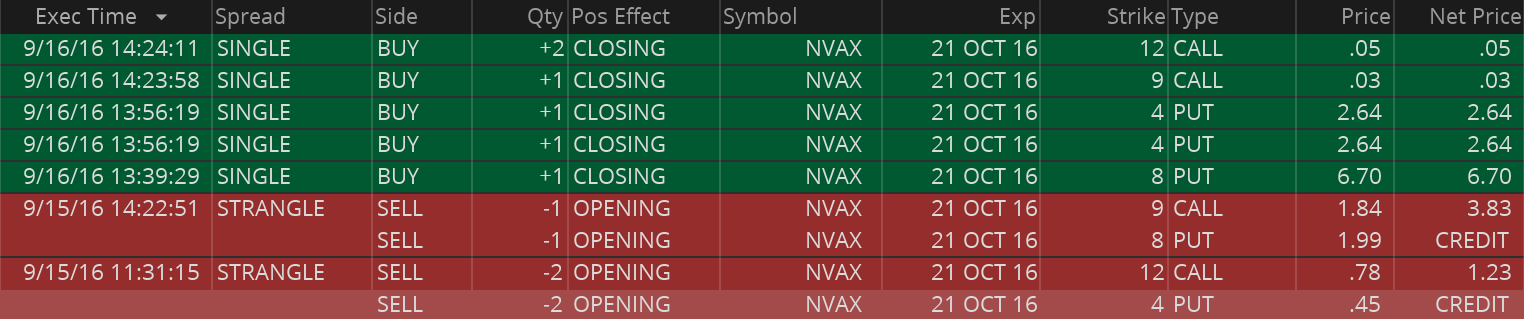

Novavax (NVAX) Strangles

Notes: My biggest mistake was with NVAX. I made $104 earlier in September but I counted this as a separate position because I completely closed out the previous position and opened this new one.

The reason volatility for NVAX was so high was because the company was awaiting “phase three trial judgment” for a vaccine they were making. The results of the trials were unfavorable and the stock tanked down to around $1.25 from $8.25. In other words the stock lost 80% of it’s value in one day.

I would have been fine if I hadn’t opened the additional 9 8 strangle because it would have been just a ~$300 loss. I got greedy like a pig and paid the price. My account is around 10k, so I should not open a position with a margin requirement over $500 (5%). The initial margin requirement started at $420, but when I opened the 9 8 strangle the margin requirement roughly doubled.

I will cheat up around $100-$150 to open positions in the $600-$650 range because otherwise I wouldn’t be able to open some positions, but when possible, I must keep the position size at or under 5% of the total account value in order to be successful long term, which in my case is $500.

Margin Requirement/Cost: $420 up to $840

Margin Requirement/Cost: $420 up to $840

Income: -$595.78 (-$582 less commissions and fees)

Lesson Two: Careful Order Entry

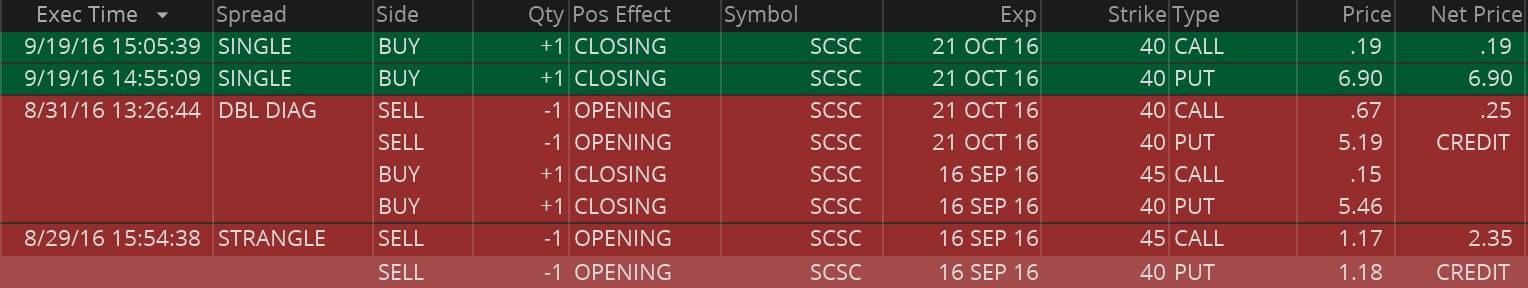

ScanSource (SCSC) Earnings Strangle

Notes: This was initially an earnings trade back on August 29. ScanSource missed earnings by a lot and the stock tanked. In after hours post earnings the stock traded down to 37.79, my break even was 37.65. I made an adjustment and held onto the position in hopes of a rebound. The stock did rebound and cut my $330 loss down to around $230.

But then I made a mistake buying the put back for more than I sold it for by entering my limit order incorrectly at the ask price instead of the midpoint. Tough $250 lesson to be more careful particularly in a less liquid market.

Margin Requirement/Cost: $875

Margin Requirement/Cost: $875

Income: -$461.17 (-$449 less commissions and fees)

(VIP) Earnings Strangle

Notes: I opened this up incorrectly! I reversed the call and the put to create an inverted strangle. Closed it out when I could for a small wash loss.

Margin Requirement/Cost: $615

Margin Requirement/Cost: $615

Income: -$18.20 (-$6 less commissions and fees)

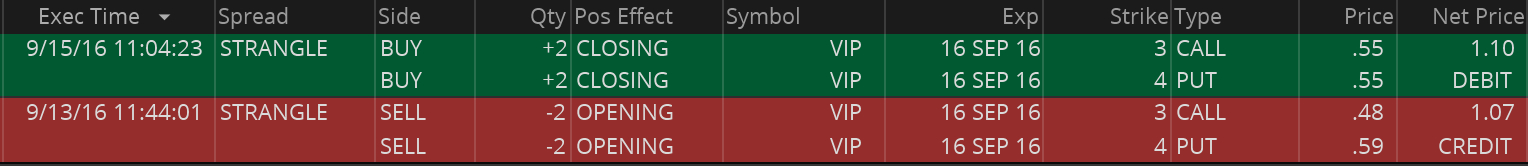

Lesson Three: Be on the Correct Side of Volatility

When volatility is low (less than 60%) you want to be a net buyer of options. When volatility is high (over 60%) you want to be a net seller of options.

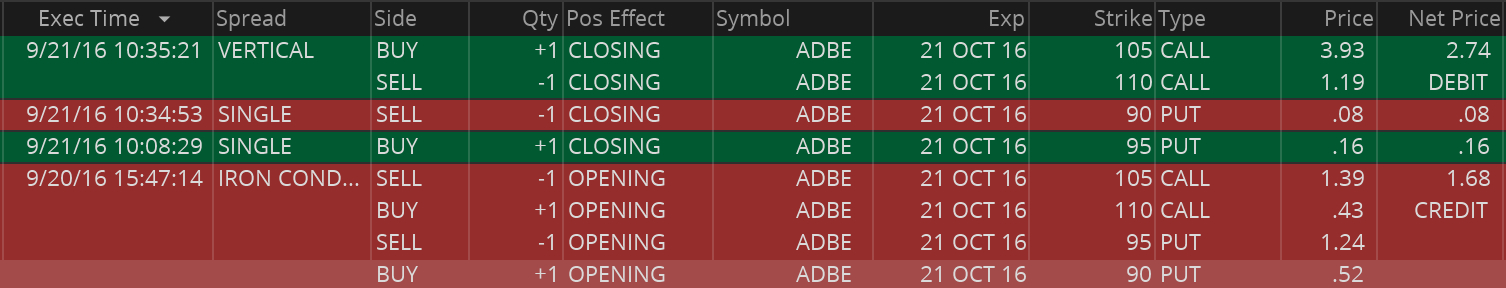

Adobe (ADBE) Earnings Iron Condor

Notes: This was an earnings trade and I was on the wrong side of volatility. The implied volatility percentile of ADBE was 58%. When selling options you want the implied volatility to be over 60% and the higher the better.

Margin Requirement/Cost: $500

Margin Requirement/Cost: $500

Income: -$126.16 (-$114 less commissions and fees)

Combined these three mistakes cost me $674.36. I expect to lose on some trades and that is okay. For example, I lost on the Verifone earnings trade. But because I was on the correct side of volatility, had the correct position size, and chose a stock with a consistent post earnings volatility drop, I was in a good position to win most of the time. However, these trades listed above are examples in which I could have known not to make and were preventable.

The Rest of My September Trades

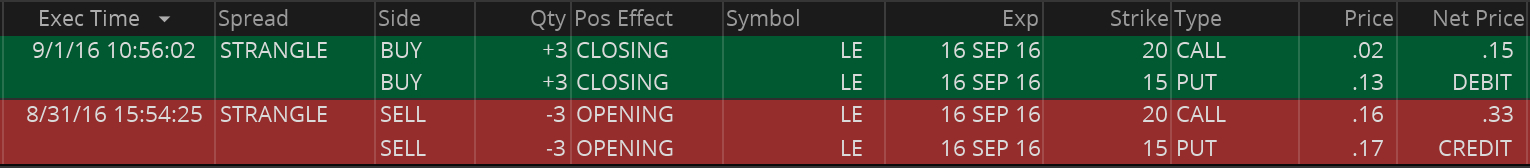

Lands’ End (LE) Earnings Strangle

Notes: This was an earnings trade that went according to plan. Closed it out at the at the 50% profit target.

Margin Requirement/Cost: ~$600

Margin Requirement/Cost: ~$600

Income: $35.72 ($54 less commissions and fees)

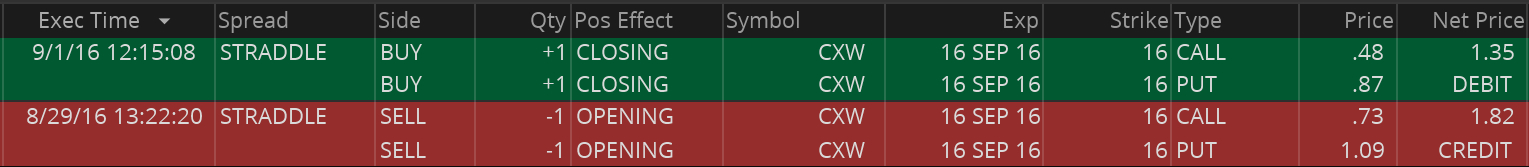

Corrections Corp of America (CXW) Straddle

Notes: There was a lot of volatility for this stock when there was an announcement that the department of homeland security was reevaluating using private prisons. A lot of these contracts are at the state level, so I thought the move would be overstated. Closed at 25% profit target once volatility died down.

Margin Requirement/Cost: ~$500

Margin Requirement/Cost: ~$500

Income: $40.92 ($47 less commissions and fees)

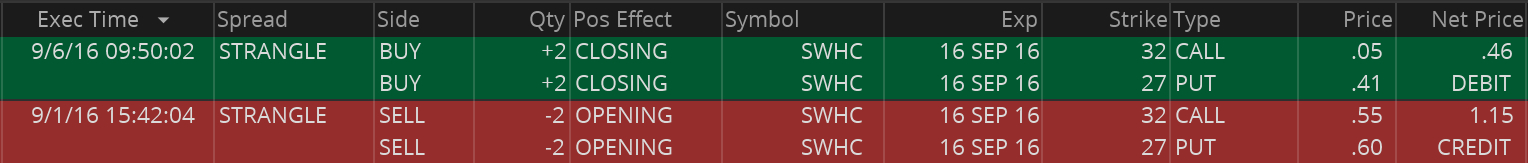

Smith and Wesson Holding Company (SWHC) Earnings Strangle

Notes: Another successful earnings trade. My position size was too big but I was fortunate in that it worked out in this case. Was able to close it out at the 50% profit target

Margin Requirement/Cost: ~$940

Margin Requirement/Cost: ~$940

Income: $125.80 ($138 less commissions and fees)

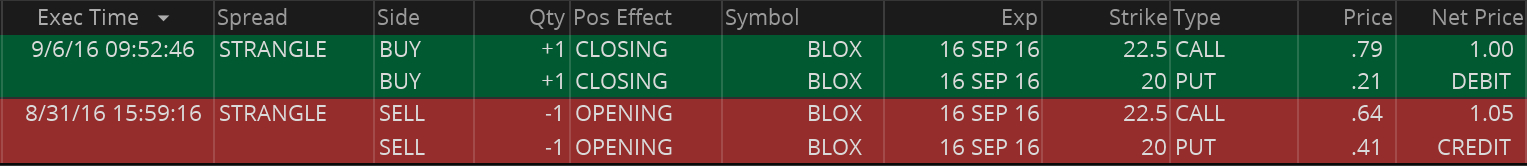

Infoblox (BLOX) Earnings Strangle

Notes: Another earnings trade. They announced earnings on August 31. Implied volatility on 2 September had dropped from the 86 percentile down to the 2nd for this stock, but the option pricing didn’t reflect that, IV dropped but was approaching my break even so I just closed for a wash/small loss.

Margin Requirement/Cost: ~$600

Margin Requirement/Cost: ~$600

Income: -$1.08 ($5 less commissions and fees)

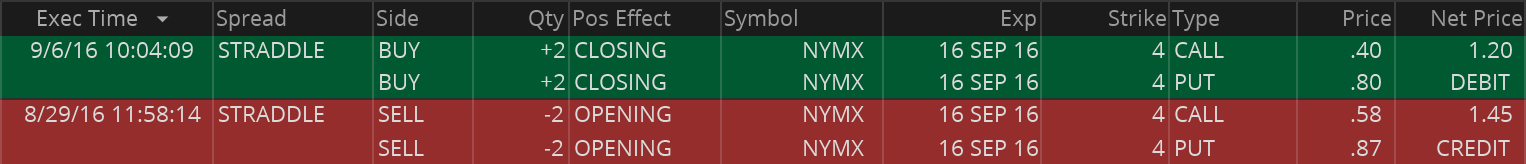

NYMOX (NYMX) Strangle

Notes: There was a lot of volatility for pharmaceutical stocks. Probably related to the EpiPen outrage. Not enough liquidity but was still able to close for a profit.

Margin Requirement/Cost: ~$635

Margin Requirement/Cost: ~$635

Income: $37.80 ($50 less commissions and fees)

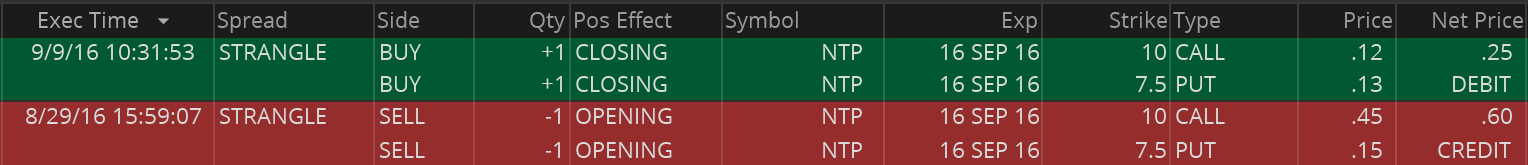

Namtai (NTP) Strangle

Notes: This was another stock trading with high volatility due to an announcement. Not sure how much volatility dropped but time decay certainly helped. Closed at 50% profit target.

Margin Requirement/Cost: Not recorded

Margin Requirement/Cost: Not recorded

Income: $28.92 ($35 less commissions and fees)

Energous Corp (WATT) Earnings Strangle

Notes: Bad Q2 earnings, net short position, high 88th percentile IV, was able to close at a 50% profit target after waiting a little while.

Margin Requirement/Cost: $535

Margin Requirement/Cost: $535

Income: $83.92 ($90 less commissions and fees)

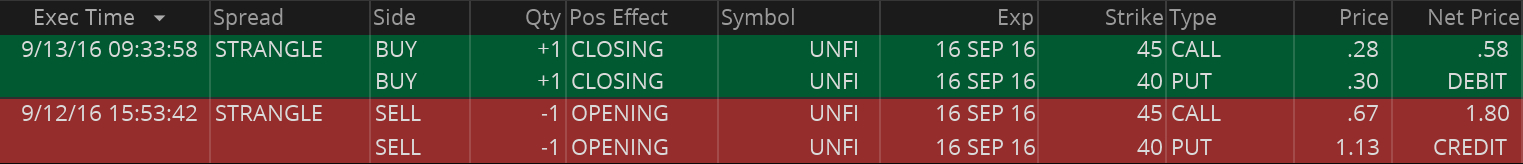

United Natural Foods (UNFI) Earnings Strangle

Notes: I calculated an expected move of +/- 2.77 from 41.80. Didn’t move hardly at all and was able to close the next day for a nice profit. Margin requirement was too high but I didn’t get burned on this one.

Margin Requirement/Cost: $837

Margin Requirement/Cost: $837

Income: $115.92 ($122 less commissions and fees)

Novavax (NVAX) Strangle

Notes: I counted this as a separate from the other NVAX position because these were September options and I closed them completely out before opening a new NVAX position. NVAX was trading with high volatility. Closed this in phases. Added a smaller strangle, which turned out to be ill advised. My initial position had a smaller margin requirement.

Margin Requirement/Cost: ~$650

Margin Requirement/Cost: ~$650

Income: $104.32 ($147 less commissions and fees)

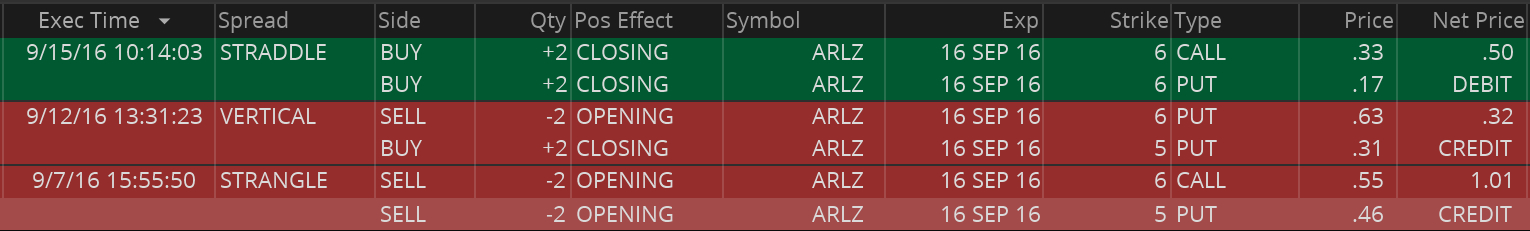

Aralez Pharmaceuticals (ARLZ) Strangle

Notes: Another pharmaceutical stock trading with high volatility, resumed trading on Thursday 9-15 and was able to close at well over a 25% profit target.

Margin Requirement/Cost: $582

Margin Requirement/Cost: $582

Income: $147.70 ($166 less commissions and fees)

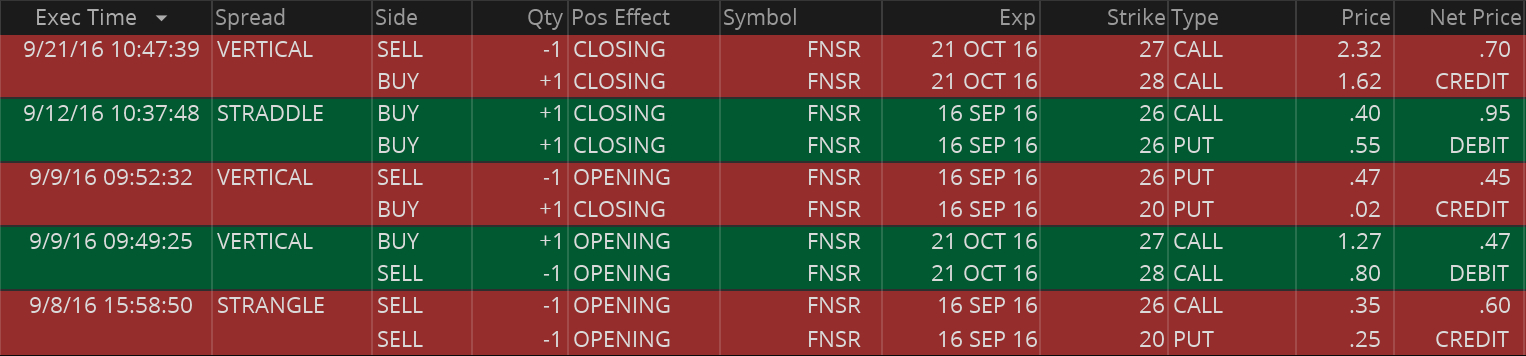

Finisar Corp (FNSR) Earnings Strangle

Notes: Had a big earnings beat, stock went up as high as 26.5 after hours. My break even on the upside was 26.61. Had a very nice drop in implied volatility. But didn’t matter as much since it moved beyond my range. Made some adjustments. Dropped down allowing me to close my original strangle, had a long position on FNSR to make up some of the losses. Closed on the 21st for a wash.

Margin Requirement/Cost: $490

Margin Requirement/Cost: $490

Income: $17.79 ($33 less commissions and fees)

iShares Mexico ETF (EWW) Iron Condor

Notes: Somewhat high volatility, took a neutral position because I think when the fed does not tighten it will help the emerging markets. Perhaps should have gone a little bullish. ETF approached by upper call, so closed out the short call on the 21st. Maybe could of held onto it, but didn’t want the risk.

Margin Requirement/Cost: ~$328

Margin Requirement/Cost: ~$328

Income: -$1.25 ($14 less commissions and fees)

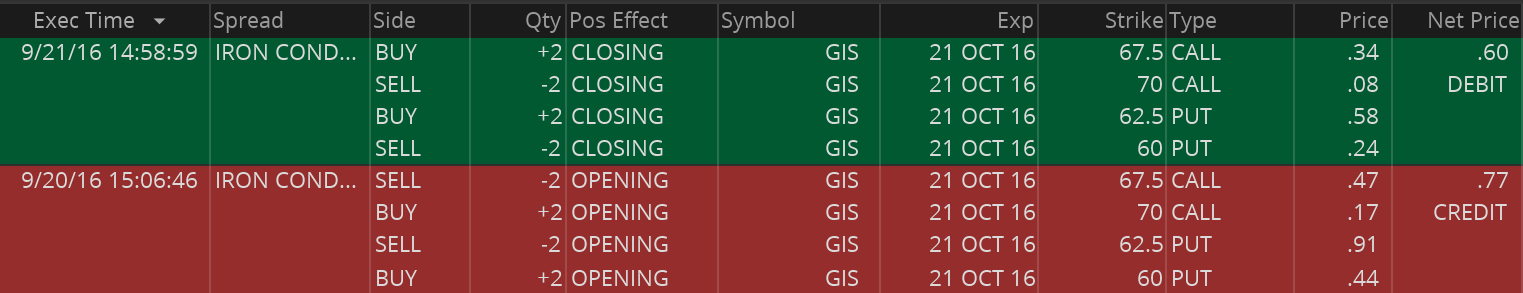

General Mills (GIS) Earnings Iron Condor

Notes: I prefer the strangle, but did this risk defined iron condor because of the margin requirements and position sizing. Standard earnings trade. Got some implied volatility drop but not as much as the last two earnings sessions. Closed for a wash.

Margin Requirement/Cost: $500

Margin Requirement/Cost: $500

Income: $9.60 ($34 less commissions and fees)

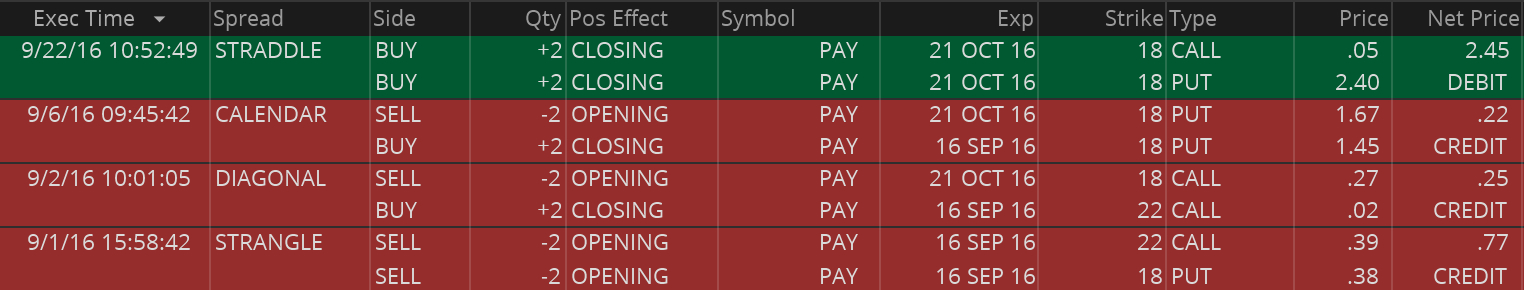

VeriFone Systems (PAY) Earnings Strangle

Notes: Beat earnings but stock tanked beyond my break even. Adjusted the call side down for some additional credit, and hopes that the stock rebounds some. Adjustment ended up costing me more $.

Margin Requirement/Cost: ~$640

Margin Requirement/Cost: ~$640

Income: -$266.64 (-$242 less commissions and fees)

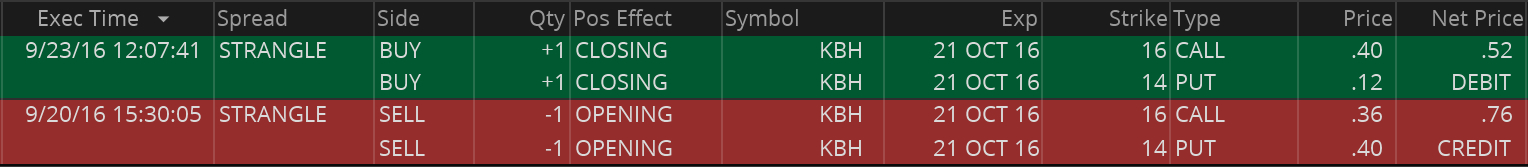

KB Home (KBH) Earnings Strangle

Notes: Earnings trade. Got a nice drop in volatility but stock was approaching my break even on the high side and decided to close out for other opportunities.

Margin Requirement/Cost: $280

Margin Requirement/Cost: $280

Income: $17.96 ($24 less commissions and fees)

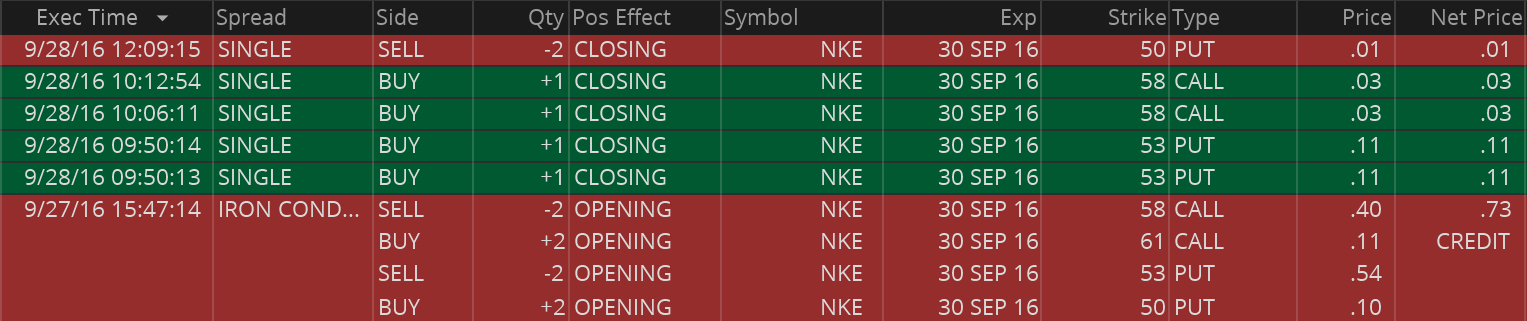

Nike (NKE) Earnings Iron Condor

Notes: Another earnings trade. This one had a nice setup. NKE has a nice volatility drop after earnings, there are month contracts (which have the most volatility “juice”), and IV percentile was at 72%. I’d prefer volatility was higher, but 72% is certainly high enough for an earnings trade. I did a defined risk Iron Condor since the margin requirements are high. Nike announced earnings after hours, they beat, but the stock sold off. As of 10PM in after hours NKE was at 54.09, just hope it holds tomorrow and volatility drops! IV dropped to 28%, and with it the value of the options I sold plummeted. This was a textbook trade, if I could do this 2-3 times a week I’d be thrilled, but unfortunately these types of trades don’t come along every week.

Margin Requirement/Cost: $600

Margin Requirement/Cost: $600

Income: $101.65 ($120 less commissions and fees)